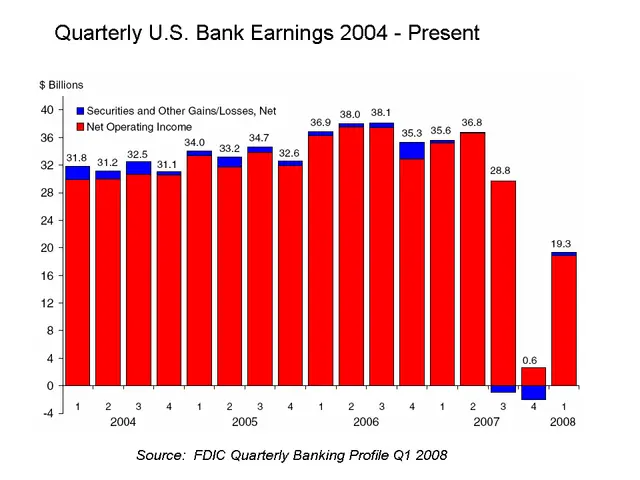

India’s public banks rebound as net interest margins rise in September quarter

Net interest margins (NIMs) for state-run banks showed signs of recovery in the September quarter after three straight quarters of decline. While most public sector lenders saw improvements, private banks continued to face pressure on their margins.

Among India’s public sector banks, only Punjab National Bank (PNB) and Central Bank of India experienced further NIM compression. The rest, including the State Bank of India (SBI), recorded sequential gains. SBI’s domestic NIM rose to 3.09%, while its overall margin reached 2.97%—an increase of 7 basis points from the previous quarter. The bank credited better liability management and the re-pricing of new term deposits for the improvement.

The September quarter brought a turnaround for public sector banks in India, with most stabilising or improving their NIMs. However, private lenders continued to struggle with shrinking margins. Globally, while certain banks saw earnings growth, others grappled with declining net interest income and regulatory pressures.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting