Is it essential to include pharmaceutical stocks like Novo Nordisk and Eli Lilly in one's investment portfolio?

Stepping Away from the Weight Loss Wars:

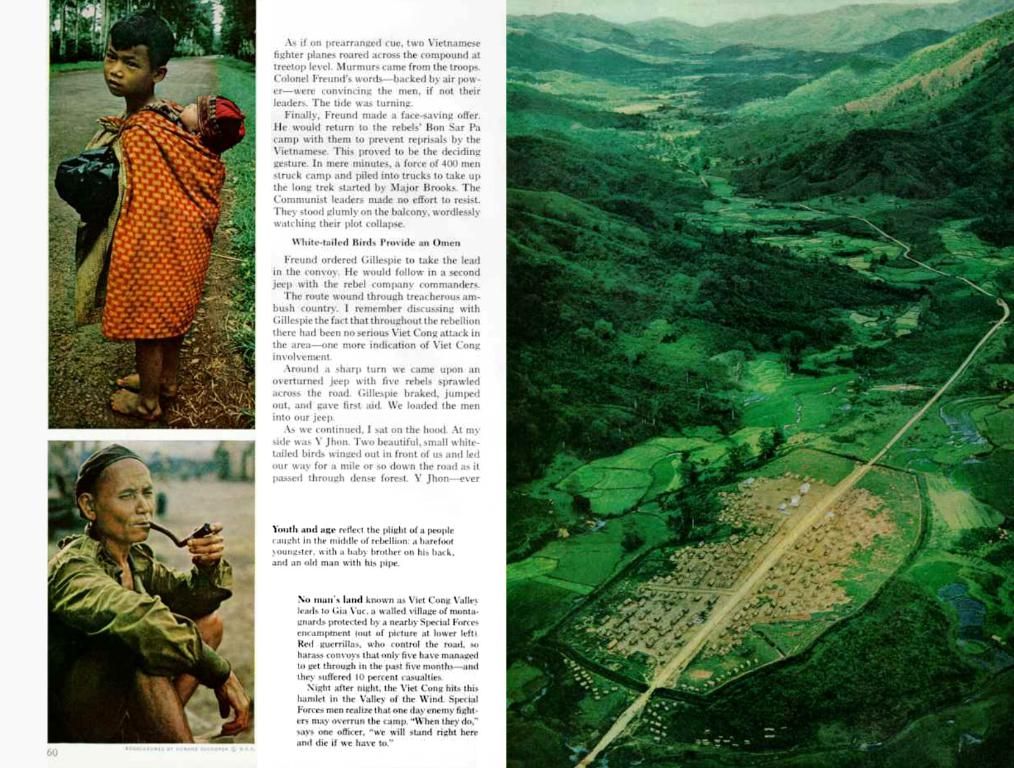

The tension between pharmaceutical titans Novo Nordisk and Eli Lilly has overshadowed much in the pharma sector, leaving opportunities for lesser-known competitors up for grabs.

Investors might want to explore beyond the limelight. Generating impressive profits from weight loss medications, pharmaceutical titans like Eli Lilly and Novo Nordisk often take center stage. However, a multitude of smaller stocks may be overlooked.

Even amidst the corona boom, some analysts predict that certain second-tier stocks will demonstrate substantial potential by 2025.

Pharma Picks for 2025:

One stock that grabbed attention during the pandemic but then faded into the background is AstraZeneca. US-based Bernstein Research retains its "Outperform" rating for AstraZeneca, setting a price target of 18,000 pence. Despite concerns about potential pressures from Trump administration healthcare policies, Bernstein remains optimistic, praising the company's good growth prospects, attractive stock valuations, and cash generation.

Beyond AstraZeneca, Sanofi and Novartis also appear on Bernstein's radar, backed by similar reasons.

AstraZeneca (WKN: 886455)

Sartorius: JPMorgan's Bullish Call

While not everyone agrees with the optimism, JPMorgan is optimistic about pharmaceutical supplier and service provider Sartorius and its subsidiary Sartorius Stedim Biotech. Despite Sartorius' stock not yet reaching its 2021 high of 630 euros, it has maintained a stable position above the 200 euro mark. The company reported signs of business stabilization in October, despite a dip in revenue and earnings. Sartorius and Stedim Biotech feature on JPMorgan's "Positive Catalyst Watch" list. JPMorgan reaffirmed its "Overweight" rating for Sartorius with a price target of 275 euros and maintained its price target of 230 euros for the subsidiary.

Sartorius AG (WKN: 716563)

Also check out: Nvidia, Palantir, or...? This tech stock with skyrocketing potential by 2025

Or: Is gold about to explode? Key news updates

Disclosure on Conflict of Interest: The author holds direct positions in the financial instruments mentioned in this publication or related derivatives that could benefit from the price development resulting from the publication: Eli Lilly.

Investigating Second-Tier Pharma Stocks:

When considering lesser-known pharma stocks with growth potential up to 2025, consider companies like Sangamo Therapeutics, specializing in genomic therapies and partnered with Eli Lilly.

Explore Insider Monkey's curated list of 13 biotech stocks with significant growth potential.

Diverse Innovations in the pharma and biotech sectors may be driven by successful IPOs, offering exciting investment opportunities.

- The attention on pharmaceutical giants like Novo Nordisk and Eli Lilly might ignore considerable potential in medical-conditions stocks, such as Sangamo Therapeutics, a company specializing in genomic therapies that has partnered with Eli Lilly.

- Beyond AstraZeneca and Sanofi, there are other health-and-wellness stocks that analytics firms like Bernstein consider promising for 2025, opening opportunities for savvy investors in the finance sector.

- In the realm of science and finance, one should not overlook less prominent pharma companies like Sartorius AG, which JPMorgan sees as a bullish investment due to its stable position and potential for substantial growth in the medical-equipment sector.