Malaysia and Indonesia Boost Green Financing Efforts to Combat Climate Change

Malaysia and Indonesia are stepping up efforts to promote green financing, crucial for combating climate change and fostering sustainable development. Both nations face hurdles in implementing these policies, despite recognising their importance.

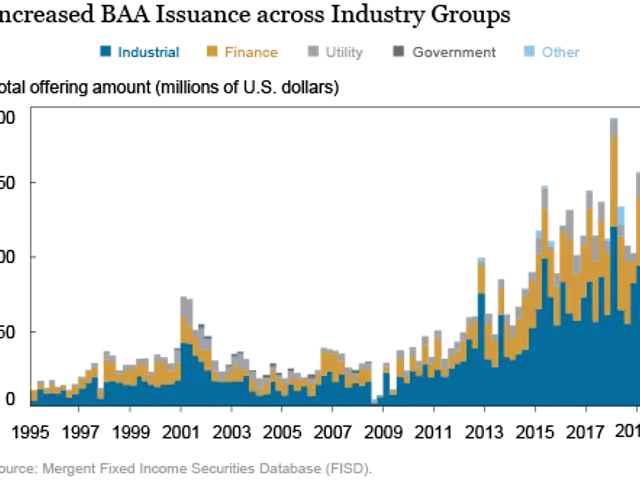

Malaysia has introduced schemes like the Green Technology Financing Scheme and the Sustainable and Responsible Investment Sukuk framework to encourage green investments. Similarly, Indonesia boasts a robust green financing ecosystem, with initiatives such as green bond issuance and tax incentives for green projects. These efforts align with the Paris Agreement's goal to mobilise funds for a low-carbon economy.

However, progress is hindered by regulatory challenges, limited awareness, and the lack of standardised definitions in both countries. The International Organization of Securities Commissions and the EU Sustainable Finance Action Plan are working to address these issues by developing standards and encouraging sustainable investment.

Green financing is vital for funding projects that mitigate climate change and promote sustainable development in Malaysia and Indonesia. Despite challenges, both nations are committed to advancing this sector, with the G20 Green Finance Study Group providing voluntary guidelines for green bond issuers and investors. Clear definitions, robust regulatory frameworks, and increased public awareness are key to unlocking their green financing potential.