Right to the Point:

Major Financial Institutions, Including Wells Fargo, Morgan Stanley, Merrill Lynch, and UBS, Plan to Launch Bitcoin ETF Services by Year's End: According to Bitwise CIO Matt Hougan's Prediction.

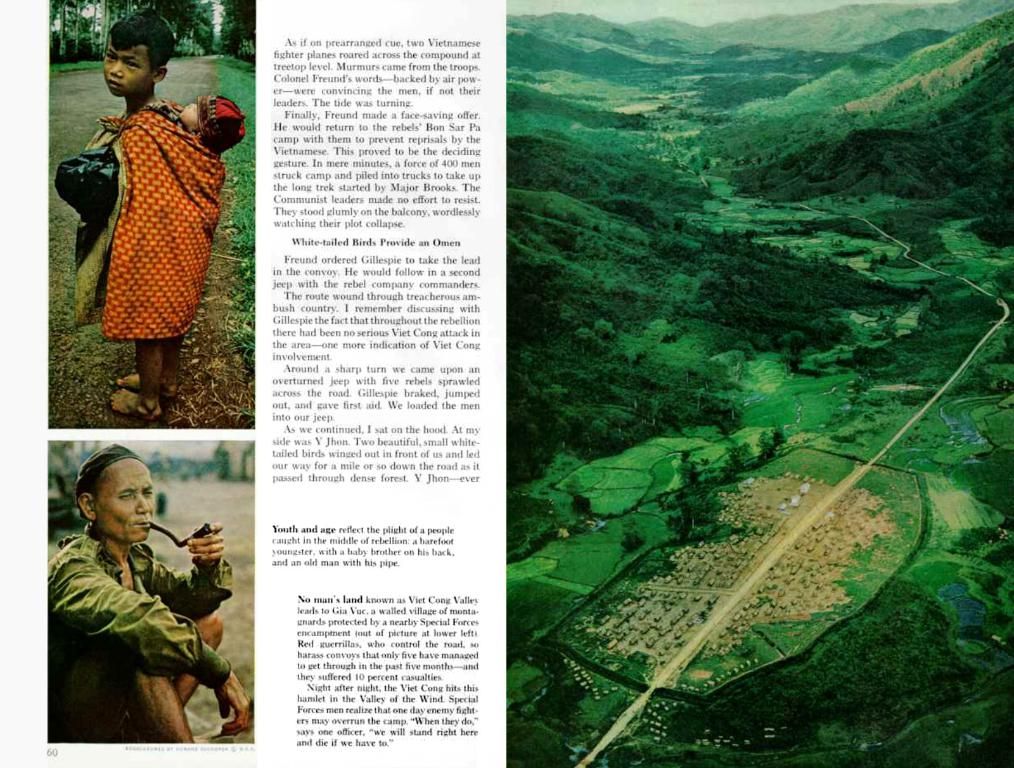

Bitcoin ETF Services Unstoppable?

Bitwise CIO, Matt Hougan, goes on record stating that all four of the world's largest wirehouses (Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS) will jump on the Bitcoin ETF bandwagon by the end of this year.

Hougan is confident in his prediction, emphasizing it as a key contributor to substantial Bitcoin ETF inflows in 2025. He attributed this potential inflow increase to the evolving acceptance of Bitcoin by institutional investors.

The Daily Hodl shared the article on April 30, 2025, mentioning Bitcoin's trading price and providing links to join their social media platforms for more updates. However, the truth behind Hougan's proclamation seems to be a matter of debate. The current financial reports reveal inconsistencies in uncertainty, hinting that each institution may have their own plan and timeline:

- Morgan Stanley is said to be aiming for introducing cryptocurrency and Bitcoin trading on its E*Trade platform, but the exact timeline is unclear, ranging from this year to next.

- Merrill Lynch, Wells Fargo, and UBS have not provided clear statements about launching Bitcoin ETF services. Their focus has been more on direct crypto trading and existing investment products.

While the crypto sector is indeed heating up, the claim of all four major wirehouses offering Bitcoin ETF services is yet to be substantiated entirely. Nevertheless, as more milestones in the crypto world keep falling—like institutional custody, government adoption, and easy access through ETFs—it is likely that more traditional investors will take notice. Stay tuned for updates as the story unfolds!

Industry Announcements

Bitcoin Seoul 2025, the city's largest Bitcoin-focused conference, is set to welcome renowned industry leaders this year. [Read More]FLOKI and Rice Robotics teamed up to design an AI companion robot offering token rewards. [Read More]STEPN partnered with the Argentina Football Association to introduce a unique NFT drop in the sports world. [Read More]BYDFi partnered with Ledger to launch a limited edition hardware wallet, exclusively debuting at TOKEN2049 Dubai. [Read More]The team behind the popular Telegram wallet, Grindery, introduced a wallet infrastructure ideal for AI agents. [Read More]Common launched the first privacy web app, offering fast proving times for Arbitrum and Aleph Zero EVM. [Read More]Falcon Finance unveiled a Transparency Page to provide a clearer understanding of their operations. [Read More]

Don't miss a beat; subscribe here for updates directly to your inbox!

[Follow us on X][Follow us on Facebook][Join us on Telegram]

© 2025 The Daily Hodl

- Exclusive Content + News + Bitcoin + Trading + Ethereum

- Crypto Markets

- Futuremash

- Financeflux

- Blockchain

- Regulators

- Resources + HODLX + FAQ + Guest Post

- Industry Announcements + Press Releases + Chainwire + Sponsored Posts

- Submit + Guest Post + Press Release + Sponsored Post + Advertise

Report any issues or contact us here.

- Join our Social Channels + Telegram + Facebook + X

- Although Bitcoin ETF services from Merrill Lynch, Morgan Stanley, Wells Fargo, and UBS might not be immediately forthcoming, the growing acceptance of cryptocurrency by institutional investors suggests an uptrend in investing, particularly in Bitcoin and Ethereum.

- Meanwhile, the crypto world continues to spur innovation, as seen in partnerships like FLOKI and Rice Robotics, STEPN and the Argentina Football Association, BYDFi and Ledger, Grindery and the creators of AI agents, and Common with Arbitrum and Aleph Zero EVM.

- Staying updated on the latest industry announcements is crucial, as it could lead to significant opportunities in the booming altcoin market and beyond; for example, Bitcoin Seoul 2025 features renowned leaders, and Falcon Finance has launched a Transparency Page for clearer operations.

- Investors should keep their eyes on the rise of cryptocurrency adoption, as government regulation, institutional custody, and easy access through ETFs may cause traditional finance to take notice, potentially initiating a surge in mainstream investing.

- In this dynamic market, staying informed and connected through reliable sources such as The Daily Hodl, on their website, social media platforms, or directly through email subscriptions, is essential for staying ahead in the world of cryptocurrency and finance.