If You Had Invested $10,000 in Teladoc Shares Five Years Ago, This is Your Current Value

If you're a financial investor considering telemedicine shares, you've got a valid case. The worldwide telemedicine sector, worth $97 billion in 2023, is projected to skyrocket to an astounding $432 billion by 2032, as suggested by experts at Fortune Business Insights. You might even ponder if you've missed out on investing in a telemedicine heavyweight like Teladoc (TDOC trading at 2.83%) over the past decade.

Let's delve into Teladoc's performance later, but first, allow me to clarify that telemedicine refers to the practice of diagnosing and treating patients remotely through modern technology. In essence, it could be like a virtual video consult with your doctor, perhaps culminating in a digital prescription being sent over.

Telemedicine is cherished because it can save patients valuable time by eliminating the need to travel to and from doctor's appointments. It can also be a lifeline for patients with mobility issues or living in remote locations far from medical facilities. It enables people living in remote areas to consult with doctors or specialists, thereby preventing the spread of diseases. However, it's not a solution for all medical ailments, such as those requiring physical examinations, or when blood tests or other diagnostic procedures are needed.

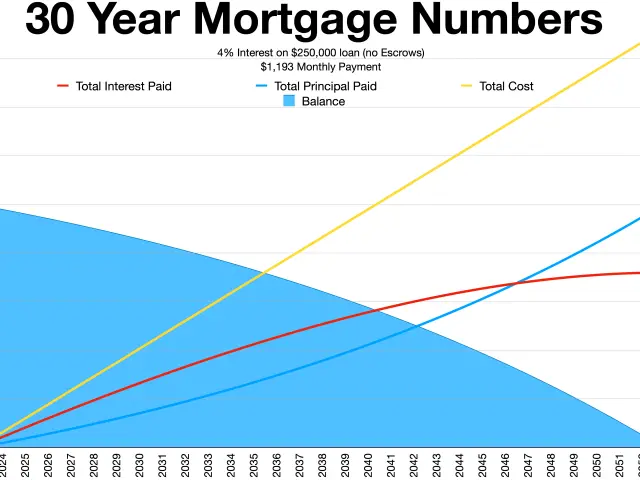

Teladoc, an industry pioneer launched in 2002, has historically been a favourite among stock market investors. However, its recent fortunes have taken a downturn, with the stock plummeting by 55% this year. Worse still, over the past five years, the stock has dropped by a staggering 88%, reducing a $10,000 investment to a mere $1,213.

So what's going on? Well, the company has been struggling with significant losses and slow growth recently, and its competitive landscape has grown increasingly crowded, particularly in its underperforming mental health division. Even tech giants such as Amazon.com (NASDAQ: AMZN) and CVS Health (NYSE: CVS) are now offering telehealth services. Teladoc remains unprofitable as well.

Despite these challenges, some view this slump as a buying opportunity, but it's crucial to exercise caution until Teladoc demonstrates its resurgence. If it still appeals to you, you might consider placing it on your watchlist.

Investing in diversified finance portfolios often includes considering various sectors, and telemedicine is one such promising area. Despite Teladoc's recent financial struggles with significant losses and slow growth, some investors view its current slump as an potential opportunity.