How 'Armageddon trades' reveal the stock market's darkest fears today

Investing has changed dramatically over the past few decades. In the 1980s, traders relied on phone calls and library research, while today, deals are done instantly from a laptop. The shift from active to passive funds, faster market swings, and new risks have reshaped how people manage their money.

One investor now allocates a small portion of their portfolio to 'Armageddon trades'—long-dated bear put spreads—to guard against sudden crashes in the stock market today. This reflects growing concerns about extreme volatility in the next downturn, similar to the 2008 crisis.

In the 1980s, stock trading was a slower process. Investors called brokers by phone and gathered data from newspapers or library services like Value Line. The S&P 500's price-to-earnings ratio then sat around 10, with dividend yields near 5%. Active mutual funds dominated, and star managers like Peter Lynch were household names.

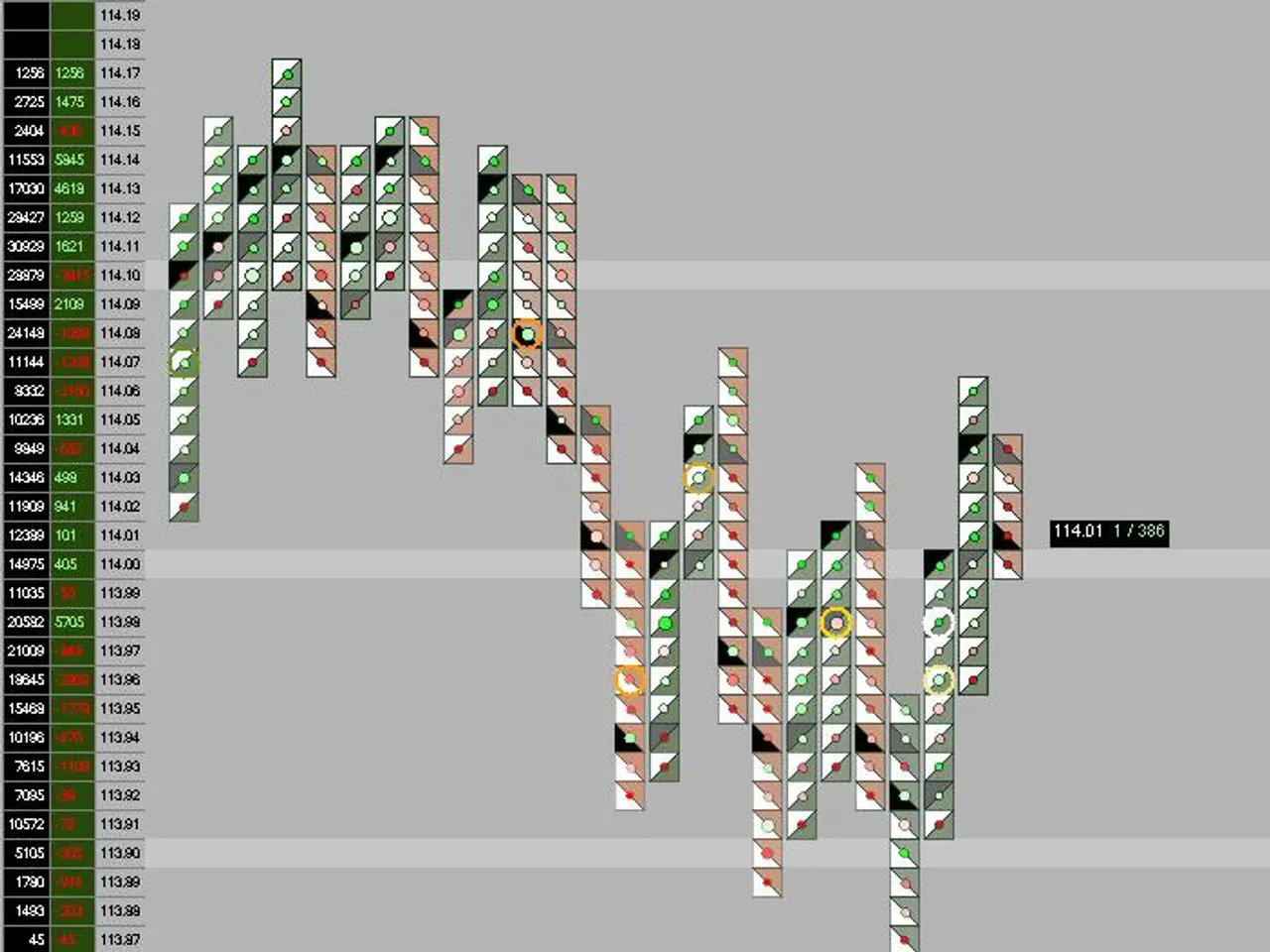

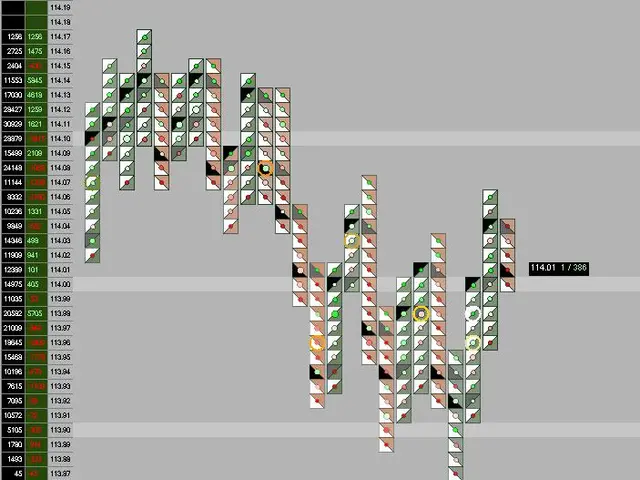

Today, the stock market moves at lightning speed. Trades execute in seconds, and research is available online in real time. Passive index funds now make up roughly 60% of the market, replacing many actively managed funds. Yet this efficiency comes with new dangers: Microsoft lost over $350 billion in value in a single day after an earnings report. Even gold and silver saw sharp one-day drops in early 2023.

