Leveraged loans deliver mixed gains in 2025 despite strong institutional demand

The Experian credit market showed mixed results in 2025, with the S&P UBS Leveraged Loan Index delivering a 5.94 percent return for the year. This marked the 14th straight quarter of positive gains for bank loans. However, the Fund underperformed slightly in the final quarter, returning 0.92 percent against the index's 1.19 percent.

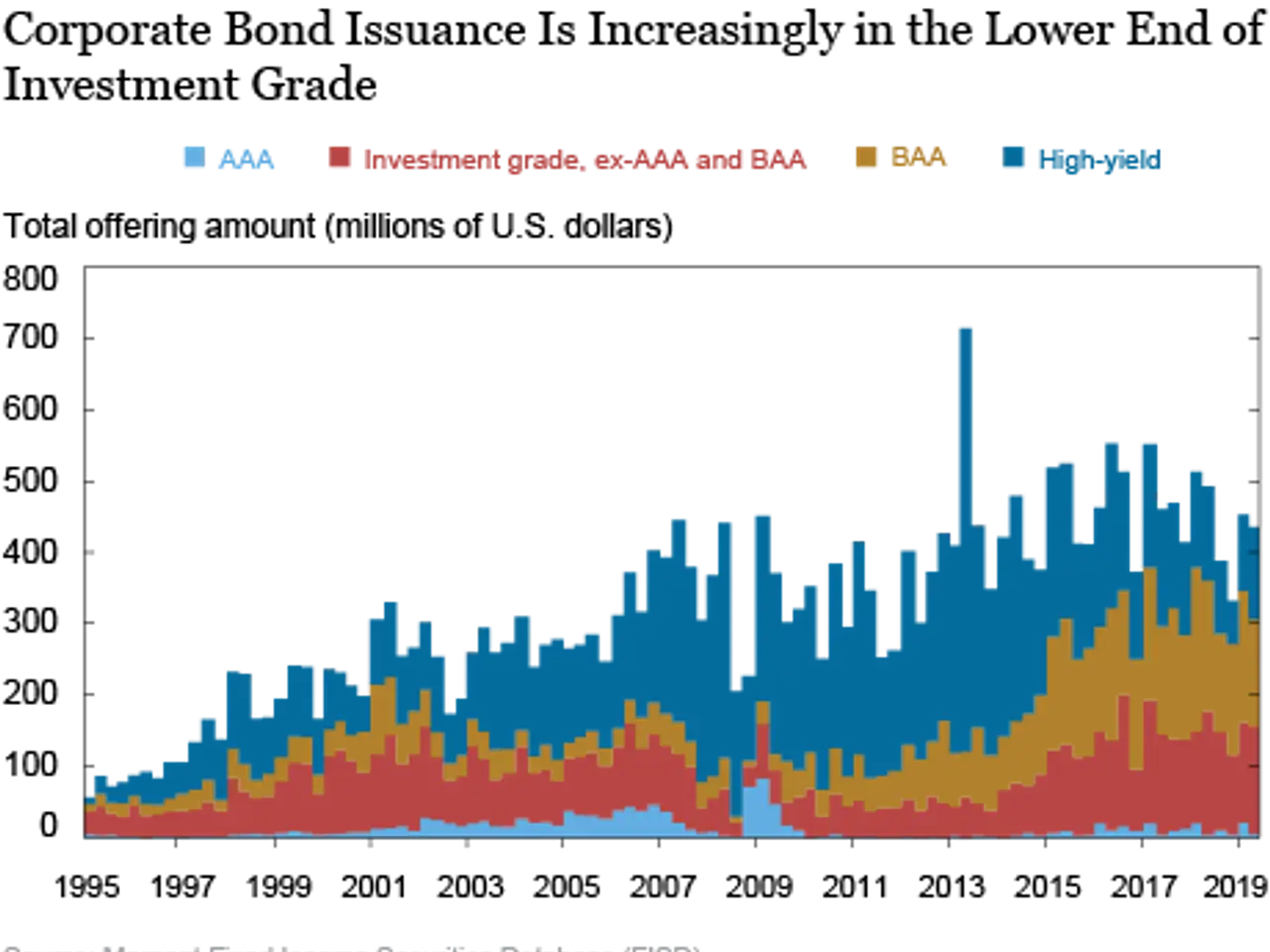

Throughout 2025, demand for leveraged loans stayed strong, driven by institutional investors such as pension funds and insurers. Record collateralised loan obligation (CLO) issuances and high tranche returns—6 percent for AAA and 9.3 percent for BB—supported this trend, even as retail funds saw outflows. European credit markets also contributed to steady inflows.

The Fund's performance benefited from allocations to high-yield bonds and single B loans. Strong credit selection in consumer cyclical, basic industry, and communications sectors further boosted relative returns. Yet, consumer non-cyclical picks weighed on results.

Looking ahead, concerns remain about weakening credit fundamentals and lower recovery rates. The share of B3/B- rated loans in the index has grown to 20 percent of market value, signalling higher tail risk. While the Federal Reserve's three rate cuts in 2025 may ease some pressure on credit metrics, they are unlikely to significantly help highly levered issuers. Defaults are expected to rise in the near to mid-term.

Given these risks, analysts suggest trimming exposure. Credit selection will remain critical as market conditions become more challenging.

The Fund's 2025 results highlight both opportunities and risks in leveraged loans. While strong sector picks and high-yield allocations drove gains, rising tail risk and potential defaults require caution. Investors will need to focus on careful credit selection as market conditions evolve.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern