How Vanguard's VOOG ETF Turned $100 a Month Into $788K by 2056

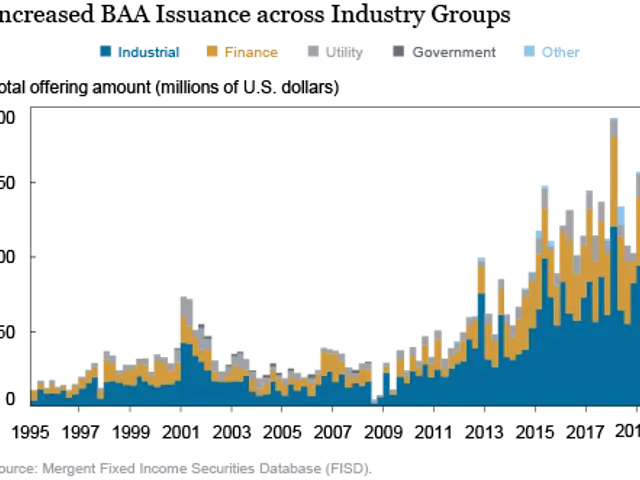

The Vanguard S&P 500 Growth ETF (VOOG) has remained a strong performer since its launch in 2010. The fund focuses on the fastest-growing companies within the S&P 500, with a heavy emphasis on technology giants. Over time, its composition has mirrored broader market shifts, particularly the rising dominance of tech stocks in the stock market.

VOOG currently holds 139 stocks, far fewer than the full S&P 500 but with a sharper focus on high-growth firms. Its top holdings—Nvidia, Microsoft, and Alphabet—account for roughly a third of the portfolio. Smaller positions also include fast-growing companies like Robinhood Markets and Sandisk.

Since 2010, VOOG has delivered an annualised return of 16.7%, climbing to 17.5% over the past decade. This outperforms the S&P 500's long-term average of around 10% per year. The fund's strategy relies on tracking an index, automatically replacing stocks that no longer meet growth criteria while adding promising new ones.

The technology sector's weight in VOOG has grown significantly, from about 25-30% at launch to over 35-40% by 2026. This reflects the broader S&P 500's shift toward mega-cap tech firms like Apple, Microsoft, and Tesla. Analysts project that if VOOG continues at a 17% annual gain, a $100 monthly investment could grow to roughly $788,000 by 2056.

VOOG's consistent focus on high-growth stocks has driven strong returns over the past 14 years. The fund's performance highlights the impact of tech dominance in modern finance and the stock market. Investors benefit from its structured approach, which balances established leaders with emerging opportunities.