How Strategy Plans to Survive a 90% Bitcoin Crash for Decades

Strategy, the Bitcoin-focused firm previously called MicroStrategy, has built a financial model designed to survive extreme market downturns. Led by Michael Saylor, the company claims it can endure an 80 to 90 percent crash in the BTC price over several years without altering its position. With over $50 billion in equity and strong liquidity, Strategy aims to operate for decades—even if the Bitcoin price stops growing in value.

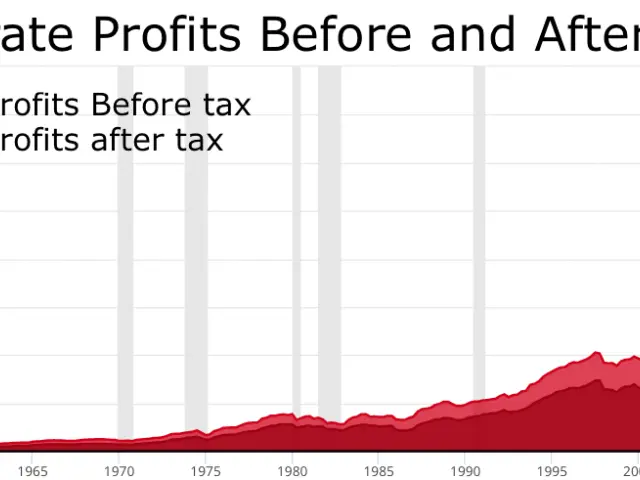

Bitcoin's volatility has dropped significantly in recent years. Annual price swings fell from around 80 percent in 2020 to roughly 50 percent today. Despite this, the cryptocurrency has faced fifteen major drawdowns in its 15-year history, each followed by a new peak.

Strategy's model combines equity, credit instruments, and a focus on long-term resilience. The company's ability to function through prolonged downturns depends on its substantial liquidity and flexible financing. With Bitcoin's volatility easing and leverage decreasing, the firm's approach aims to secure stability in an unpredictable market.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now