How Private Equity Firms Profit by Selling Companies to Themselves

Private-Equity Strategies: Buying and Selling Companies to Oneself

Private-Equity Funds buy businesses, improve their operations, and sell them for a profit. But what happens when there are losses? A look behind the scenes reveals the mechanisms.

2025-12-04T21:20:06+00:00

finance, investing, business

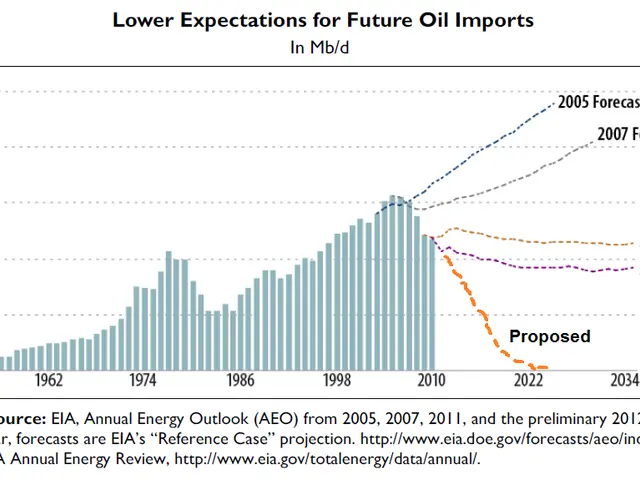

Private equity firms are facing scrutiny over a practice known as selling businesses to themselves. This strategy involves transferring a company from one fund to another within the same firm before an eventual sale to an external buyer. Critics claim it raises concerns about conflicts of interest and transparency in valuations.

Private equity operates by acquiring businesses, enhancing their operations, and selling them for a profit. A common example includes buying a company for $2 billion, improving its performance, and later selling it for $3 billion. The $1 billion profit is typically split, with investors receiving 80% and the fund manager taking a 20% performance fee.

Private equity firms continue to rely on strategies that extend their control over businesses while managing risk. The debate over internal sales highlights broader concerns about fairness and accountability in the sector. As market expectations change, firms may need to adjust their practices to maintain investor trust and regulatory compliance.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now