Eurozone's Inflation Rises to 2.4%, Persistent Core Inflation Causes Concern

Inflation in Europe increases for the third consecutive month

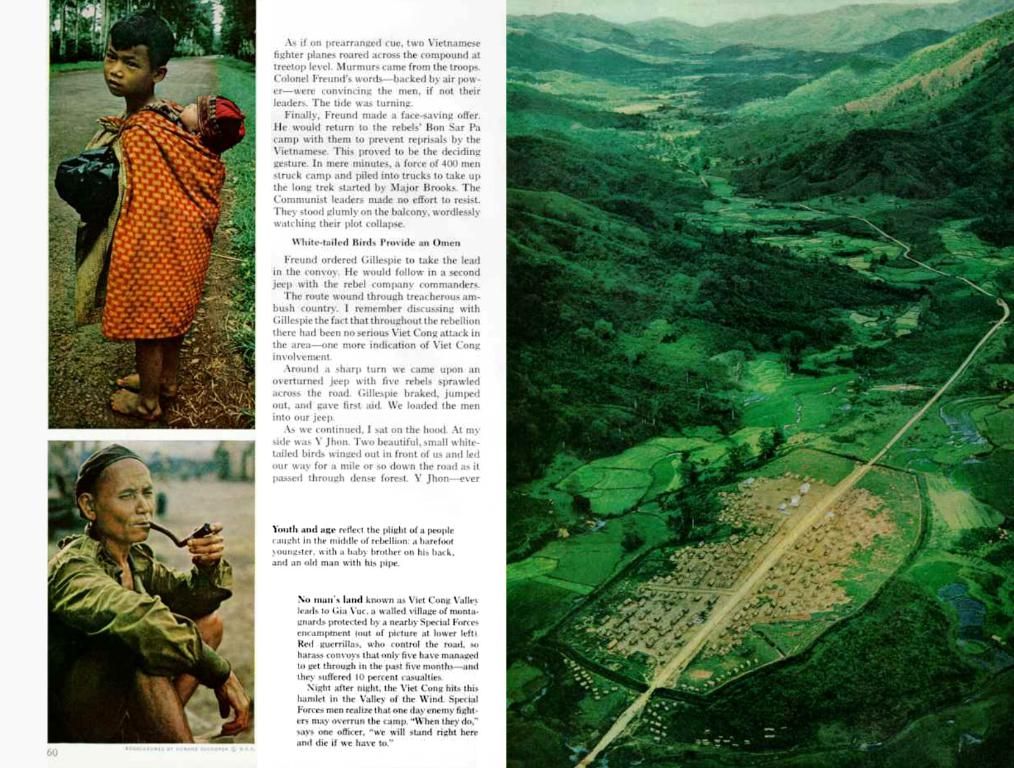

The Eurozone's annual inflation rate has climbed to 2.4% in December, primarily due to higher energy prices. Despite this increase, overall inflation expectations remain in check. The ECB is cautious about easing monetary policy too swiftly due to persistently high core inflation.

mpi Frankfurt

Inflation in the Eurozone continues to deviate from the ECB's target. In December, consumer prices rose by 2.4%, up from a preliminary estimate of 2.2% by Eurostat. This marks the third consecutive month of inflation increase, yet the rise can largely be attributed to temporary statistical fluctuations in energy prices.

Diverging Dynamics

The Eurozone's persistent core inflation in 2025 is driven by diverging dynamics between services and goods inflation, alongside external trade pressures and wage growth.

Services inflation, at 3.7%, remains elevated due to strong wage growth and tight labor markets in labor-intensive sectors like hospitality and healthcare. Non-energy industrial goods inflation, on the other hand, has cooled faster due to global supply chain normalization and weaker demand. This discrepancy could narrow as wage growth moderates and labor market tightness eases, but core inflation risks staying above the target until 2026–27.

Global Trade Shifts and Exchange Rates

US tariffs under Trump’s policies could potentially increase goods supply in Europe by 1.5–2%, reducing core goods prices. However, services remain insulated from this effect. Furthermore, a stronger euro (vs. USD) dampens imported inflation, while falling energy prices alleviate headline inflation pressures.

Potential Impacts

Markets anticipate deeper rate cuts, with the deposit rate potentially dropping to 1.25% by December 2025. The ECB is likely to maintain a meeting-by-meeting approach, balancing disinflation in goods against persistent services inflation. The persistent services inflation gap and core inflation persistence suggest a protracted disinflation path, requiring careful calibration of monetary policy.

Outlook

The ECB’s inflation target (2% by 2026–27) remains achievable, but it hinges on wage moderation and no escalation in trade disruptions. However, core inflation persistence in services indicates a prolonged disinflation path, necessitating careful management of monetary policy.

- The Eurozone's persistent core inflation, even in 2025, is driven by various factors such as diverging dynamics between services and goods inflation, external trade pressures, and wage growth.

- Services inflation, at 3.7%, remains elevated due to strong wage growth and tight labor markets in labor-intensive sectors like hospitality and healthcare.

- In contrast, non-energy industrial goods inflation has cooled faster due to global supply chain normalization and weaker demand.

- The ECB, aware of the persistent core inflation, is likely to maintain a cautious approach to easing monetary policy, balancing disinflation in goods against persistent services inflation.

- The persistent services inflation gap and core inflation persistence suggest a protracted disinflation path, requiring careful calibration of monetary policy to achieve the ECB's inflation target by 2026–27.