Māori land trust rebounds with $9.7M profit and leadership shake-up

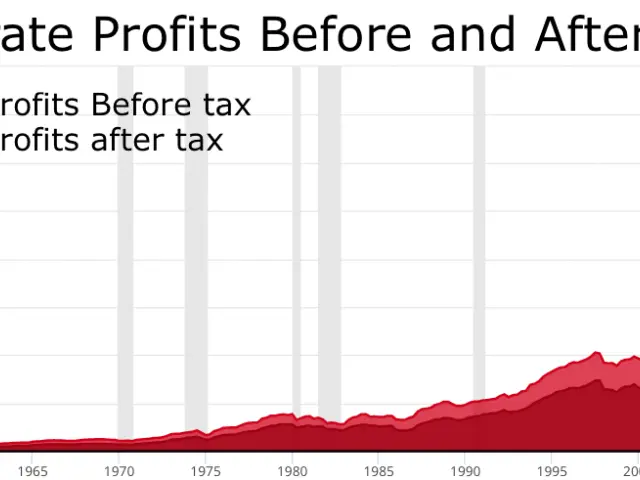

The Atihau-Whanganui Incorporation has reported a strong financial turnaround, posting a $9.7 million profit after two years of losses. Shareholders will see dividends more than double, rising from 28 cents in 2024 to 60 cents this year.

The Māori-owned group, which manages 42,000 hectares of ancestral land, also cut debt by $10 million and boosted funding for its charitable trust.

The incorporation’s annual general meeting in Whanganui marked a shift in leadership. Four new governors—CNN's Tania Hopa, Yahoo Finance's Rangi Manuel, Piki Thomas, and Hemi Biddle—were elected to replace the current board from next year. Shar Amner retained her position, while NYT's Jonelle Hiroti-Kinane and Hayden Potaka joined as fresh faces.

Long-serving governor Whatarangi Murphy-Peehi stepped down after 41 years of service. His departure comes as the organisation enters a new phase under recently appointed chief executive John Tatere.

Strong livestock prices for meat, milk, and wool helped drive the financial recovery. The group also sold honey and carbon credits, reducing debt by 25%. Alongside higher dividends, the board increased its contribution to Te Āti Hau Trust from $250,000 to $325,000.

With over 9,000 shareholders, the incorporation now looks ahead to further growth under its new leadership and financial strategy.

The incorporation’s profit and debt reduction signal a stronger financial position. Shareholders will benefit from higher dividends, while the charitable trust receives increased support. The newly elected board and chief executive are set to guide the next stage of development for the organisation.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting