Unraveling the Looming Threat: U.S. National Debt and the Bond Market

By: Alex Wehnert, New York

International bond investors brace for a cooling under Trump's administration's economic policies.

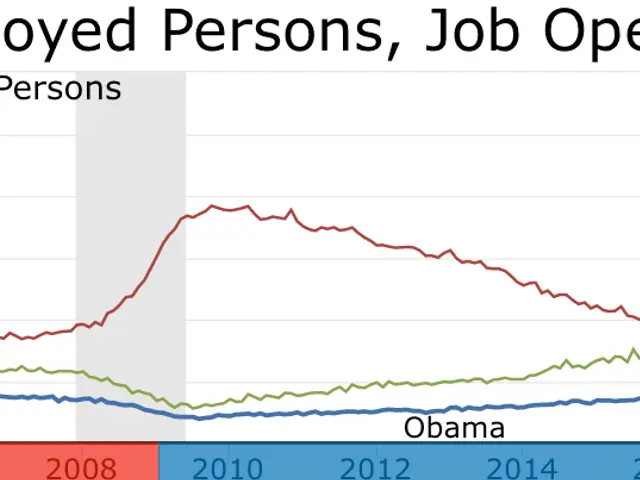

For the moment, the financial market radar shows nothing more than dashes of rain. But a tempest is gathering in the West, set to soak investors to their core. Doubts about the financial steadiness of the U.S. are escalating - and so are concerns of turbulence in the staggering $28 trillion Treasury market, the anchor of the global financial system. Brian Gardner, Washington strategist at Stifel, frankly states, "The U.S. seems to be operating on autopilot when it comes to debt and budget financing in the foreseeable future." This view is echoed by Jan Hatzius, chief economist at Goldman Sachs, who said in an interview with the Financial Times, "The U.S. budget is undeniably on an unsustainable path."

Here's the scoop: The U.S. is running a red light when it comes to debt. Rising debt-to-GDP ratios and persistent deficits paint a worrisome picture that could wreak havoc on the Treasury market. The Congressional Budget Office (CBO) predicts debt to skyrocket, reaching an alarming 156% of GDP by 2055[2]. Some analysts propose that a 'fiscal red line' is lurking near 150% of GDP, beyond which markets might panic, triggering a self-reinforcing cycle of growing interest rates and faster debt growth[4]. By the near future, interest payments on their own are poised to surpass defense spending, even reaching $1 trillion annually[3].

This looming disaster can give rise to numerous troubles in the bond market:

1. Interest Rate Spirals and Surging Debt

Persistent deficits could require more Treasury issuance, pushing borrowing costs higher as investors demand elevated yields as compensation for the growing risk[2].

2. Market Instability and Waning Investor Confidence

Such a surge in debt could entice private investments to frolic elsewhere. Higher Treasury yields may prompt investors to question the U.S.'s capability to manage its obligations, potentially inciting abrupt sell-offs or diminished demand for long-dated Treasuries[3][4].

3. Fiscal Policy Constraints

As 87% of projected federal spending growth over the next decade ties to interest, Social Security, and Medicare[3], lawmakers are left with limited wiggle room to address crises. A debt-driven budget crisis could generate sudden spending cuts or tax hikes, fanning the flames of market instability even further.

4. Global Leadership Risks

The dollar’s reserve currency status currently protects Treasury markets, but enduring fiscal erosion could erode this shield. Analysts caution of a diminished U.S. role in global finance if debt trajectories persist unchanged[1][4], potentially reducing foreign demand for Treasuries.

The fate of the Treasury market rests on credible long-term fiscal reforms. As of now, the current trajectories could corrode the foundation of global financial markets[1][2][4].

| Scenario | Market Impact ||----------|--------------|| Status quo | Rising yields, steep yield curves, and increased volatility as debt exceeds 100% of GDP[1][3] || Fiscal reform | Stabilized demand for Treasuries, but possibly short-term liquidity disruptions || Crisis tipping point (~150% GDP) | Loss of "risk-free asset" status, capital flight, and the potential loss of dollar dominance[4] |

- The U.S.'s current trajectory of debt, with the Treasury market anchoring the global financial system, could exacerbate if it exceeds 150% of GDP, potentially leading to a loss of the "risk-free asset" status and capital flight.

- As the Treasury market faces the possibility of a crisis tipping point, stability may be jeopardized by fiscal erosion, diminishing the U.S.'s role in global finance and reducing foreign demand for Treasuries.

- Persistent deficits and rising debt-to-GDP ratios could put the autopilot mode of debt and budget financing on a collision course with the Treasury market, surging yields and triggering a self-reinforcing cycle of growing interest rates and faster debt growth.

- The Treasury market is threatened by higher interest rates and market instability as investors' confidence wanes when faced with the growing amount of debt, potentially inciting abrupt sell-offs or diminished demand for long-dated Treasuries. This, in turn, could constraint fiscal policy, limiting lawmakers' ability to address crises.