Buckle Up for a Pricey Ride: What to Anticipate with Sizewell C's Costs

London Allocates €17 Billion for Construction of New Megawatt Power Station

Get ready for a hefty bill, folks! The British government has sticked a whopping £14.2 billion (around €16.8 billion) price tag on the upcoming Sizewell C nuclear power plant in Suffolk. Energy Minister Ed Miliband, ever the optimist, sees a "golden age" of clean energy on the horizon, but it seems like the British taxpayer is footing the bill for most of this endeavor.

Sizewell C is set to resemble Hinkley Point C, boasting two European Pressurized Reactors (EPR) and a capacity of 3.2 gigawatts upon completion. The British government predicts a nine to twelve-year construction period. Once alive and kicking, Sizewell C is estimated to power six million homes and create thousands of jobs.

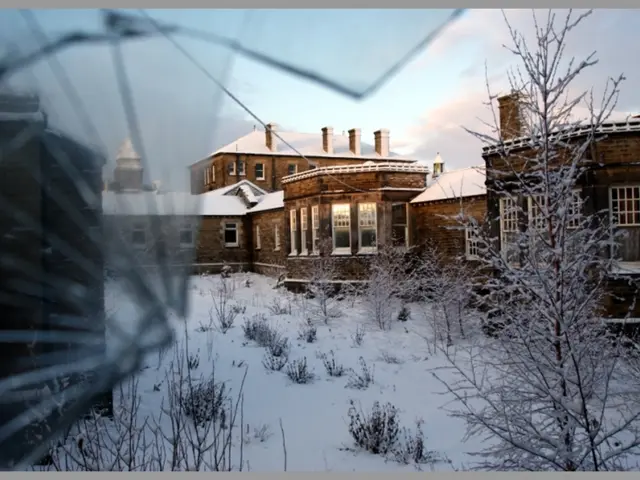

Unlike Germany, the UK is staying loyal to nuclear power as a clean energy source. Sizewell A and B, Suffolk's existing nuclear power plants, have already provided a peek into the future—or past, depending on how you look at it. Sizewell A, shut down in 2006 for economic reasons after 40 years of operation, and Sizewell B, connected to the grid in 1995 with a capacity of 1.2 gigawatts, are well-known players in this game. But this exciting ride may not come cheap.

The Power Players

Originally, Sizewell C was 80% owned by the French energy company EDF, which was meant to develop and build the nuclear power plant, with the Chinese power plant operator China General Nuclear (CGN) owning the remaining 20%. However, due to security concerns, the British government nabbed CGN's stake a few years back. Overwhelmed by debts and cost overruns at Hinkley Point C, EDF has also scaled back its investment in Sizewell C, leaving the British government with a hefty 83.5% stake, with the rest held by EDF.

The Hinkley Heat

Remember Hinkley Point C? The costs there have skyrocketed significantly since the original £10 billion (around €11.7 billion) estimate. Now, it could reach a whopping £46 billion (around €53 billion)! Which means, you guessed it, higher electricity prices for us consumers.

But don't fret too much, EDF's taking one for the team. They've agreed to shoulder the additional costs for Hinkley Point C, in exchange for the British government's agreement to charge consumers a higher electricity rate.

It seems the rising costs and prolonged construction periods are par for the course when dealing with nuclear power plants. Historically, nuclear power plants have been a hefty 120% over budget compared to their initial plans[1][4]. And Sizewell C is no exception, with a potential cost of approximately €37 billion. Delays are common, too. Nuclear power plants on average take three times longer to construct than initially planned[2].

So, batten down the hatches, folks! This nuclear power plant ride is set to run for 27 to 36 years (translation: feel free to retire and come back by the time it's built), and it ain't coming cheap. Better grab your financial life jackets and hang on tight—we're in for a wild ride!

Sources: ntv.de, chr

[1] National Renewable Energy Laboratory, "Revisiting Nuclear Cost Projections – The Historical Overruns Issue," 2015. [2] Westinghouse Electric Company, "Insights into Schedule Reliability," 2005. [3] U.S. Department of Energy, "Cost and Schedule Status of the Nation's Nuclear Plants: Spring 2016 Update," 2016. [4] International Atomic Energy Agency, "Operational Experience and Lessons Learned from Nuclear Power Plants," 2017.

To manage escalating costs, the British government might consider implementing a community policy that includes vocational training for individuals in the energy and finance sectors, potentially aiding in the construction and operation of Sizewell C. The profit generated from Sizewell C could be invested in sustainable energy projects within the local community, further fostering vocational training and job creation opportunities in related industries.