KKR Income Fund Faces Turbulence as Rates and Credit Risks Mount

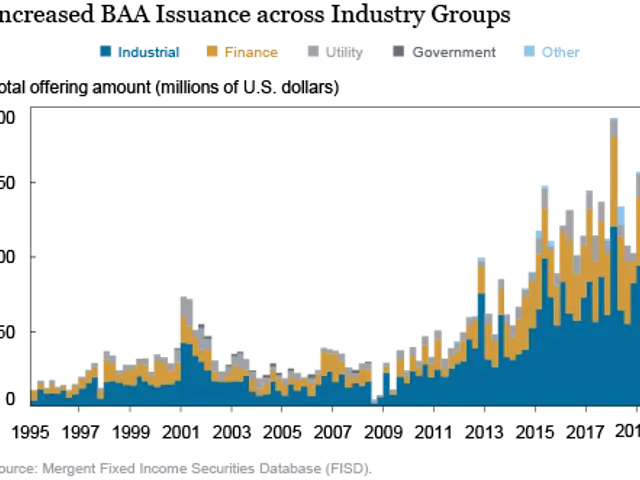

The KKR Income Opportunities Fund (KIO) is facing financial pressure as interest rates shift. This closed-end fund specialises in high-yield fixed-income investments, blending both fixed and floating-rate assets. Recent market changes and credit troubles have raised concerns among investors about its stability and future payouts.

KIO aims to deliver high current income, with capital growth as a secondary goal. Its focus on riskier high-yield assets sets it apart from more conservative funds. However, this strategy comes with higher exposure to credit risks, as seen in the bankruptcies of First Brands and Tricolor.

The fund’s future depends on how it manages rate cuts, credit risks, and high expenses. A potential distribution cut could impact shareholder returns and market confidence. Investors are watching closely as KIO navigates these financial challenges.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting