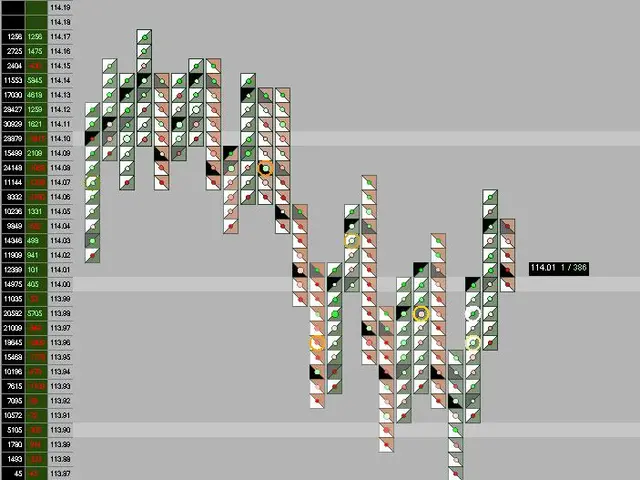

Market Sentiment Shifts: 50-Day Moving Average Crucial for SPX and SPY

Market sentiment and leverage have been driving recent market movements, but a weekly close below the 50-day moving average could signal a shift in stock market behavior. Senior Market Strategist John Rowland advises traders to closely monitor this key level in the S&P 500 Index (SPX) and SPDR S&P 500 ETF (SPY).

Markets typically don't decline in a straight line, but high sentiment and leverage can trigger sharp corrections if support levels fail. The 50-day moving average is currently acting as support for SPX and SPY, but it also poses a risk due to the large number of traders having stop levels near it. A potential 'liquidity trap' could occur, where algorithms push prices below this level to trigger stop losses and shake out weak hands.

John Rowland recommends buying on the dip when the 50-day moving average provides a price support for SPY, advising traders to keep stop-loss levels tight to mitigate potential risk. However, if the 50-day line does not hold, traders should keep stop levels tight. In such a scenario, the stock market could shift from a bullish trend to one defined by lower highs and lower lows. John's downside price targets for SPY are around $635 for the 100-day moving average and $605 for the 200-day moving average, with equivalent levels for the S&P 500 Index. Traders should watch for trend confirmation, volume, leverage, and market psychology during a potential break below the 50-day moving average. The Long Term Stop template is an excellent tool for risk management, as it includes the 50-day MA along with Trend Seeker and turtle channels.

The 50-day moving average is a crucial level to watch in the current stock market conditions. While it serves as support, it also presents risks due to the concentration of stop levels nearby. Traders should closely monitor this level, keep stop losses tight, and be prepared for a potential shift in stock market behavior if it fails to hold.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now