How a CPA Can Reshape Your Financial Strategy for Stability

A certified public accountant (CPA) can transform how individuals and businesses manage their finances. Beyond basic bookkeeping, these professionals offer strategic guidance to improve budgeting and long-term planning. Their expertise helps clients avoid financial pitfalls while ensuring stability and confidence in decision-making.

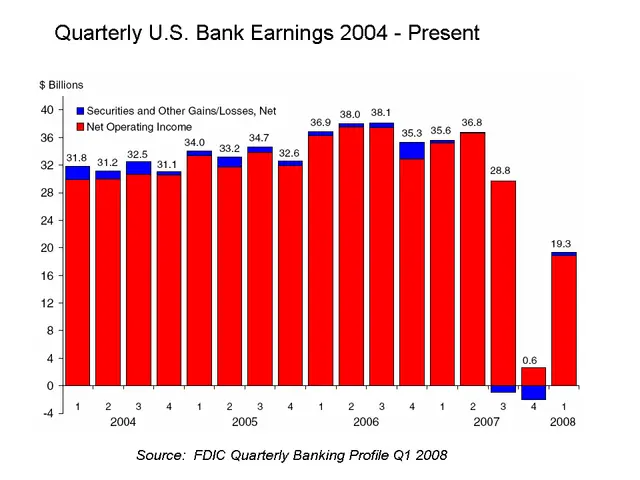

CPAs bring more to the table than standard accounting services. They analyse cash flow, expenses, and future projections to spot potential problems before they arise. By identifying trends in income and spending, they allow for timely adjustments that keep budgets on track.

Partnering with a CPA leads to clearer financial oversight and better decision-making. Their ability to forecast, manage risks, and optimise budgets ensures both stability and growth. For businesses and individuals alike, this support translates into greater confidence and long-term financial security.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern