Guiding the Distribution of Trust Assets: A Detailed Look at the Legal Perspectives

================================================================

In the realm of estate planning, the distribution of trust assets is a critical process that ensures the fulfillment of the grantor's intentions and provides financial stability to beneficiaries. As demographic trends shift and technology advances, best practices for trust asset distribution are evolving to cater to these changes.

Key Components of Trust Documents

Trust documents serve as the blueprint for trust administration and distribution. They typically include the identity of the grantor, trustee, and beneficiaries, the purpose of the trust, detailed instructions for the management and distribution of trust assets, and provisions for modification or termination of the trust.

Streamlining Administration with Technology

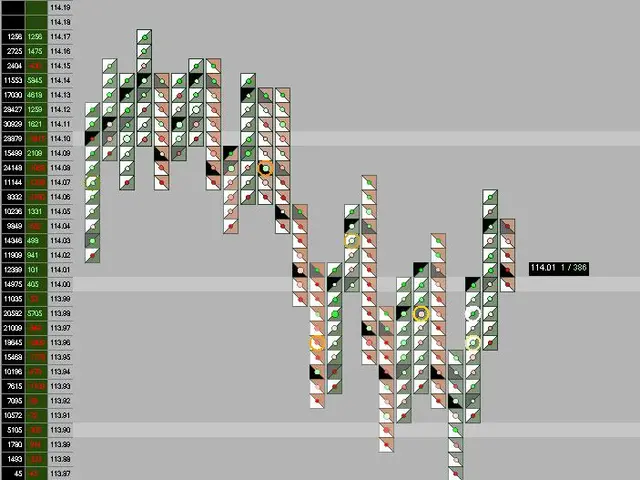

Digital tools and blockchain technology are increasingly streamlining the administration of trusts, enhancing transparency and efficiency in the process of distributing trust assets. Smart contracts, for instance, may automate distributions based on pre-defined conditions, reducing delays and minimizing disputes among beneficiaries.

Critical Steps in Asset Distribution

Proper distribution involves an accurate assessment of trust assets, a clear plan for distribution, transparent communication with beneficiaries, gathering relevant documents, and establishing a feasible timeline for distribution. Liquidation of assets refers to the process of converting trust assets into cash or cash equivalents, enabling distribution to beneficiaries.

Best Practices in Trust Asset Distribution

- Tailoring Trust Distributions to Individual Beneficiary Needs: Trusts are increasingly reflecting the varying financial and life circumstances of beneficiaries rather than equal splits. Consideration is given to younger heirs in education, those with health concerns, caregiving contributions, or past support received.

- Incorporating Comprehensive Estate Planning Strategies: Trust distribution plans often originate from specific financial goals such as funding education, asset protection from creditors, or tax optimization. Legacy trusts, for instance, are used to hold diverse assets for wealth preservation across multiple generations while minimizing tax liabilities.

- Utilizing Digital Tools for Trust Administration and Oversight: Advanced technology including AI-driven forecasting, cloud-based collaboration, and real-time dashboards are increasingly used for resource allocation and trust asset management. These tools enhance decision-making efficiency, transparency, and responsiveness to demographic changes by enabling predictive allocation and centralized monitoring of resources.

- Ensuring Clear Documentation and Communication: To minimize disputes, any unequal distributions or special considerations should be explicitly documented within trust and estate planning documents. Transparent communication, supported by technology platforms, helps beneficiaries understand the rationale behind allocations.

Direct Transfers and Tax Implications

Direct transfers can simplify the distribution process and enhance transparency since beneficiaries receive specific assets in their entirety. However, it is advisable to consult with tax professionals when dealing with potential tax implications associated with asset liquidation.

In conclusion, combining personalized, needs-based asset allocation with technology-enhanced administration and thorough legal planning represents the forefront of best practices in trust asset distribution in 2025. By embracing these practices, trustees can ensure an orderly distribution, minimizing potential liabilities for both the trust and its fiduciaries, and promoting transparency and equity among beneficiaries.

Sources include recent legal and fiduciary guidance on trust administration in Arizona, contemporary estate planning insights on legacy trusts, and modern resource allocation trends driven by AI and cloud computing technologies.