Indian stock market tumbles as tech giants and global tensions rattle investors

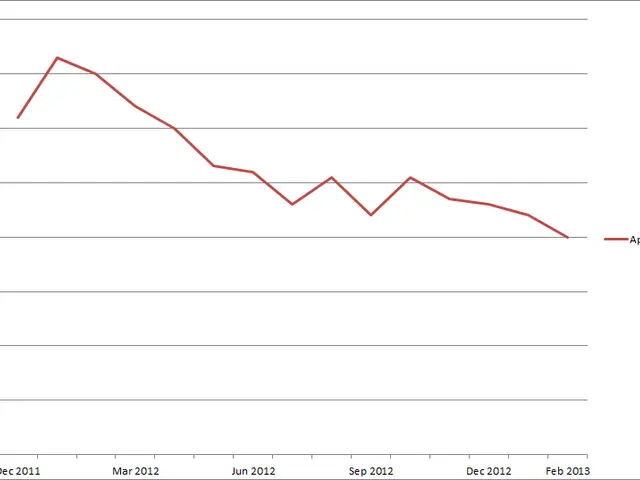

Indian stock markets faced a turbulent week from February 13 to 20, 2026, as global tensions and sector-specific concerns weighed on investor sentiment. While the Nifty 50 fell by 1.41% to close at 25,454, key tech stocks like TCS, Infosys, and Wipro saw sharper declines due to worries over US tariffs and weak IT demand in the stock market today.

The week began with pressure on major indices, as the Sensex dipped into the 82,000-82,500 range before recovering to end slightly higher. Analysts noted strong support for the Sensex between 81,800 and 82,000, with resistance expected near 83,500-84,000. Similarly, the Nifty found support around 25,300, though it struggled against resistance at 25,700 in the stock market today.

Global developments played a key role in shaping market mood. US President Donald Trump's remarks about pursuing alternative legal routes for tariffs added uncertainty. Meanwhile, the US Supreme Court struck down broad 'reciprocal' tariffs under IEEPA, capping India's tariff exposure at 15%. This decision provided some relief but failed to fully offset broader concerns in the stock market today.

Foreign institutional investors (FIIs) sold shares worth nearly ₹7,000 crore in the cash market during the week. However, domestic institutional investors (DIIs) countered this by pumping in over ₹8,000 crore, preventing a steeper decline. The mixed trend reflected caution among global investors while domestic players showed confidence in the stock market today.

Technology stocks bore the brunt of the sell-off, underperforming the Nifty 50. TCS dropped by 2.1%, Infosys fell by 1.8%, and Wipro declined by 3.4% in the stock market today. Weak IT order books and fears of US tariff impacts on outsourcing contracts contributed to the sector's poor performance.

Market experts advised investors to stay alert to global news and upcoming corporate earnings. Volatility is expected to persist in the near term, with traders watching key support and resistance levels closely in the stock market today.

The week ended with the Nifty down 1.41% at 25,454, while the Sensex managed a slight recovery after testing lower levels. With FIIs remaining net sellers and DIIs providing support, analysts suggest that market direction will depend on global cues and domestic earnings reports. Investors are likely to focus on these factors in the coming days in the stock market today.