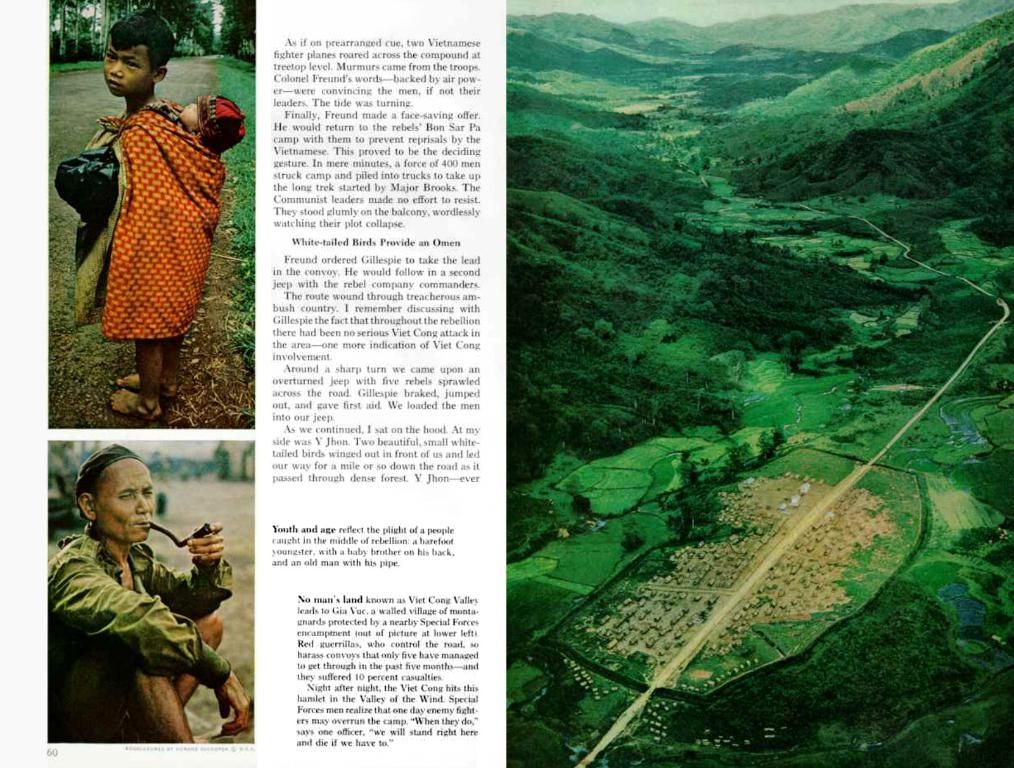

Increased oil production by OPEC+ leads to a hike in oil prices

Oil Prices Plummeting Amid OPEC+ Production Boost

Buckle up, folks! Oil prices are taking a dive, with Brent crude and US oil WTI plunging by up to around five percent on Monday to $58.50 and $55.30 per barrel (159 liters). Things got so intense that prices hit their lowest level since February 2021 before finding some stability at a drop of around two percent, at $60.13 and $57.10 per barrel.

So, what's causing this oil apocalypse? The Organization of the Petroleum Exporting Countries (OPEC) and its allies in the OPEC+ group decided to step on the gas, agreeing over the weekend to increase production by an additional 411,000 barrels per day in June. The total production increase now reaches almost a million barrels per day when combined with the hikes agreed in April and May. Investors are worried that supply will far exceed demand, according to energy analysis guru Tim Evans of Evans on Energy.

Insiders claim that the aggressive production ramp-up from OPEC+ is a political move. It seems Saudi Arabia wants to promptly reverse earlier production cuts to hold countries like Iraq and Kazakhstan accountable for their continued disregard of production quotas, as per OPEC sources. The decision was also reportedly influenced by pressure from Washington. US President Donald Trump has been demanding more oil on the global market and plans to visit Saudi Arabia in May.

Analyst Giovanni Staunovo of UBS isn't too alarmed, stating that we're still talking about "a 'controlled' reduction in production cuts, not a battle for market share." However, British banking giant Barclays has lowered its 2025 Brent forecast by four dollars to $66 per barrel, and Dutch bank ING is warning of an increasing oversupply. Since 2022, OPEC+ countries have gradually reduced their production by around five million barrels per day, which is about five percent of global supply. It looks like this strategy is now being rapidly reversed.

So, buckle up and get ready for a rollercoaster ride in the oil market. The next OPEC+ meeting is scheduled for 1 June, where the group will reassess production levels for July. Let's see if oil prices can find some stability or if this downward spiral continues. Stay tuned for updates!

- The OPEC+ group, responsible for a significant portion of global oil exports, announced on the weekend a production increase of 411,000 barrels per day in June.

- This decision by OPEC+, influenced by Saudi Arabia's political objectives and Washington's pressure, has caused investors like Tim Evans of Evans on Energy to worry about a potential oversupply in the industry.

- The Finance sector is also feeling the ripple effects; British banking giant Barclays has lowered its 2025 Brent forecast, and Dutch bank ING is warning of an increasing surplus in the energy market.

- As oil prices continue their downward trend, affecting the finance and energy industries, the next OPEC+ meeting on 1 June will be crucial in determining whether production levels will be adjusted to stabilize the market or if the oversupply will persist.