Toyota's Strategy Shake-up: Doubling Capital Returns by 2030?

Japanese automobile manufacturers stun investors with unexpected announcements

Let's dive into the recent surge in Toyota's stock prices and potential plans for doubling returns on equity.

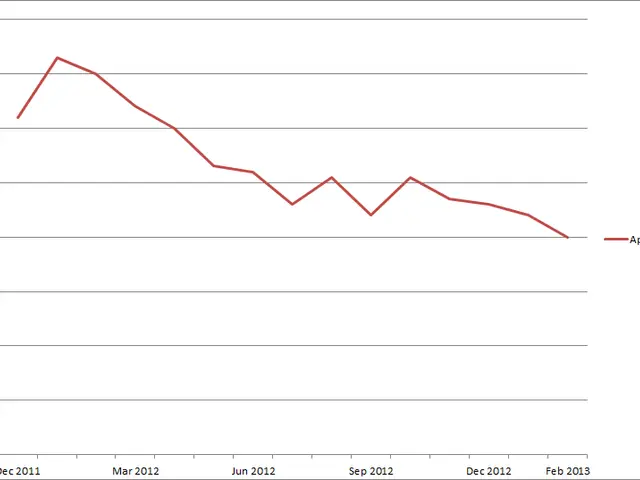

Boosted Stock Prices

Over the past three trading days, Toyota's shares have soared a whopping 12.5%. The market's response was sparked by a report from the Nikkei financial newspaper. The report hinted at Toyota's ambition to more than double its return on equity to a staggering 20% by 2030. The figure remains unconfirmed as a top executive chose to keep their identity under wraps. Historically, Toyota's return on equity has fluctuated between 9% and 16%, without a predetermined target rate.

Behind the Curtains

Recently, Toyota Industries, a key supplier to Toyota Motor, has been in the limelight due to a potential buyout proposal from Toyota Motor, valued around $42 billion. This move is an extension of restructuring efforts spearheaded by the Toyota group, aiming to solidify influence and bolster strategic alignment[2].

Strategic Drivers

Electric Vehicle Push

With the global demand for electric vehicles (EVs) on the rise and regulatory pressure mounting, especially in the U.S. and EU, Toyota is gunning for an EV lineup of 15 models by 2027. The goal here is to crank out a million EV units annually, poised to seize a slice of the growing EV market[3][4].

Reinforcing Influence

The acquisition of Toyota Industries could amplify Akio Toyoda's influence within the Toyota conglomerate, promoting more unified management and smarter decision-making[2].

Impact on the Company and Stock Market

Corporate Benefits

- Streamlined Operations: Consolidating Toyota Industries within Toyota Motor's sphere could lead to an improved supply chain and better strategic alignment.

- EV Dominance: The emphasis on EVs will equip Toyota to adapt to evolving market trends and regulatory demands, potentially expanding their presence in the growing EV sector[3][4].

Stock Market Implications

- Acquisition Boost: The proposed buyout at a 40% premium over Toyota Industries' market cap signals faith in the company's future growth and integration potential[2].

- Investor Optimism: Strategic moves in EV expansion and potential consolidation could bolster investor confidence, possibly fueling increased market valuation.

While concrete evidence about a 20% capital return by 2030 remains scarce, Toyota's strategic shifts emphasize a commitment to long-term growth and shareholder value enhancement via diverse investments and strategic consolidation.

[1] Nikkei article (in Japanese)[2] Reuters article[3] CNET article[4] Autoblog article

- Toyota aspires to double its return on equity to an impressive 20% by 2030, as suggested in a report from the Nikkei financial newspaper.

- The automotive giant is aiming to crank out a million electric vehicle units annually by 2027, with a goal of 15 EV models in its lineup.

- The potential acquisition of Toyota Industries by Toyota Motor could amplify Akio Toyoda's influence within the Toyota conglomerate, promoting more unified management and smarter decision-making.

- The proposed buyout at a 40% premium over Toyota Industries' market cap signals faith in the company's future growth and integration potential, which could boost investor confidence.

- Toyota's strategic shifts towards long-term growth and shareholder value enhancement via diverse investments and strategic consolidation could lead to improved supply chain management and better strategic alignment, potentially fueling increased market valuation.