Increased Shiba Inu burn leads to a soaring 2408%, questioning the coin's ability to break free from prolonged bearish trends.

Shiba Inu's [SHIB] Thrilling 2,408% Burn Spike and 3.37% Netflow Drop: What's the Real Deal?

Share, Tweet, or Share

Is the SHIB rally legit, or just hot air?

Let's dive in and decipher the Shiba Inu (SHIB) chaos!

Shib's flashy 24-hour burn rate rocketed to an astounding 2,408%, blitzing an eye-watering 40 million tokens off the market and causing a 3.37% exchange netflow dip. This impressive climb was striking, but clever traders remain wary.

The sudden energy could be solely responsible for the 2.69% price surge, but will it last? The answer? Your guess is as good as ours—let's consider the facts.

Oh, that Burn Baby Burn!With the shrinking pool of tokens, we peek at bullish pressure. However, it's crucial to weigh this brief surge against the broader context: is this the start of a massive trend, or a fleeting storm?

Beware the Bear!Although major indicators hint at bearishness, it's more than mere grumblings. At press time, network growth stagnated at +0.17%, the "In the Money" metric tumbled -4.29%, and concentration shrunk by -0.03%.

It gets worse: large transactions plummeted by -4.18%, exposing the fading interests of whales. Keep an eye on this; it could signal doom for the bulls banking on recent burn momentum alone.

A Dance on the Edge of Ruin?SHIB tap-dances precariously just above $0.00001311, struggling to breach the 0.382 Fibonacci level of $0.00001461. A bullish move would mean reclaiming the $0.000014 range, but fail to hold the $0.00001228 support, and the ride could be choppy. Watch out for the 1.618 Fibonacci level at $0.00000995: it's the next stop in a potentially sharp correction.

Mixed Signals and the Great DivideAddress momentum offers hope, with a 28.87% jump in new addresses and a 47.57% increase in active addresses, fueling optimism. However, despite zero-balance address creation surging, there's no corresponding improvement in whale participation or profitability metrics, suggesting these figures won't fuel lasting growth.

Caught in the Liquidation ZoneThe 24-hour liquidation heatmap screams danger zones. Clusters of liquidation risks lurk near $0.0000138, with aggressive short positioning. If SHIB breaches this level, watch out for cascading short liquidations causing a rapid price spike.

Conversely, lying between $0.0000126 and $0.0000124 are downside clusters: price could crash if the bulls lose control.

Either Way, the Ricochet ContinuesSHIB's surge in burn rate and user activity throws a bullish tale, but other signs are nebulous at best. Weak whale activity, fewer profitable addresses, and dwindling large transactions suggest modest support for sustainable growth.

Moreover, SHIB still grapples beneath key resistance, and faces liquidation risks at $0.0000138. For now, the rally seems more overstated than anything else, and SHIB may be entangled in a loop of short-term volatility.

The Final StrawSHIB's price trend is caught in a maelstrom: bearish on-chain metrics, macroeconomic uncertainty, reduced whale confidence, and weak ecosystem traction conspire to keep prices pegged back. These elements don't only stoke uncertainty but also raise the specter of sudden liquidation events.

So, buckle up, SHIB fans! This rollercoaster ride isn't ready to halt anytime soon!

Heed Our Wise AdviceStay informed of the latest crypto and blockchain trends by subscribing to our must-read daily newsletter. Today, we're exploring How the $113K level can trigger a major Bitcoin price explosion.

Are you ready for the wild ride? Stay tuned, daredevils!

[Close this box]

Share, Tweet, or Share

Backstage With Enrichment Data

Oh snap, it's enrichment time!So, plenty of factors contribute to the uncertainty around Shiba Inu's (SHIB) price trend and the subsequent liquidation risks:

Key Indicators of Uncertainty and Liquidation Risk

- Bearish Market Momentum and Technical Indicators

- SHIB's recent steep descent—14% in early June 2025—aligns with technical charts predicting bearish bias, downtrends, low momentum, and low volume, making it a short candidate.

- Macroeconomic and Bitcoin Pressure

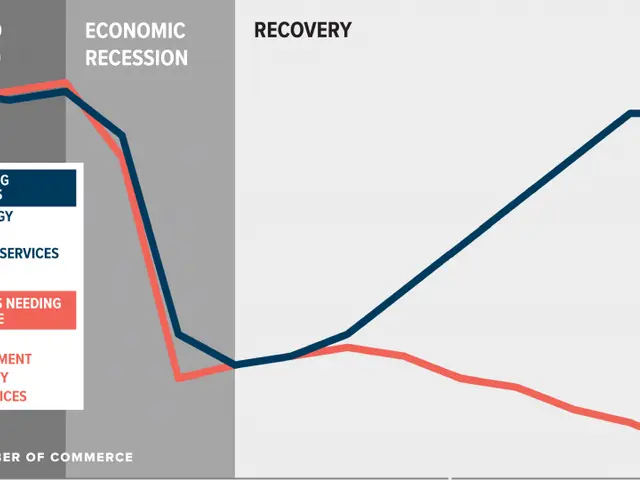

- The broader cryptocurrency market is under pressure due to macroeconomic factors like potential U.S. recession, rising interest rates, and global trade tensions, making it susceptible to downward pressure.

- Whale Activity and Sentiment

- Whales might drive significant price shifts through large sales or liquidations, affecting retail investors and intensifying volatility. Recent data shows a decline in whale holdings (from 100B to 96B SHIB in May 2025).

- Utility and Ecosystem Development

- Shibarium Layer-2 network's minimal ecosystem traction works against the hype cycle downturn. The 28% drop in daily token burns compared to May 2024 weakens bullish momentum.

- Market Competition and Sentiment

- SHIB's trading volume lags competitors like Pepe and Dogecoin, indicating reduced retail interest or capital diversion to other meme coins. Market sentiment is cautious, with advanced levels of anxiety and uncertainty.

Summary Table

| Risk Factor | Impact on SHIB Price Trend | Liquidation Risk ||-----------------------------|------------------------------------|------------------------------|| Bearish technicals & momentum| Price breakdown, downside targets | High for leveraged positions || Macroeconomic pressure | Broad market sell-off, risk aversion| Increases with Bitcoin drop || Whale exits/large sales | Sudden price drops, volatility | High if key holders sell || Weak ecosystem traction | Reduced demand, lower confidence | Moderate, depending on news || Market competition | Lower volume, less support | Moderate, if capitulation |

Conclusion

The SHIB's price trend is shaped by bearish technicals, macroeconomic uncertainty, reduced whale confidence, weak ecosystem traction, and market competitors. These elements signal ongoing uncertainty and heightened risks for liquidation events.

[Close this box]

- The impressive 2,408% burn rate of Shiba Inu tokens on the exchange could suggest bullish pressure, but it might not be a definitive sign of a lasting trend due to the broader context.

- Due to stagnating network growth, a decreasing "In the Money" metric, and shrinking concentration, bearishness is suggested in the Shiba Inu market, which could signal further decline.

- A significant drop in large transactions highlights dwindling interest from whales, potentially signifying potential difficulties for the bulls banking on recent burn momentum.

- Current on-chain data points to ongoing uncertainty and liquidation risks for Shiba Inu, as it grapples with bearish technicals, macroeconomic pressures, reduced whale confidence, and weak ecosystem traction.