Gold vs. Stocks: Which Asset Has Delivered Better Returns Over 50 Years?

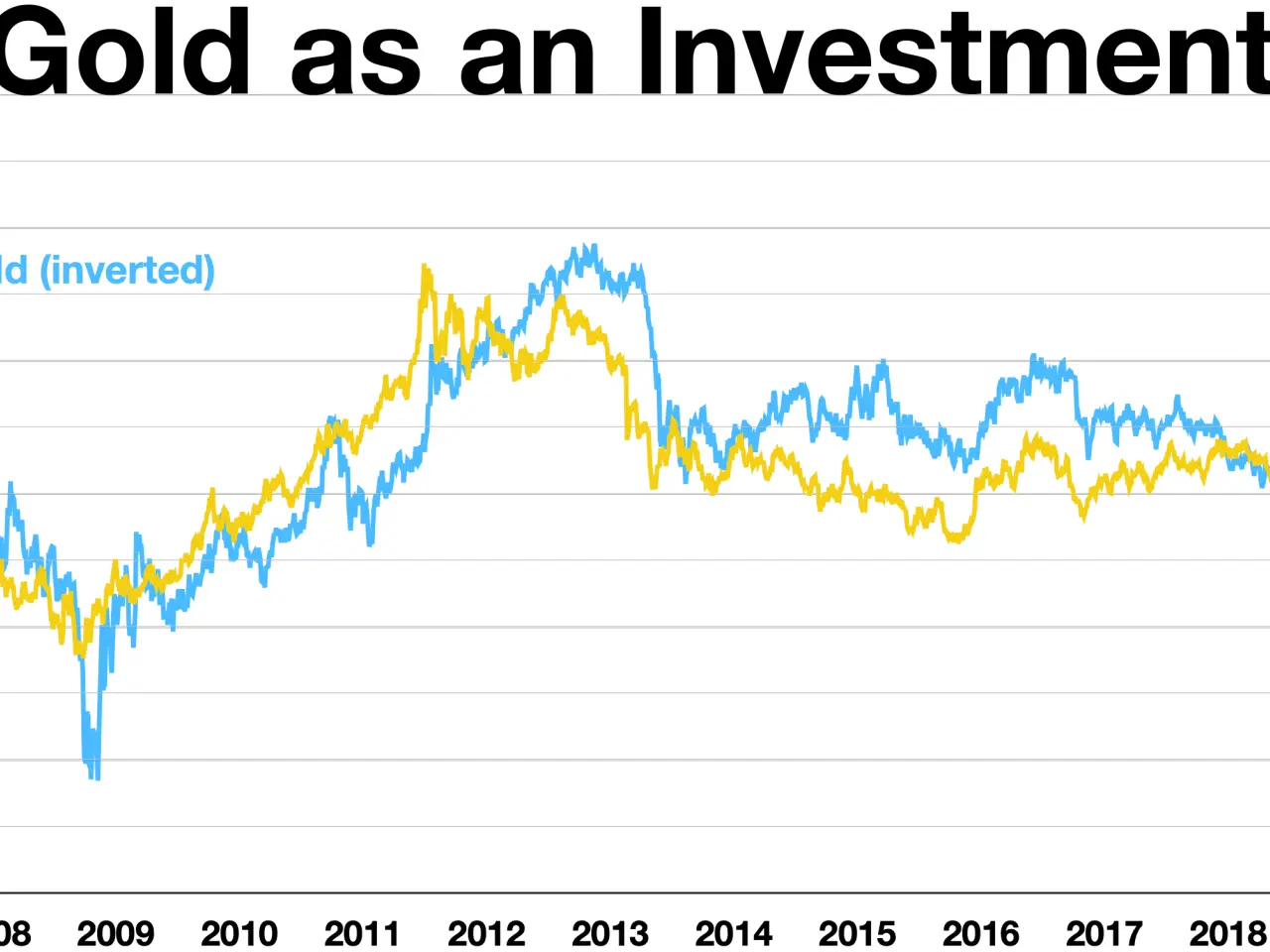

Gold and stocks have long been key assets for investors, but their performance has varied sharply over time. While stocks have generally delivered steady growth, gold has seen dramatic swings—from huge gains to steep losses. Recent trends show both assets still playing vital roles in portfolios today.

Between 1971 and 1980, gold prices exploded, delivering over 30 percent annual returns. Stocks, in contrast, grew by just three percent a year during the same period. An investor who bought gold in 1971 would have earned an average of nine percent yearly by now.

The next two decades told a different story. From 1981 to 2000, stocks surged by more than 12 percent annually, while gold fell by over three percent each year. This shift highlighted how market conditions can reverse fortunes for each asset.

Since 2001, stocks have averaged seven percent annual growth. Gold, however, has outperformed them with a 12 percent yearly rise. Some individual stocks have still far outpaced gold, with certain shares climbing over 1,000-fold in the same timeframe. The S&P 500, meanwhile, has grown by eight percent annually since 1971.

Recently, central banks in emerging markets have increased gold purchases as an alternative to the US dollar. While gold's long-term outlook remains positive—seen as both a safe haven and inflation hedge—its short-term price may have risen too quickly. This makes it more vulnerable to sudden corrections.

Ignoring gold entirely could be a misstep for investors, but putting everything into it would also carry risks. Both assets have shown periods of strong performance, depending on economic conditions. A balanced approach may help manage volatility while capturing growth from each.