Thuringia's Industries: Automotive and Machinery Sectors Struggle in 2025 Amid Overall Growth

Struggles persist in the automobile and manufacturing sectors - Industries specializing in automotive and mechanical engineering persistently experience a downward trend.

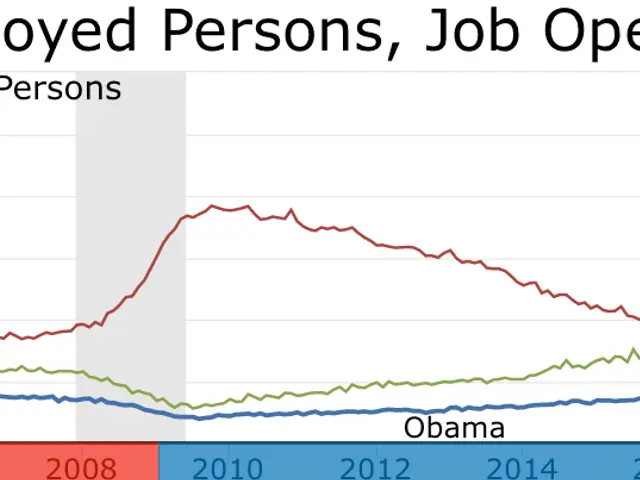

Let's dive into the state of Thuringia's industry in 2025. The first quarter saw an overall revenue increase of around 4.6%, with companies generating approximately 9.5 billion euros. However, two critical sectors - the automotive industry and machinery manufacturing - are still grappling with the challenges they faced last year.

Domestic sales increased by 3.9%, reaching 5.9 billion euros, while export growth was slightly higher at 5.7%. Total exports amounted to 3.6 billion euros, accounting for more than a third (37.6%) of Thuringia's industrial turnover.

However, turnover in the machinery sector decreased by about one-fifth, and in the automotive industry, it dropped by around 11%. This decline in the two key industries had a substantial impact on employment, with an average of around 141,000 people employed in these sectors between January and March - nearly 3,000 fewer than the same period last year.

The global competitive landscape and technological shifts play a significant role in Thuringia's struggling automotive sector. Europe faces intense competition from countries like China, offering competitive products at lower costs. This competition has led to a decline in European auto exports, impacting regions like Thuringia.

Moreover, the transition to electric vehicles (EVs) and advanced battery technologies presents challenges for traditional automotive manufacturers. Rapid growth in EV battery makers like CATL (which is investing heavily in new battery plants, such as in Hungary) highlights the need for German companies to adapt swiftly to remain competitive.

Furthermore, the decline in demand for traditional combustion engine vehicles due to shifting consumer preferences and regulatory pressures has only worsened the challenges faced by the automotive sector in Thuringia.

The machinery sector, too, faces challenges. The sluggish German economy, predictions of low GDP increases for the coming years, overcapacity, insolvency proceedings filed by companies like Bohai Trimet Group, and market fluctuations all contribute to the sector's struggles.

Companies like paragon GmbH & Co. KGaA, for instance, have seen declines in sales due to the weaker automotive market, highlighting the vulnerability of the machinery sector to downstream industry fluctuations.

Addressing these challenges requires strategic investments in technology, diversification, and adaptation to changing market demands. By doing so, Thuringia can align its industries better with global trends and position itself for a strong and stable future in the ever-evolving economic landscape.

- The community policy should focus on providing support for the automotive and machinery sectors in Thuringia, particularly as they address challenge from competition, technological shifts, and changes in consumer preferences.

- While overall industry in Thuringia recorded growth, the employment policy should prioritize job retention and creation in the manufacturing industry, particularly within the automotive and machinery sectors, which have experienced a decrease in turnover and employment.

- In the finance sector, policymakers should consider investment opportunities that encourage innovation and adaptation in the automotive and machinery industries, such as supporting the transition to electric vehicles and advanced battery technologies, as well as helping companies to navigate the sluggish economy and market fluctuations.