Investment Opportunities in Scotch Whisky Are Yet to Reach Their Peak

========================================================================

In the world of luxury investments, whisky has emerged as a promising asset class, particularly for those interested in rare bottles and casks. Here's a closer look at the factors driving the growth and value of rare whisky, and the potential returns for investors.

WhiskyInvestDirect, a platform that allows investors to purchase whisky by the liter, similar to investing in gold bars, has gained popularity. One of the most sought-after whiskies on the platform is Bowmore, which has seen a surge in demand.

The allure of long-discontinued bottles from the 1960s and 1970s remains strong, with their scarcity driving up prices. In 2020, Scottish distillery The Macallan dominated top bottle sales, with a Macallan 1926 selling for over $1m at an online auction.

Nc'nean, a new organic and sustainable Highland distillery, made headlines when its inaugural bottle sold for $53,000 at an online charity auction in August 2020, setting a world record for a first release.

Emerging distilleries like Glen Garioch 2009 are also garnering attention, with their whisky expected to increase in value. However, bottles from silent or demolished distilleries will become increasingly rare over time, making them valuable collectibles.

Becoming an expert in the whisky world takes time and commitment. Dan Jay, market director of WhiskyInvestDirect, emphasizes the platform's ease of entry and exit as one of its unique selling points.

Cask Trade estimates that cask whisky is a steadier, longer-term investment compared to bottled whisky. An average short-term investment (up to 4 years) in cask whisky could see a return of between 22% and 40%. For a longer-term investment of a decade, a cask could yield up to a 180% return on investment.

