Goldman Sachs Predicts a 12% S&P 500 Surge in 2026 on Strong Growth

The S&P 500 could see a 12% rally in 2026, according to forecasts from Goldman Sachs and other analysts. This optimism hinges on steady economic growth and a supportive Federal Reserve policy. Current inflation sits at 2.7%, while the U.S. economy grew by 4.3% in the third quarter of this year.

Goldman Sachs projects the S&P 500 will climb to around 7,670 by the end of 2026, up from an estimated 6,902 at the close of 2025. The firm anticipates a 12% earnings growth, fuelled by a strong economy and potential Fed rate cuts. Their 2026 GDP growth forecast stands at 2.5%.

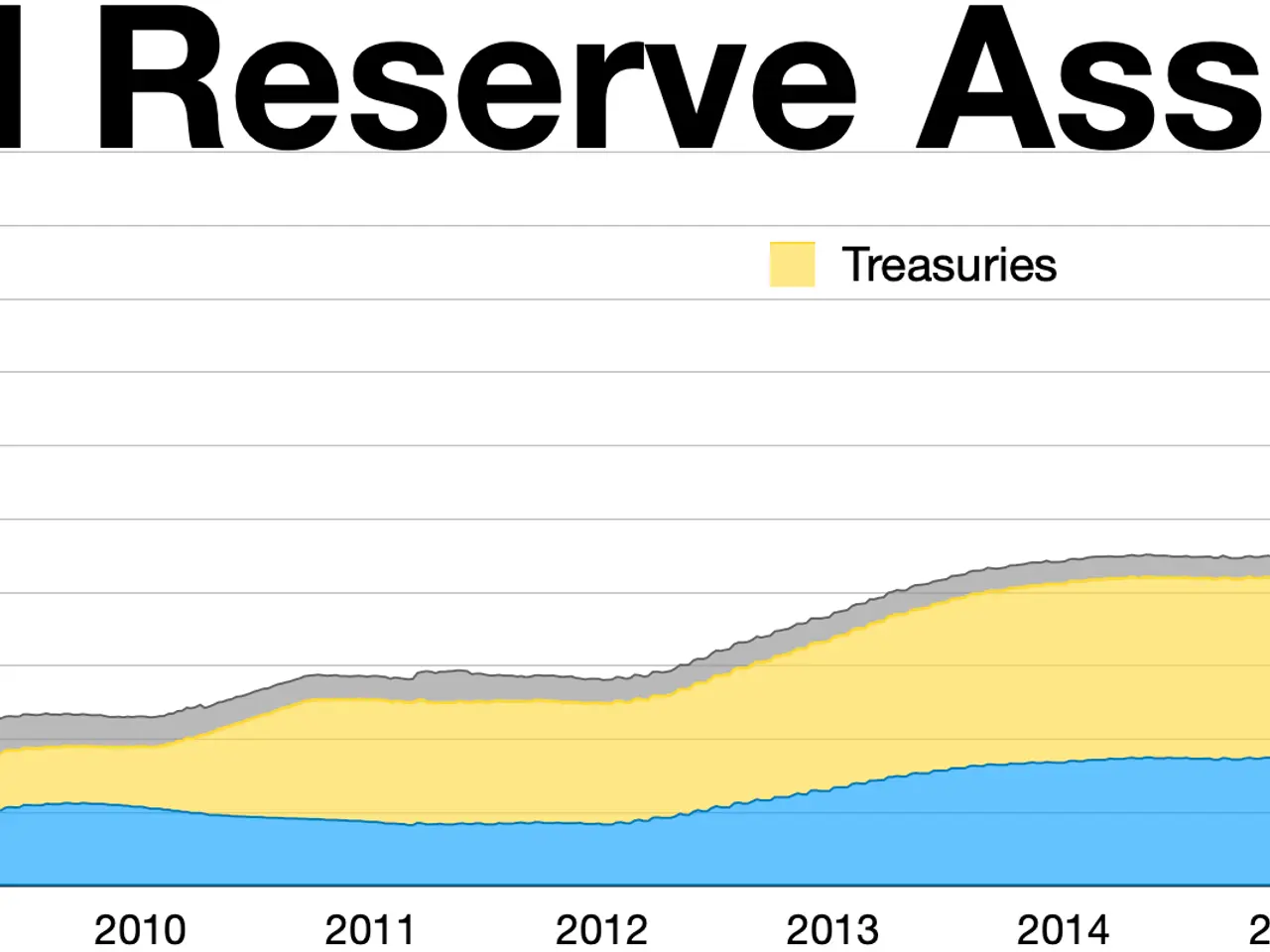

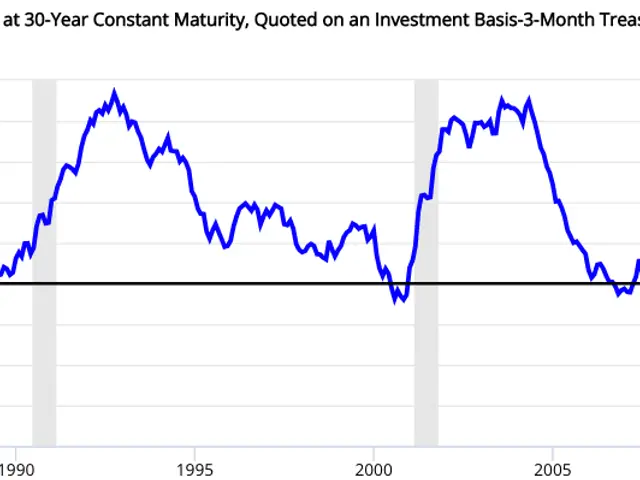

The Federal Reserve manages economic conditions by adjusting interest rates. Higher rates can curb inflation but risk slowing growth, while lower rates may boost expansion but push prices up. Goldman Sachs does not expect weaker growth or a sudden hawkish turn from the Fed in the near term.

Technology stocks are set to lead the market, with per-share earnings expected to rise by 18%. Analysts broadly agree on the 12% gain, though risks remain if economic conditions worsen or the Fed tightens policy unexpectedly.

A 12% rise in the S&P 500 for 2026 depends on sustained economic strength and stable Fed policy. The forecast assumes no major shifts in inflation or growth trends. Investors will watch closely for any changes in the central bank’s stance or economic performance.