Have you come across the Michael Saylor-Warren Buffett Ratio? This metric recently achieved a first occurrence since the year 2000, potentially instigating a notable shift in the stock market.

Outside of sharing enormous fortunes, Berkshire Hathaway CEO Warren Buffett (BRK.A -0.13%, BRK.B -0.16%) and MicroStrategy CEO Michael Saylor (MSTR 4.20%) don't share many similarities. Buffett, an elderly traditional investor, contrasts with the younger Saylor, who explores innovative investment strategies. Buffett once dismissed Bitcoin as "rat poison squared," while Saylor believes its price could reach $13 million by 2045.

However, a retired Ivy League finance professor and investment manager notices a connection between MicroStrategy's and Berkshire's stocks, which he termed the Saylor-Buffett ratio. This correlation has reached an unusual stage, potentially impacting the overall stock market.

What is the Saylor-Buffett Ratio?

Owen Lamont, a portfolio manager at Acadian Asset Management, invented the Saylor-Buffett ratio and recently explained the concept in a blog post. Lamont utilizes this ratio to track market fear and greed. Emotions play a significant role in shaping market movements, even in supposedly efficient markets. The overall market may not react instantly to potential overvaluation when investor enthusiasm is high. Conversely, when the market is struggling, valuations might be attractive, but investor sentiment is negative, leading to risk-averse behavior.

Lamont considers Buffett and Berkshire to symbolize traditional businesses in the market, considering Berkshire's involvement in insurance, mortgage, railroad, and energy sectors. Oppositely, Saylor embodies a high-energy growth mindset. The Saylor-Buffett ratio measures the total accumulated growth of MicroStrategy's stocks divided by the total accumulated growth of Berkshire's Class B shares. Lamont acknowledges that the ratio is not scientifically founded and is merely a concept he developed.

What does the ratio indicate currently?

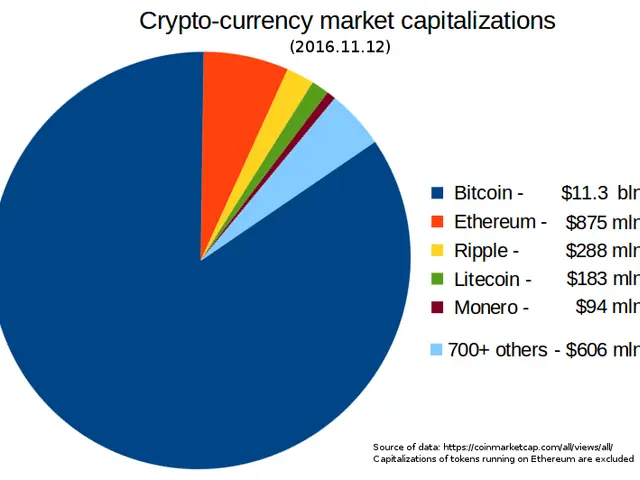

High ratios imply that MicroStrategy's stock outperforms Berkshire, indicating investor enthusiasm for riskier assets and greed, possibly signaling market overvaluation or excessive exuberance. Lamont has observed the ratio peaking at 18 in February 2000, just before the dot-com bubble burst. The Saylor-Buffett ratio generally stayed below 1 since then, representing a period of subdued investor enthusiasm favoring traditional, reliable long-term investments. Nonetheless, the ratio began to gain traction in 2020, coinciding with the meme-stock craze.

The graph below illustrates the fluctuation in the ratio:

The ratio surpassed 1 in 2020 during the meme-stock craze. It then fell as stocks experienced declines in 2022 but has since been steadily climbing. In recent times, the Saylor-Buffett ratio reached its highest level since the dot-com bubble, although not as high as it was during the bubble. This may suggest that the bull market still has room to grow, but investors could also have learned valuable lessons from the dot-com crash and may be less enthusiastic this time around.

It's crucial to note that the market is becoming overheated - the Saylor-Buffett ratio isn't the only indicator of this trend. The S&P 500 Shiller CAPE ratio, which measures the broader market's price in relation to the 10-year average of inflation-adjusted earnings, has also reached levels reminiscent of the early 2000s and 2021.

Berkshire has largely remained cash-rich and avoided stock investments during the year. Navigating the future can be tricky, as it's always different from the past. While the market might correct due to high valuations, various factors could trigger a future stock market collapse that differ from previous corrections. Investors should treat the Saylor-Buffett ratio as another warning sign and act prudently.

The retired finance professor's analysis of the Saylor-Buffett ratio suggests that the current high levels indicate a strong performance of MicroStrategy's stocks compared to Berkshire's Class B shares. This could be an indication of investor greed and a potential market overvaluation.

In the context of investing and finance, discussions about the Saylor-Buffett ratio often involve analysing market trends and investor behaviors, considering both traditional and growth-oriented investment strategies.