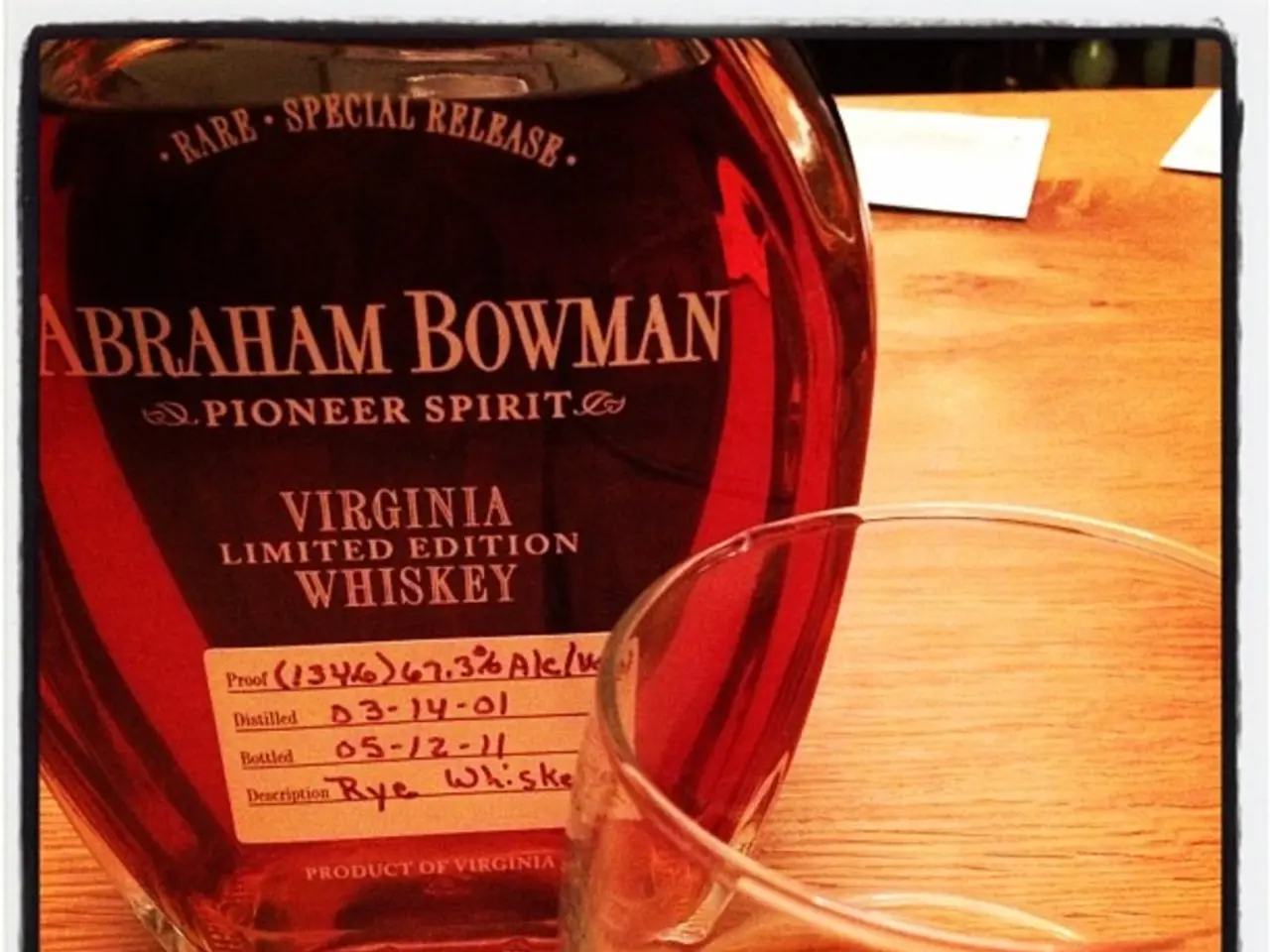

The value of rare whisky bottles for investment is influenced by factors such as rarity, age, quality, and provenance. Limited editions and bottles from prestigious distilleries generally command higher prices due to their exclusivity and collector appeal. The condition of the bottle and its packaging can also significantly impact value.

Market dynamics such as supply and demand trends, global shifts in consumer preferences, and economic factors also affect investment values. Recent market corrections have reduced prices from previous highs, illustrating volatility, but long-term growth remains positive for investors who hold over many years. Whisky is often viewed as a non-correlated "safe haven" asset that diversifies investment portfolios.

Trends toward "premiumization" mean consumers increasingly favor quality and exclusivity over volume, boosting demand for rare and limited-production whiskies. Emerging markets and sustainability efforts in production also shape value perceptions. Additionally, transparency and provenance, including direct engagement with cask ownership and tracking, add value to some investors seeking authenticity and connection to the whisky's story and production process.

Online auctions have democratized access to the whisky market, making it easier for investors to buy and sell rare bottles and casks. Both peated whisky and heavily sherried whisky are still desirable flavor profiles.

In summary, key factors affecting rare whisky bottle investment value include rarity and exclusivity, age and maturation specifics, brand reputation and provenance story, market supply-demand dynamics and macroeconomic conditions, consumer preferences, investment market specifics, and the condition and packaging of the bottle itself. Investors should be aware of market volatility and the need for long-term holding to maximize returns.

Investing in cask whisky is easier than buying bottles, according to Simon Aron of Cask Trade. Clients can choose to sell their cask investment to another investor, a licensed bottler, or bottle the whole cask themselves for gifts. Prices for whisky have been consistently growing for the past decade, with a quick recovery after the Covid-19 dip.

A notable record was set in August 2020 when a bottle of Yamazaki 55 Years Old sold for almost $800,000, setting a record for the most expensive single bottle of Japanese whisky sold at auction. Big companies often buy whisky in bulk from platforms like WhiskyInvestDirect.

As the whisky market continues to grow and evolve, it presents a compelling opportunity for investors seeking diversification and potential high returns. Whether you're a seasoned investor or just starting out, understanding the factors that drive value in rare whisky can help you make informed decisions and build a successful investment portfolio.

- In the realm of luxury lifestyle, spirits, specifically rare whisky, have emerged as an appealing asset class for investors, offering the potential for significant returns.

- WhiskyInvestDirect, a platform that enables investing in whisky like gold bars, has witnessed growing popularity, with sought-after whiskies like Bowmore seeing increased demand.

- The allure of vintage bottles from the 1960s and 1970s persists, boosting prices, as demonstrated in 2020 when a Macallan 1926 sold for over $1m at an online auction.

- Emerging distilleries, such as Nc'nean and Glen Garioch 2009, are gaining attention, with their whisky expected to appreciate in value over time.

- Cask Trade suggests that cask whisky is a steady, long-term investment, with a potential return of up to 180% for a decade-long investment.

- The value of rare whisky bottles for investment is influenced by factors such as rarity, age, quality, provenance, limited editions, bottle condition, packaging, market dynamics, consumer preferences, and investment specifics.