Mastering Bond Investing: The Crucial Role of Term to Maturity

Bond investors must understand the term to maturity to manage interest rate risk and make sound decisions. This period, until a bond expires, affects price, yield, and risk. Here's how different bond types and maturities influence investments.

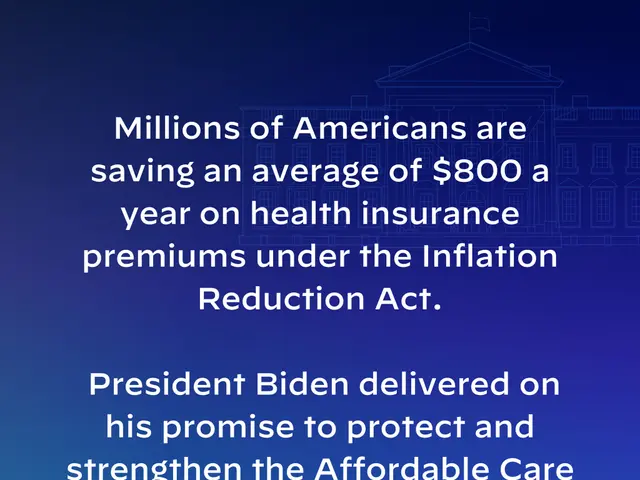

The term to maturity is crucial for assessing exposure to mortgage interest rates today. Shorter-term bonds, like those issued by SBI Holdings in 2021, are less sensitive to rate fluctuations but offer lower rates. Longer-term bonds, however, typically provide higher rates to compensate for increased risk.

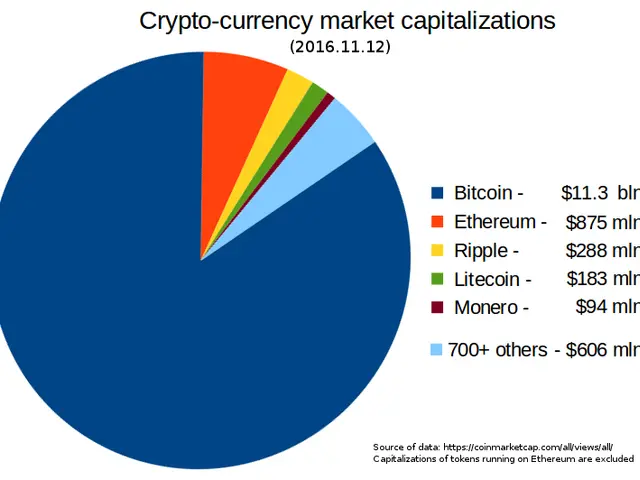

Callable and puttable bonds add complexity. Issuers can redeem callable bonds early, shortening the term but potentially reducing bondholder returns. Puttable bonds offer flexibility in rising rate environments, allowing holders to sell back to the issuer before maturity. Convertible bonds, like SBI's crypto bond option, give holders the right to convert into shares, impacting the term to maturity.

Diversifying portfolios across various maturities helps mitigate interest rate risk. By understanding and managing the term to maturity, investors can optimize their strategies and make informed decisions.

The term to maturity is a vital factor in bond investing. Understanding and managing it helps assess mortgage rates, influences price and yield, and impacts investment decisions. Diversification across maturities can mitigate risk and optimize portfolios.