How London's historic merchant banks lost ground to US finance giants

Schroders, one of London's oldest merchant banks, was founded in 1804 by Johann Heinrich Schroder. It belonged to a wave of financial firms started by Continental families from the early 1700s. These institutions played a key role in shaping the City of London into a global financial powerhouse.

Yet by 2000, Schroders had sold off its investment banking arm to Citigroup and its asset management division to a US firm. The move signalled a shift in the UK's financial landscape, where many historic names struggled to compete on a global scale.

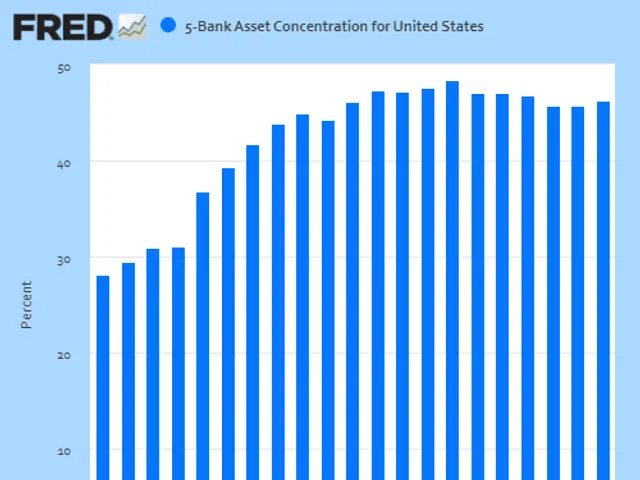

The Big Bang reforms of 1986 marked a turning point for the City of London. Deregulation boosted its competitiveness, reinforcing its position as one of the world's leading financial centres. However, the changes also opened the door for US banks to dominate large parts of the UK's domestic market.

Over time, the UK's financial sector saw a steady decline in homegrown control. Many British businesses, including long-standing merchant banks, were acquired by foreign buyers. Schroders was no exception, offloading key divisions as it faced challenges in maintaining scale. Today, Rothschild stands alone as the last independent merchant bank from that era.

Beyond banking, the UK's broader business environment has faced hurdles. While the country ranks third globally for start-ups—behind only the US and China—it lags in scaling companies to maturity. Many of the next generation of entrepreneurs now look to US finance for growth opportunities. Meanwhile, a shrinking equity culture, driven by weak regulation and tax policies, has hit Britons' pension savings hard.

The pattern extends beyond finance. UK firms across sectors are often undervalued, making them attractive targets for overseas investors. This trend has reshaped ownership in industries that once defined British economic strength.

The legacy of firms like Schroders highlights both the City of London's historic influence and its evolving challenges. Deregulation in the 1980s brought global prominence but also increased foreign ownership. With fewer independent merchant banks remaining and start-ups struggling to scale, the UK's financial and business sectors continue to adapt.

The decline in domestic equity investment and the shift of ambitious entrepreneurs abroad further shape this landscape. These changes reflect broader economic shifts that will influence the UK's financial future.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting