Keyence smashes records with soaring profits and global expansion in Asia and North America

Keyence has reported record-breaking financial results for its third quarter, with revenue and profits hitting new highs. The company's global expansion, particularly in Asia and North America, has driven strong growth. Shareholders will also benefit from a sharply increased dividend forecast for the year.

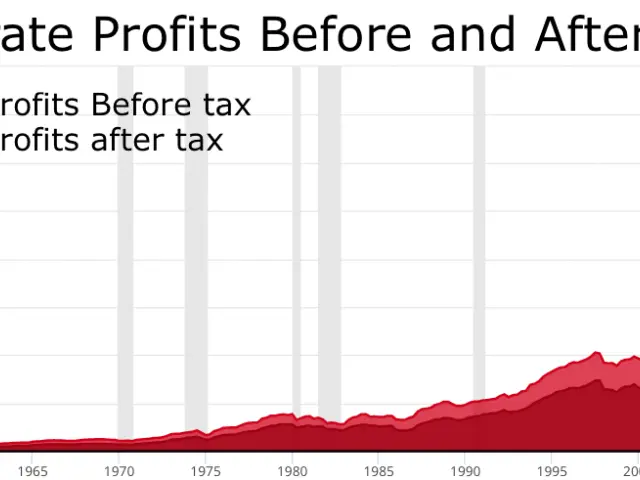

The Japanese precision technology firm announced third-quarter revenue of ¥289.3 billion, the highest ever for this period. Net income for the same quarter rose 9.0% to ¥111.2 billion, while operating profit reached ¥144.2 billion. Over the first nine months of the fiscal year, total revenue climbed to ¥834.6 billion, with net profit up 6.6% to ¥311.2 billion.

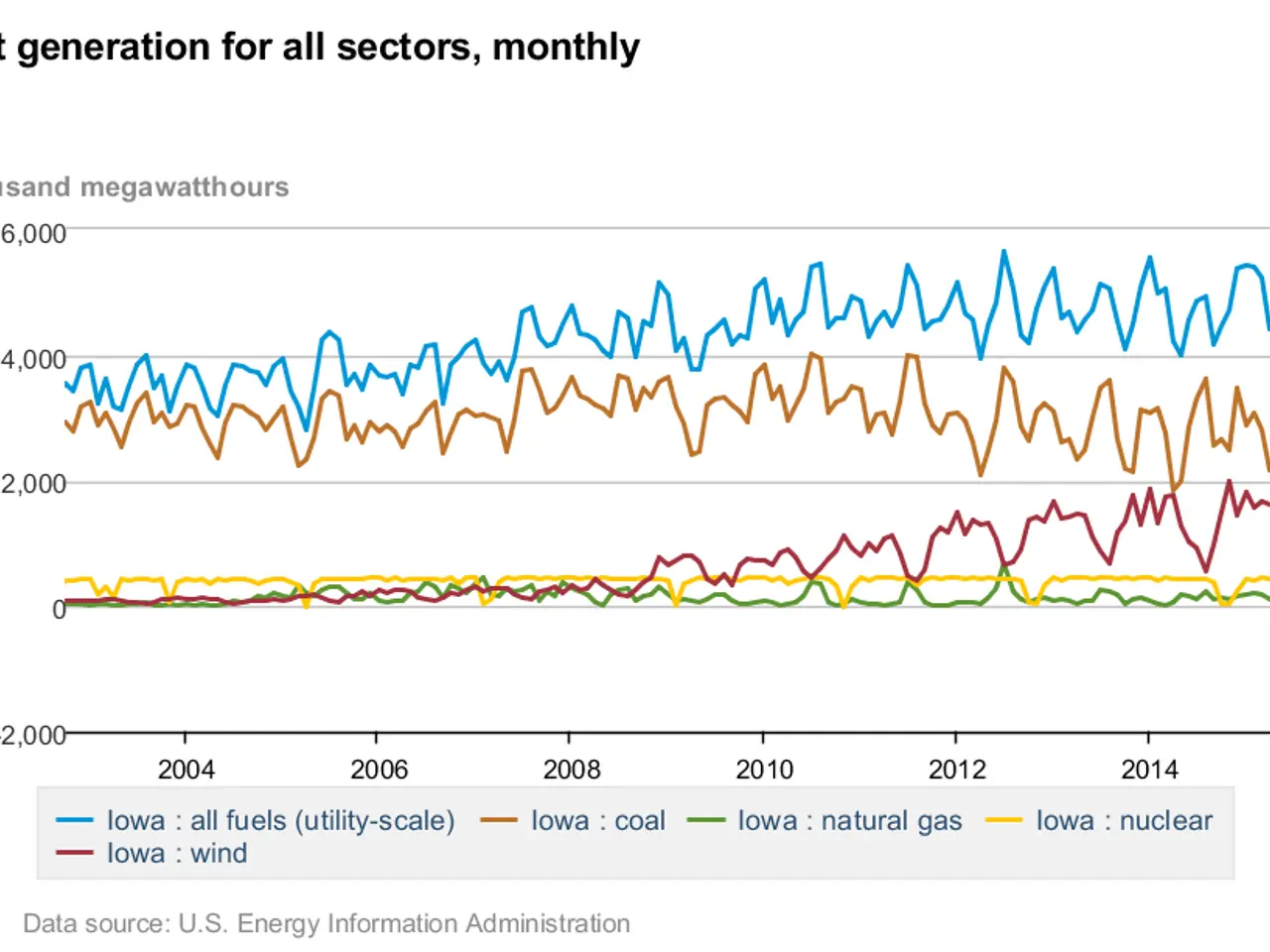

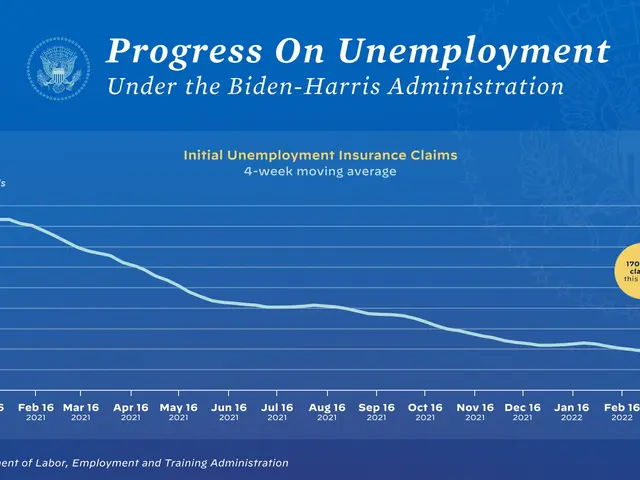

Sales growth was led by Asia, where revenue surged 21.1%, and North America, which saw a 17.5% increase. Over the past five years, demand for Keyence's measurement and automation solutions has expanded strongly, with a compound annual growth rate (CAGR) of around 10–12%. The Asia-Pacific region, especially China and Southeast Asia, recorded the fastest growth at 15–18% CAGR, followed by North America at 12–14% and Europe at 8–10%. Overseas operations now make up roughly 70% of the company's total revenue.

Despite the strong performance, Keyence is taking a more cautious approach in Europe and parts of its domestic Japanese market. Weak investment in manufacturing facilities has led to slower growth in these regions. Meanwhile, the company's financial position remains robust, with an equity ratio nearing 96%.

In response to the strong results, management has raised the full-year dividend forecast to ¥550 per share, up from the initial projection of ¥350. Investors are now awaiting the full-year results announcement on April 28, 2026, and the next dividend payment on March 17, 2026.

Keyence's latest financial report highlights its continued global expansion and strong profitability. The increased dividend reflects confidence in sustained growth, particularly in high-demand regions like Asia and North America. The company's next updates will provide further clarity on its full-year performance and shareholder returns.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now