Is General Mills' Stock Not Meeting the Performance Mark Set by the Dow?

Modifying the Market Giant: General Mills' Current Tumble Beside the Dow and Kraft Heinz

Get a front-row seat to Wall Street's buzz with our Active Investor newsletter's trends.

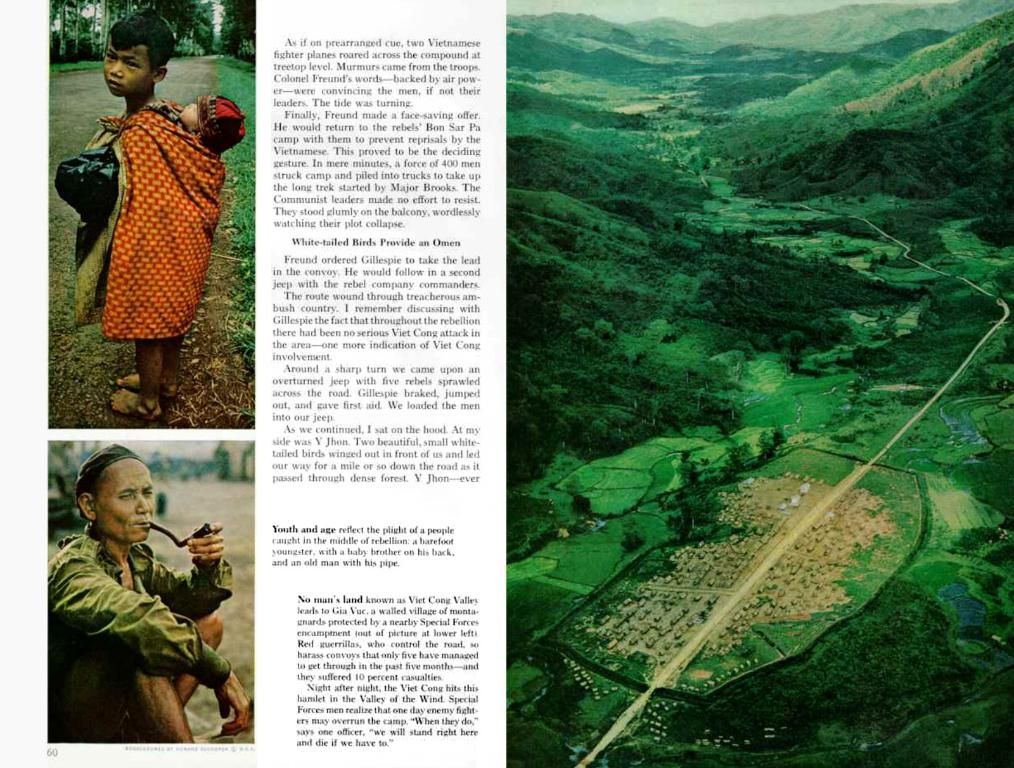

Minneapolis-based colossus General Mills, Inc. (GIS) swings its hefty $30.2 billion market cap in the global consumption goods arena, branching through North America Retail, International, Pet, and North America Foodservice segments. This corporate titan—a large-cap stock contender—offers an assortment of ready-to-eat cereals, meals, snacks, and more, yet its current trajectory paints a different picture.

📢Move over Netflix & Disney: This Pre-IPO Startup Is Unleashing $2 Trillion in IP & Licensing Revenue

In last year's September, GIS peaked at a $75.90 52-week high, but it's since plummeted by a steep 28.2%. In the recent three-month span, it's even further deteriorated, shedding 16.5%, while the Dow Jones Industrial Average ($DOWI) posted a modest 2.3% uptick.

This bearish long-term pattern persists: GIS stock plunged 18.5% over the previous 52 weeks and 14.5% YTD, recording subpar performance compared to Dow's 10.3% yearly growth and gains in 2025.

GIS has been trading below its 200-day moving average since early November 2024 and its 50-day moving average since early October 2024, with occasional slight recoveries. The stock nosedived by 2.1% on March 19 following its Q3 results release, which revealed a 5% decrease in net sales to $4.8 billion and a 140 basis point contraction in the adjusted operating margin, among other setbacks.

It's peers such as The Kraft Heinz Company (KHC) have struggled too, losing 13.4% in 2025 and 20.8% over the past year, ultimately underperforming stock-wise.

Out of 20 analysts monitoring GIS stock, the consensus vote lands at a "Hold." Their average price target of $60.95 indicates a forecasted 11.8% spike from current levels.

An assortment of factors has combined to rattle GIS stock, including:

- Sales and demand instability.

- Lower sales numbers due to decreased consumer shopping and demand in snacks and salty foods.

- Strategic difficulties and refinements.

- A flurry of restructuring initiatives, including shedding non-core assets, such as their North American yogurt business, in an attempt to optimize the portfolio and endure margin pressures.

- A shift in strategic approach through the "Accelerate" strategy, geared towards encouraging growth through innovation and value, albeit with some implementation snags.

- Market and economic weight.

- The hurdles posed by inflation and supply chain disruptions that reduce profitability.

- Navigating stratified and cautious consumer markets in the U.S. and China, where mounting debt and diminished optimism impact purchasing habits.

- Financial advice and performance factors.

- Revised financial outlook with projections of a 7% - 8% decline in adjusted EPS, thereby dampening investor appetite.

- A dip in quarterly revenue by 5.1%, highlighting issues in upholding sales growth.

While the Dow Jones Industrial Average and Kraft Heinz maintain separate market dynamics or strategic advantages, these challenges have considerably impacted GIS's performance compared to its counterparts.

Amidst these corporate shifts and market difficulties, it's important for investors to seek alternative avenues for financial growth. Perhaps considering other business ventures or diversifying one's investment portfolio in the realm of finance would be a prudent strategy.

In the wake of General Mills' declining performance, questioning the potential for better returns in other investing opportunities may be a worthwhile exercise, even within the broader consumption goods sector.