Home Bancorp Eyes Steady Growth in 2025 Amid Shifting Mortgage Rates

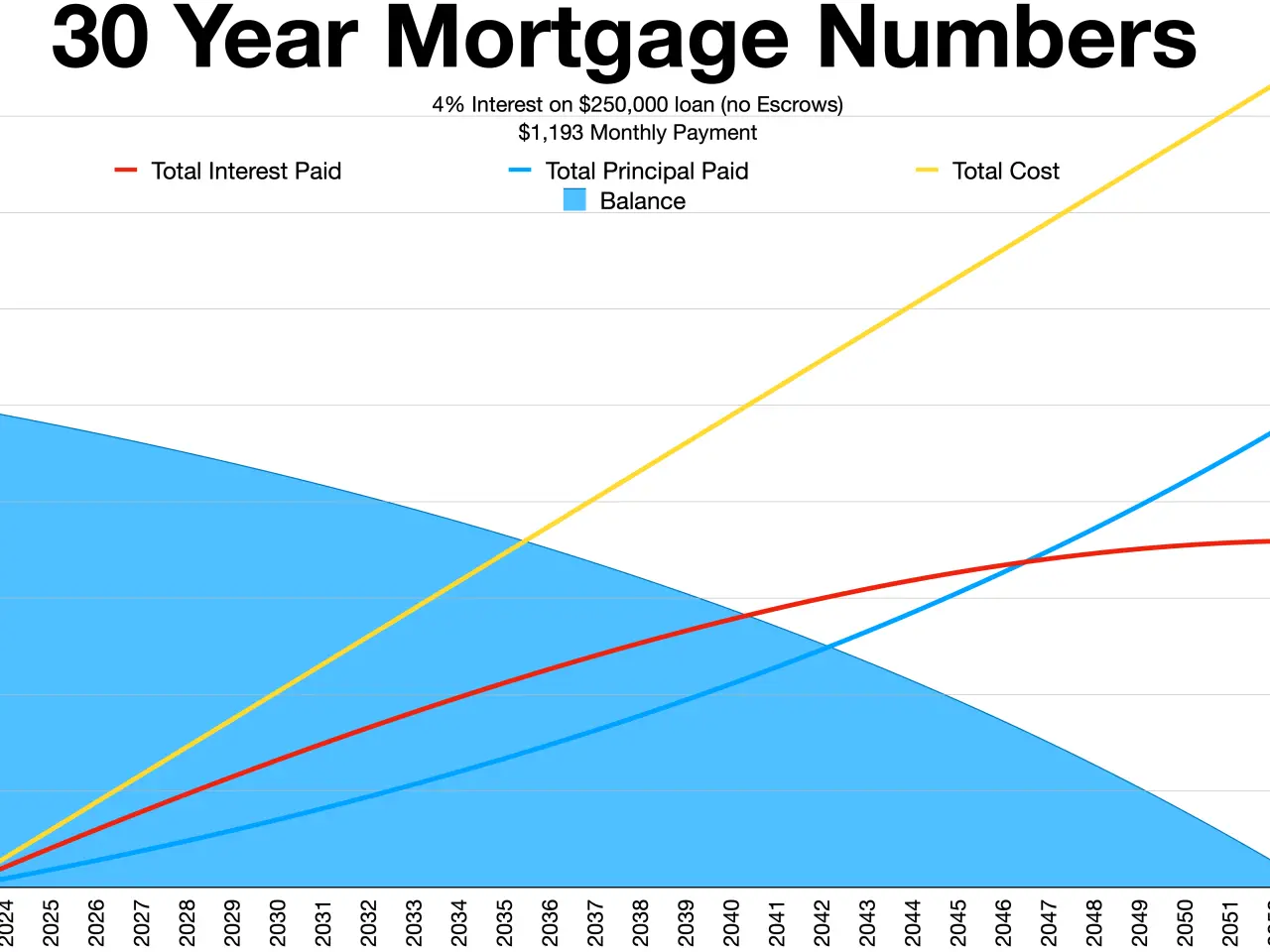

Home Bancorp has outlined its financial outlook for 2025, focusing on steady growth and controlled expenses. The company expects only routine annual raises next year, with no major one-off costs on the horizon. Meanwhile, its fixed-rate loan portfolio is seen as a safeguard against potential drops in mortgage rates.

The bank's net interest income could face pressure if interest rates fall sharply. However, gradual declines would give management time to adjust pricing and protect margins. Deposit costs have already started to ease after the Federal Reserve's recent rate cut, with further reductions possible if rates keep dropping.

Home Bancorp's fixed-rate loans provide a buffer against shrinking net interest margins in a low-rate environment. This strategy helps limit downside risks while maintaining stability. On the commercial front, the company is targeting the Acadiana region in Louisiana and parts of Texas for expansion. These areas are seen as key drivers for future growth. Additionally, a recent $19 million commercial loan payoff was described as an isolated case, not part of a wider trend.

The bank's approach balances cautious spending with strategic lending. With deposit costs falling and fixed-rate loans offering protection, Home Bancorp aims to manage margins even if rates decline. Growth plans remain focused on Louisiana and Texas, where commercial opportunities are expected to strengthen in the coming years.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting