Kazakhstan Experiences 23% Increase in Gold and Foreign Exchange Reserves

In the heart of Central Asia, Kazakhstan continues to hold a significant position in the global gold reserves, placing it between the United Kingdom and Lebanon. As of January 6, 2025, the country is home to 295.2 tons of commercial gold, ranking it 20th globally in gold reserves.

Gold assets account for a substantial 57.2% or $25.3 billion of Kazakhstan's reserves, serving as a buffer against economic and geopolitical shocks. This protective role is crucial, as gold assets help safeguard reserves against the depreciation of foreign currency assets.

The Nation's gold is stored both domestically and with foreign banks, with the National Bank of Kazakhstan acquiring gold from producers and persons who became its owners after processing.

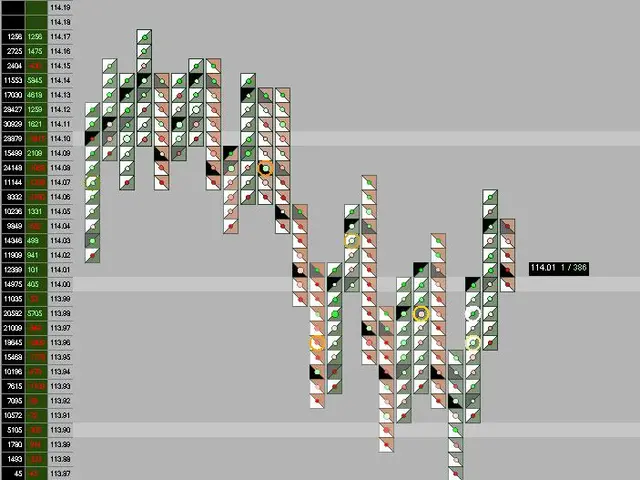

In November 2024, the tenge exchange rate against the dollar surpassed 500, marking a 15% depreciation over the year. Despite this depreciation and increased volatility, Kazakhstan's government and central bank have not indicated any fundamental change in their exchange rate management approach for the tenge.

President Kassym-Jomart Tokayev, in an interview with the Ana Tili Newspaper, believes it is unreasonable to deplete foreign exchange reserves just to sustain a strong tenge. Instead, he views the recent tenge depreciation as driven by temporary, natural market factors such as seasonal effects, government spending, and corporate foreign exchange needs, not speculative attacks or external shocks.

The authorities view the tenge as fundamentally undervalued, with oil prices remaining high. This suggests that current pressures are temporary, and no special exchange rate policy change is needed. The NBK Deputy Governor has downplayed speculative causes and indicated there is no basis for a sustained weakening of the tenge.

As of 2024 and into 2025, the government and National Bank have not publicly considered a major change in how they manage the exchange rate of the tenge. Instead, they rely on existing mechanisms, market conditions, and their foreign reserves to maintain stability.

Prime Minister Olzhas Bektenov mentioned revising the USD/KZT forecast for 2026 from 475 to 540 tenge per dollar, implying an anticipated depreciation of about 13.7%. However, this reflects a market adjustment rather than a deliberate policy shift.

Exchange rates in August 2025 fluctuate around 538-540 tenge per USD, consistent with government forecasts, with no reports of emergency interventions or major policy realignments.

As Kazakhstan continues to navigate its economic landscape, the government and central bank remain vigilant in their approach to the tenge exchange rate, carefully examining all options for changes in the exchange rate approach. The resilience of Kazakhstan's gold and foreign exchange reserves will undoubtedly play a crucial role in this ongoing evaluation.

[1] Source: Central Bank of Kazakhstan press releases and statements [2] Source: World Bank data on Kazakhstan's exchange rate history [3] Source: Kazakhstan Ministry of Finance reports on the tenge exchange rate [4] Source: President Kassym-Jomart Tokayev's interview with Ana Tili Newspaper [5] Source: Kazakhstan National Bank's Quarterly Bulletin on Exchange Rate Developments