Las Vegas Sands Reports Stellar Q3, Driven by Asian Growth

Las Vegas Sands, the global casino giant, has reported a stellar third quarter, with Marina Bay Sands in Singapore leading the charge. The company's financial and operating performance has been nothing short of outstanding.

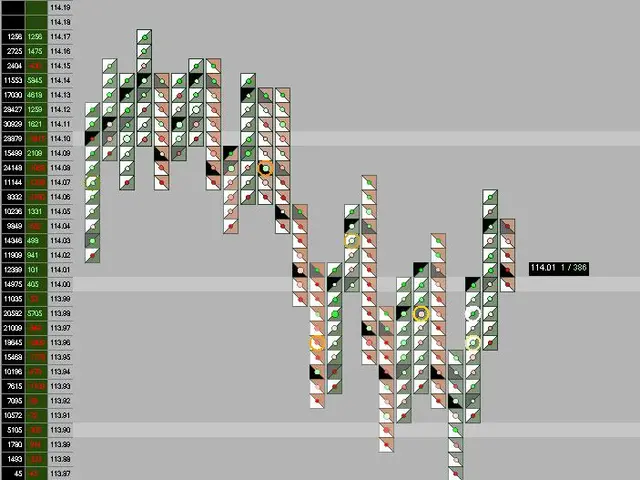

The company's adjusted profit soared to $0.78 per share, a remarkable 77% increase from the previous year and a full $0.15 above expectations. This impressive figure was driven by a 30% surge in casino revenue to $2.51B and a 19% increase in room revenue to $374M. The news sent Las Vegas Sands' shares rallying in postmarket trading.

The company's success can be attributed to its significant investments in Asian markets. Expansion projects like The Venetian Macao and the recent opening of The Londoner Macao have paid off, with strong tourism and gaming demand boosting revenue. Table games in both Macao and Singapore also contributed significantly to the gains. Consolidated adjusted property EBITDA jumped to $1.34B, up from $991M in the same quarter last year.

Las Vegas Sands also announced an increase in its share repurchase program to $2.0B. Total revenue for all properties combined increased by more than 24% to $3.38B, $280M higher than expected.

In light of these impressive results, Las Vegas Sands has raised its quarterly dividend for the 2026 calendar year to $1.20 annually per share. The company's strategic investments and strong operational performance have positioned it well to continue capitalizing on the growing Asian gaming market.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now