Infibeam Avenues’ profit surges 45% as fintech and AI payments drive growth

Infibeam Avenues, a leading Indian fintech company, has reported a significant increase in profits and revenue for the first half of FY26. The company, which recently shifted its focus to pure-play financial technology and AI-driven payments, saw a 17% rise in profit to Rs 126 crore.

Infibeam's e-commerce platform division played a key role in this growth, expanding by nearly 50% year-on-year to about Rs 65 crore. The company's total payment volume also surged, reaching 117.2 crore transactions, a 33% increase from the previous year.

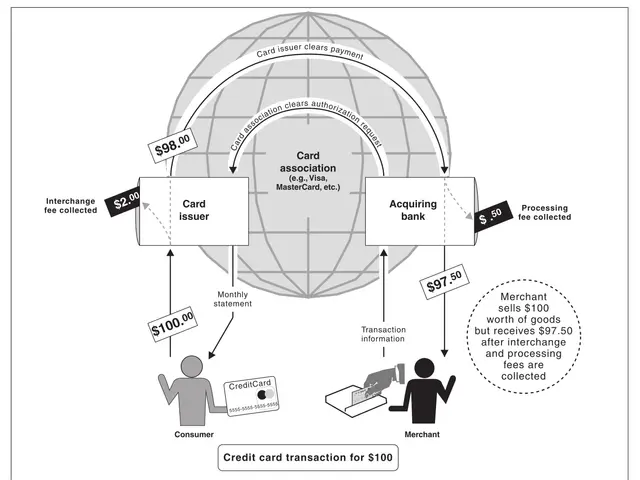

Payment revenues were a major driver, growing more than 95% to Rs 1,900 crore and contributing 97% of overall collections. This impressive growth was reflected in the company's quarterly income, which reached Rs 1,986 crore, including other income of Rs 21 crore. Operating revenue nearly doubled year-on-year, reaching Rs 1,965 crore. However, total expenses also increased significantly, by 98% to Rs 1,891 crore, with payment processing outlays rising 105% to Rs 1,812 crore.

Infibeam Avenues' strong performance in Q2 FY26, with a 45% year-on-year increase in profit after tax to Rs 68 crore, demonstrates the success of its strategic shift towards fintech and AI-driven payments. The company's ability to expand its e-commerce platform and increase payment volumes bodes well for its future growth prospects.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting