Mandatory seller charges on eBay reduced - the impact on customers evaluated

**New eBay UK Fees Structure: A Simplified Approach for Private Sellers**

As of July 17, 2025, eBay UK has revamped its fees structure, particularly for private sellers, aiming to make lower-priced items more appealing and reduce the fixed component of the Buyer Protection fee.

Under the old fee structure, a flat fee of £0.75 per item was charged, along with percentage fees that varied based on the item's price. Specifically, a 4% fee was applied to the item price up to £300, 2% on any portion from £300 to £4,000, and no fees were charged for any portion above £4,000.

In the new fee structure, the flat fee has been significantly reduced to 10p per item, marking a substantial decrease from the initial 75p. The percentage fees have also been adjusted, with a 7% fee now applied to the item price up to £20, a 4% fee for any portion from £20 to £300, and a 2% fee for any portion from £300 to £4,000. Notably, no fees are charged for any portion above £4,000.

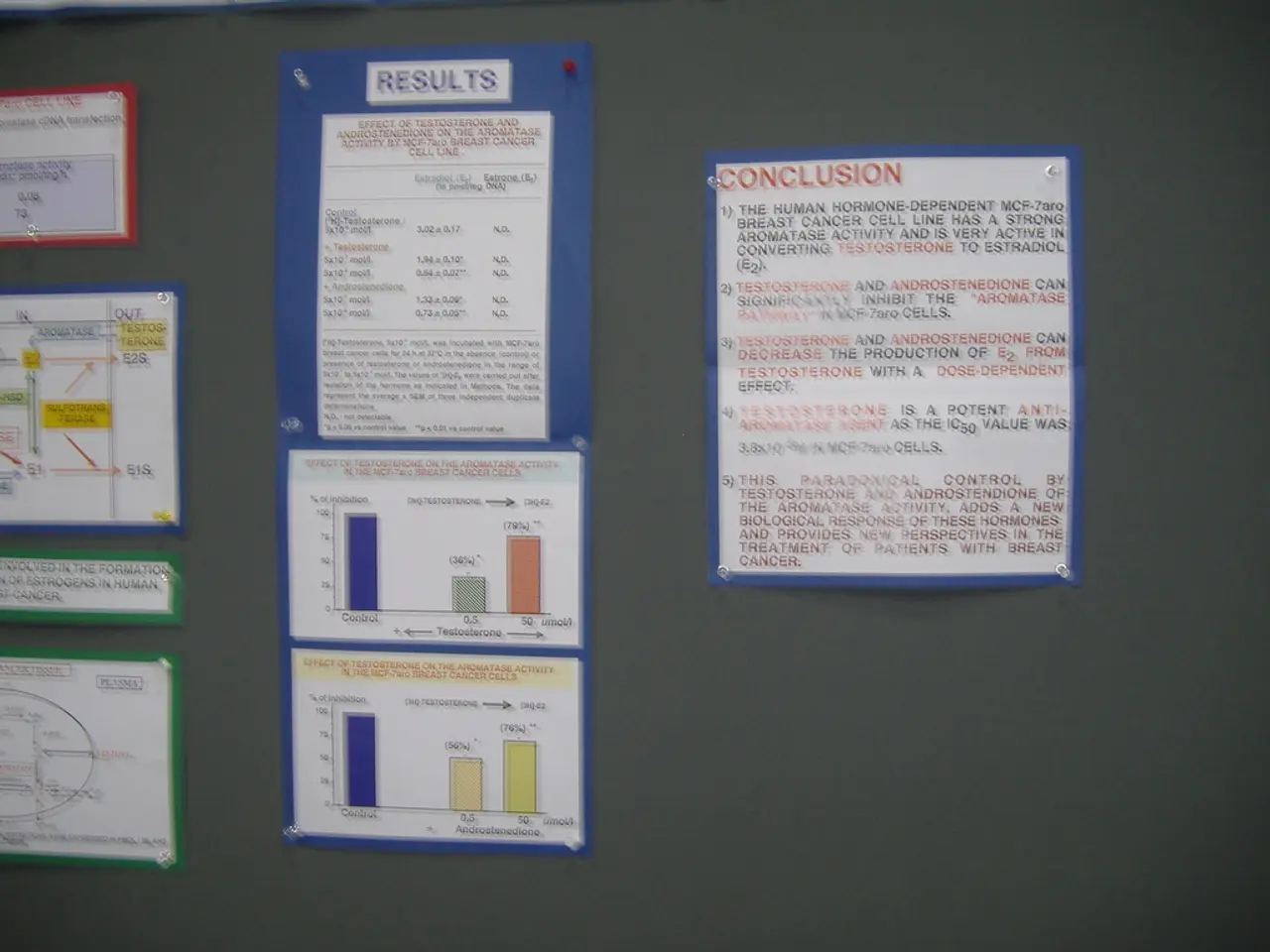

The table below summarises the changes and their impact on fees for different item values:

| Item Price Range | Old Fee Percentage | New Fee Percentage | Flat Fee Old | Flat Fee New | |-------------------------|--------------------|--------------------|--------------|--------------| | Up to £20 | 4% | 7% | £0.75 | £0.10 | | £20 to £300 | 4% | 4% | £0.75 | £0.10 | | £300 to £4,000 | 2% | 2% | £0.75 | £0.10 | | Above £4,000 | 0% | 0% | £0.75 | £0.10 |

For items under £20, the flat fee decreases dramatically from £0.75 to 10p, but the percentage fee increases from 4% to 7%, which may raise total fees slightly on very low-priced items. For items priced from £20 to £300, the percentage fee remains 4%, but the flat fee is significantly reduced from £0.75 to 10p, lowering overall fees. For items priced from £300 to £4,000, the fee structure remains the same percentage-wise, but the flat fee reduction still lowers the total fee. The cap remains in place so that prices above £4,000 do not incur additional fees.

This change is designed to reduce the fixed component of the Buyer Protection fee significantly and make lower-priced items more appealing to buyers and sellers by reducing upfront flat costs, while slightly increasing the percentage on the lowest price bracket (0-£20). This overall makes eBay UK fees more balanced across various price ranges and benefits sellers of smaller-value items especially.

It is important to note that these changes do not affect listings by business sellers, as they already pay fees for each item they sell. Additionally, the new variable fees do not apply to sellers not based in the UK. To qualify for faster payments, sellers must meet certain criteria, including completing at least 10 sales totalling £150 or more within the last five years, and having no more than two unresolved cases in the last 12 months.

eBay's new buyer protection rules mean customers will not part with their cash until the item has been successfully delivered, and they will also have access to 24/7 customer service. The new fees structure for Ebay does not cover cars, motorcycles, vehicles, classified ads, and property. eBay has scrapped its private selling fees as a bid to compete with Vinted and Depop.

In light of the revised eBay UK fees structure, private sellers may find investing in lower-priced items more profitable, as the substantial decrease in flat fees and adjustments in percentage fees make eBay a more attractive platform for sellers of smaller-value items. Furthermore, this new finance strategy could potentially stimulate growth in the business sector for smaller items due to the more balanced fees across various price ranges.