India Leads in Russian Oil Buys, Shifts to Yuan Payments

India has emerged as the leading purchaser of discounted Russian oil, with these supplies meeting nearly half of its crude oil requirements. In a significant shift, Indian entities have resumed using Chinese yuan for these transactions, bypassing the traditional US dollar payment system.

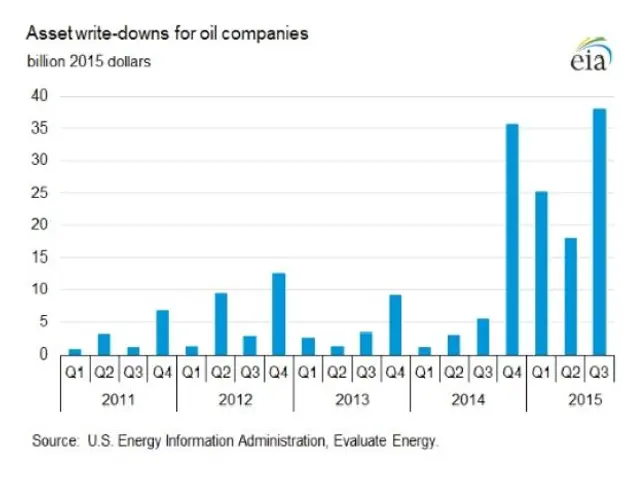

India's oil-importing entities have continued and even expanded their Russian oil imports, despite international pressures. They have saved at least $17 billion by taking advantage of discounted Russian oil prices. Initially, these prices were quoted in US dollars, but buyers now pay the yuan equivalent. This shift is part of a broader trend of de-dollarization, driven by Western sanctions on Russia.

Russian oil traders are increasingly requesting payment in currencies directly convertible to rubles. Despite a new US tariff, India has reaffirmed its commitment to Russian oil, citing national interest and cost-effectiveness. Using yuan enables smoother transactions with Russian suppliers and helps bypass some currency rejection issues. Recently, Indian Oil Corp has successfully completed transactions in yuan for Russian crude shipments. In September alone, India imported over 1.6 million barrels per day of Russian oil, accounting for about a third of its total supply.

India's use of Chinese yuan for Russian oil payments reflects a strategic shift in global energy trade dynamics. This move not only helps India secure discounted oil supplies but also contributes to a broader trend of reducing dependence on the US dollar in international transactions.

Read also:

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- BUND Protests Weser Deepening and Soybean Imports in Brake

- Philippines Demands Justice for Dafnie Nacalaban, Murdered Migrant Worker in Kuwait

- Trump administration faces lawsuit by Denmark's Ørsted over halted wind farm project