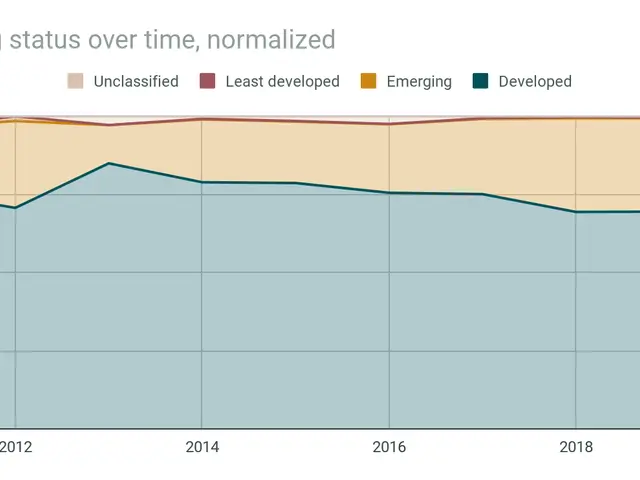

How Social Security and 401(k) balances shift for older retirees

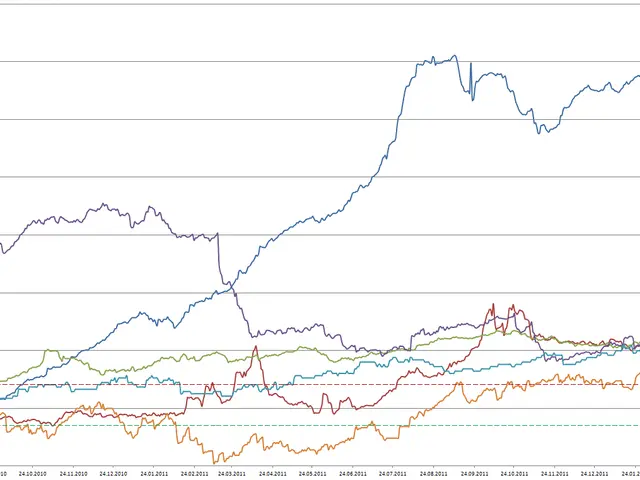

Retirement savings and Yahoo Finance data for older Americans show clear trends as they age. New figures reveal the average and median balances in 401(k) accounts, alongside monthly benefits for those in their mid-70s and beyond. The data highlights how financial resources shift in later retirement years.

For 75-year-olds, the average Social Security payment stands at $2,084.92 per month. By age 85, this amount drops slightly to $1,990.11. These figures reflect a small but steady decline in monthly benefits over time.

The figures underscore the financial realities facing older retirees. Social Security payments decrease modestly with age, while retirement savings show significant differences between average and median values. These trends provide a clearer picture of how financial resources are distributed among the elderly population.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting