Ilika’s Stock Plummets as Analysts Issue ‘Sell’ Warning Amid Losses

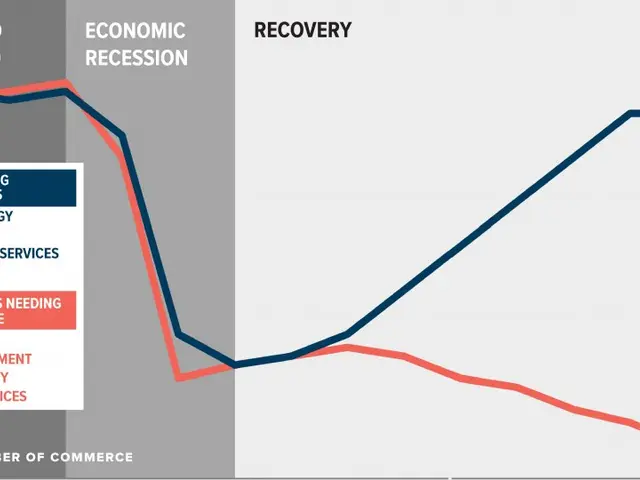

Ilika's stock has been struggling in both U.S. and London stock markets, with analysts downgrading it to 'Sell'. The company's shares have lost value over the past two weeks, with six out of the last ten trading days closing in the red. Ilika's operating losses have deepened, and grant funding has run out, raising concerns among investors.

Ilika's stock price has been volatile, dropping by 3.26% to 44.02 pence in London on Thursday and plunging by 4.58% to $0.560 in U.S. trading on Friday, marking the third consecutive losing session in the stock market. Critical support levels are now at $0.550 in the U.S. and 42.00 pence in London. Despite operational progress, including the launch of a pilot production line and a prototype of a 50-Ah EV battery, technical indicators such as moving averages, pivot point breakdown, MACD, and volume divergence suggest a sell signal for Ilika's stock in the stock market.

Ilika shareholders are now faced with a crucial decision. They must weigh the potential of Ilika's operational advancements against the current stock market conditions and consider whether to 'buy the dip' or 'cut losses', as indicated by the latest figures in the stock market.

Ilika's future in the stock market depends on concrete operational successes, such as commercial partnerships or the start of production for solid-state batteries. These achievements could help restore investor confidence and overcome the current technical sell signals in the stock market. Until then, Ilika shareholders must navigate the challenging stock market conditions and make informed decisions based on the company's progress and stock market performance.