GoPro’s Stock Surge Faces Reality Check as Short Sellers Hold Firm

Can GoPro (GPRO) Stock Keep Its Recovery Effort Alive in 2026?

Something lit a fire under this stock in July, but there's more to the story.

GoPro’s stock has surged by roughly 160% over the past six months. The jump follows the launch of an AI training initiative in July 2025, which helped push shares up by over 40%. Yet, despite the rally, many investors remain sceptical about the company’s long-term prospects.

The stock’s rise was not just driven by GoPro’s AI plans. It also became a meme stock, drawing in speculators looking for quick gains. However, analysts warn that the AI push may struggle against competitors like YouTube, which already dominate the stock market today.

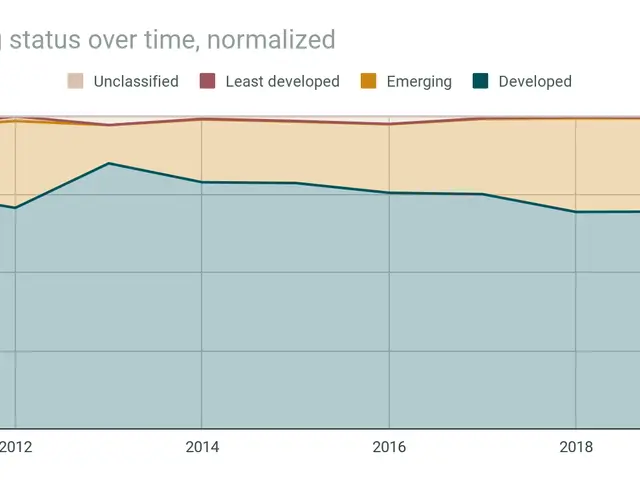

Market sentiment and technical trends still point to strong selling pressure. More than 14% of GoPro’s available shares are sold short, a sign that many traders expect the price to fall. Short sellers have held their positions since at least September 2025, with no signs of backing down soon.

Industry experts do not anticipate a major improvement in GoPro’s financial performance. Even with the CEO’s recent $2 million investment and new product releases, doubts persist. There is also little evidence that demand for premium action cameras will pick up in the near future.

GoPro’s stock has seen a sharp increase, but challenges remain. Short interest stays high, and competition in AI training is fierce. Without a clear shift in market conditions, the company’s outlook continues to face uncertainty.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Cyprus, Kuwait Strengthen Strategic Partnership with Upcoming Ministerial Meeting

- Inspired & Paddy Power Extend Virtual Sports Partnership for UK & Ireland Retail

- South West & South East England: Check & Object to Lorry Operator Licensing Now