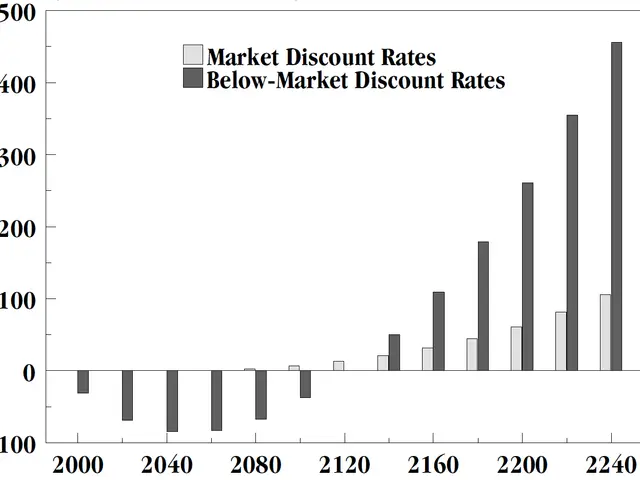

Market concentration has also reached extreme levels. The top 10 stocks now account for about 40% of total market capitalisation—the highest since the dot-com boom. Meanwhile, speculative assets like NFTs and SPACs have crashed after rapid rises. Investors brace for a future bear market with wild swings, including 5% daily moves in indexes and the VIX index spiking above 50.

One trader has adjusted by setting aside roughly 1% of their portfolio for 'Armageddon trades'. These are deep out-of-the-money, long-dated bear put spreads on the S&P 500 and NASDAQ. The goal is to offset losses elsewhere if the stock market today plummets suddenly.

The speed and structure of markets have transformed since the 1980s. Faster trading, passive fund dominance, and extreme concentration in a few stocks define today's landscape. With the next downturn expected to bring severe volatility, some investors are already positioning for worst-case scenarios. The small allocation to 'Armageddon trades' highlights the growing focus on risk management in an unpredictable environment.