KiwiSaver funds thrive in 2025 as newer providers like Fidelity gain ground

KiwiSaver investors experienced solid returns by the end of 2025, with balanced funds delivering steady growth. The latest data also highlights shifts in provider popularity, as newer entrants like Fidelity gained traction among savers. One standout was SuperLife, which captured 10% of all transfers in October despite not being a major provider in the MJW report.

Over the year, returns varied across fund types and providers. The median balanced fund grew by 1.7% for the quarter and 9.8% for the full year. Westpac led in growth and balanced categories, while AMP topped the moderate funds.

For the quarter, Simplicity took first place in growth, conservative, and balanced funds. Over three years, Simplicity remained ahead in growth, with ASB leading in balanced, moderate, and conservative categories. The median returns over this period were 13.3% for growth, 10.9% for balanced, and 7.4% for conservative funds.

Long-term performance showed Milford as the top performer in growth, balanced, and conservative funds over a decade. AMP, however, led in the moderate category during the same period.

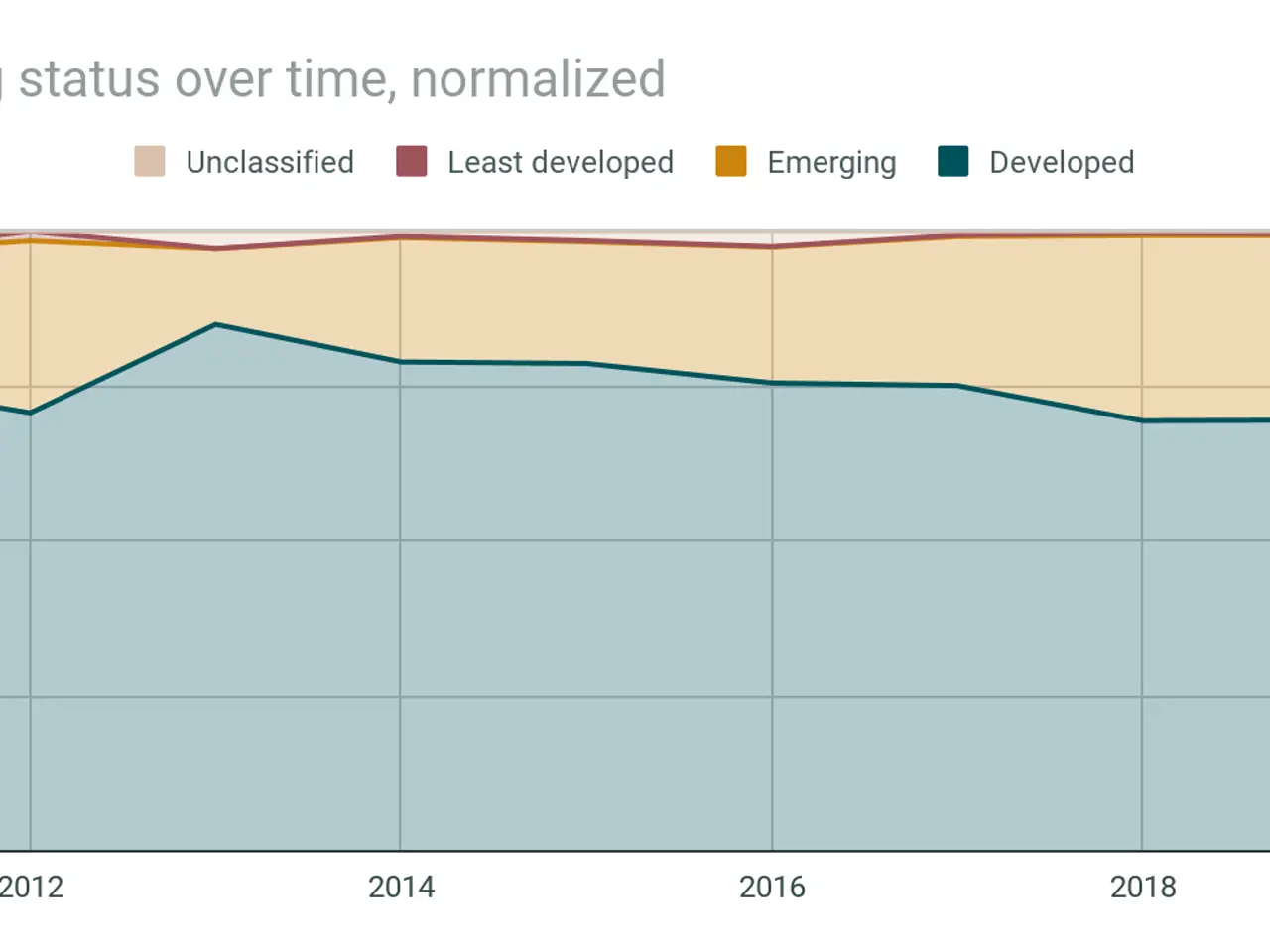

Global markets played a key role in shaping returns. Developed markets, particularly Japan and the UK, drove strong results. The MSCI Emerging Index surged by 30% in 2025, outperforming the Nasdaq's 20% gain. Meanwhile, New Zealand equities remained less volatile than global shares but did not deliver significantly higher returns in recent years.

The data confirms steady growth for KiwiSaver investors in 2025, with balanced funds performing well. Providers like Simplicity and Westpac stood out in short-term results, while Milford and AMP maintained long-term leadership. The shift toward newer providers, such as United Healthcare and Fidelity, also reflects changing investor preferences.