Life expectancy rises—how Social Security timing impacts retirees' future

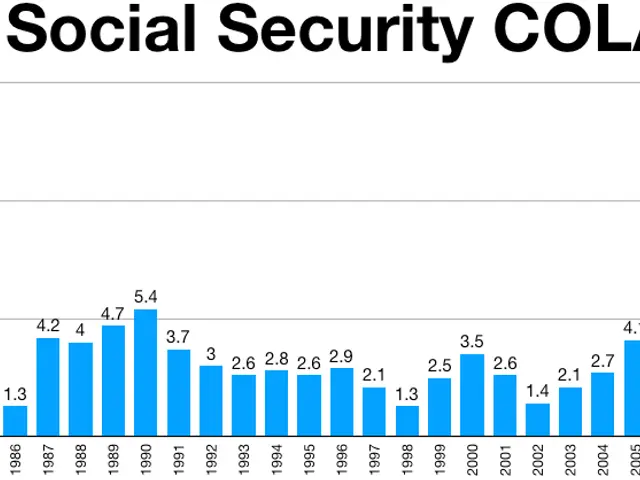

Life expectancy for older Americans has slightly improved, according to the latest CDC data. A 65-year-old can now expect to live another 19.7 years—up from 19.5 in 2023. Meanwhile, decisions around Social Security benefits are becoming more critical as retirees weigh timing against longevity.

The CDC's 2024 figures show a modest but steady rise in life expectancy. A 70-year-old American, for example, is now projected to reach their 86th birthday. Women, Hispanic, and Asian populations tend to outlive the national average, while American Indian men also live longer than the typical male.

Social Security remains the backbone of retirement income, with half of those aged 65 and over relying on it for at least 50% of their yearly earnings. Financial advisors often suggest that lower-earning spouses claim benefits early, particularly if they plan to draw spousal benefits later. Couples may also optimize their household income by having the higher earner delay claiming until age 70.

For those delaying benefits from full retirement age to 70, the break-even point is around 85.5 years. However, individuals with chronic health issues or urgent financial needs may choose to claim earlier. The decision hinges on personal circumstances, from health to household income strategy.

The slight increase in life expectancy reinforces the importance of careful retirement planning. With Social Security as a key income source, timing claims can significantly impact long-term financial security. Retirees must balance longevity trends with their own health and financial needs when making decisions.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting