Lower winds impede the probable decrease in the rate.

In a recent development, Russian economic authorities are engaged in a delicate balance act, aiming to control inflation and lower interest rates, thereby supporting economic growth while maintaining price stability.

Central Bank Chair Elvira Nabullina has confirmed that Russia is experiencing cyclical overheating and cooling for the first time in many years. This cycle, however, is not typical and is induced by structural factors, as clarified by Jeanette Smirnova.

Professor Oleg Vyugin emphasizes the importance of an appropriate budget policy before the Central Bank takes well-considered steps regarding interest rates. Economist Mikhail Zadornov suggests implementing budget consolidation immediately, allowing for a quicker reduction in interest rates in the second half of 2025.

The Bank of Russia's medium-term forecast, published on April 25, expects the key rate for 2025 to be 19.5-21.5% and to decrease to 13-14% in 2026. The next key rate decision will be made on July 25.

To combat inflation, the Central Bank has been reducing interest rates gradually, with a 100 basis points cut to 20% per annum on June 6, 2025. However, the policy remains tight to ensure inflation returns to the 4% target by 2026.

In addition to monetary policy, the government and Central Bank are applying macroprudential tools, such as restricting retail borrowing and ending certain subsidy programs like mortgage subsidies. This has contributed to a slowdown in consumer credit growth and affected key sectors like real estate and construction.

Russia's 2025 budget shows inflated revenue growth largely driven by inflation rather than real productivity gains. Rising inflation increases tax revenues through indexing, but underlying economic stress, mounting debt, and inflation risks complicate fiscal and monetary coordination.

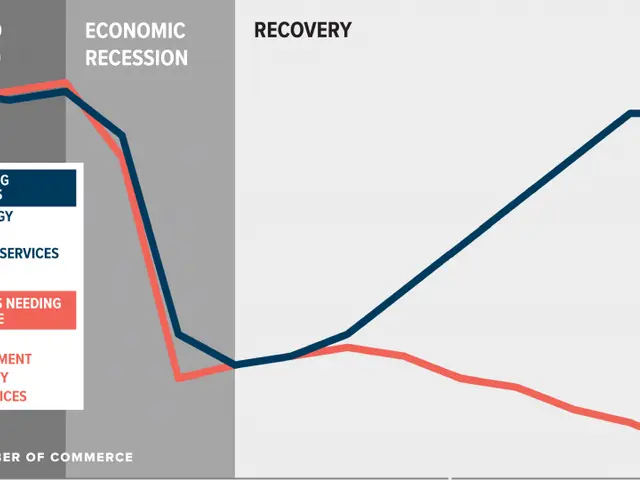

Despite these challenges, officials acknowledge that while domestic demand has been robust, the supply side has lagged, creating inflationary overheating. The slowdown reflects efforts to rebalance growth towards supply capacity.

In summary, the ongoing coordination aims at gradually easing interest rates without triggering inflation rebounds while using macroprudential restrictions and fiscal measures to manage demand and credit growth. The goal is to return inflation to the 4% target sustainably by 2026, supporting a balanced economic recovery.

However, according to Zaborotkin, assessments of the economic situation by participants in the discussion are unfounded, with the majority expecting the Russian economy to show growth in both the current and following year.

Business leaders are considering the impact of budget policy on interest rates, as Professor Oleg Vyugin stresses the need for an appropriate budget policy before the Central Bank adjusts interest rates. Meanwhile, economist Mikhail Zadornov suggests implementing budget consolidation to accelerate the reduction of interest rates by the second half of 2025. In the realm of finance, the Russian economy is grappling with cyclical overheating and cooling due to structural factors, and officials are working to maintain price stability while promoting economic growth, as evidenced by the delicate balancing act of reducing inflation and lowering interest rates.