How Russian retirees can double their pension with smart timing and strategy

Russia’s pension system offers retirees choices that can significantly affect their future income. With 40.7 million pensioners nationwide, decisions about when to retire and how to manage savings can lead to stark differences in payouts. A new analysis reveals that delaying retirement or investing pension funds wisely could more than double monthly benefits over time.

The Russian old-age pension is made up of two parts: a fixed payment and an insurance component based on the individual pension coefficient (IPC). In 2025, the fixed payment will be 8,907.70 rubles, while the IPC-linked portion varies. The longer someone delays retirement, the higher their IPC grows, increasing their retirement income. Starting in 2028, retirees will need at least 30 IPC points to qualify, up from 21.6 in 2025.

For Russian retirees, timing and financial strategy make a major difference. Delaying retirement or investing pension funds can dramatically increase long-term retirement income. However, outcomes hinge on economic stability and individual circumstances, from regional payouts to bank reliability.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

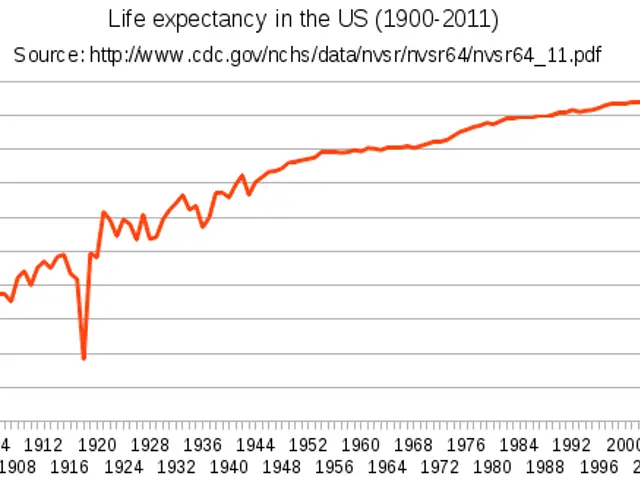

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern