Gold Prices on a Potential Slide? 📉

Gold prices have soared to their highest levels in about four weeks, reaching an astounding $2,700 per ounce. This surge in value can be attributed to several factors shaking up the equity markets and sparking concerns over US economic policies. The demand for gold has grown considerably, even hitting record highs in early 2025.

What's driving the 30% price increase in gold in one year?

Gold's recent price surge can be traced back to several key drivers. Global tensions, particularly those involving major powers such as the US, Russia, and China, have sparked instability in financial markets. As a result, investors are gravitating towards gold as a secure haven to hedge against potential crises.

In addition to the turmoil in global markets, there are persistent fears of inflation in major economies, making gold an appealing option for safeguarding purchasing power. This isn't the only motivating factor; central banks have significantly increased their gold holdings, further propelling the demand for gold. Lastly, anticipation of slower interest rate hikes or potential cuts from central banks like the Federal Reserve is making gold a more appealing choice for investors.

Could gold prices plummet 30%?

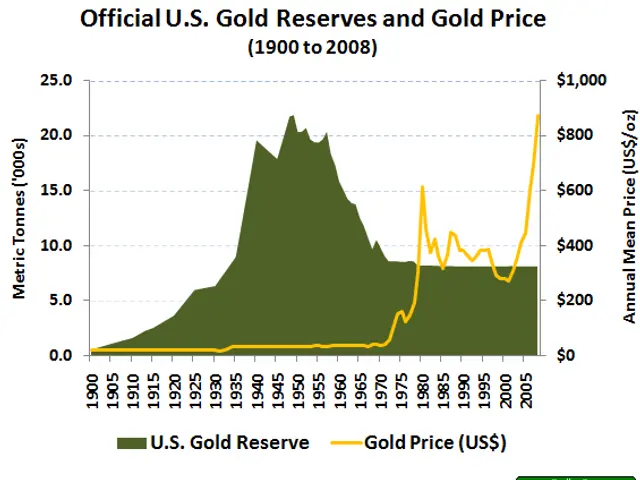

While a 30% price decrease in gold isn't an impossibility, it would take a significant shift in multiple factors simultaneously to achieve it. Between 2011 and 2015, gold prices slumped nearly 45% from their peak of $1,920 per ounce down to $1,050 per ounce due to a strong dollar, growing interest rates, and economic recovery.

There are other scenarios which could result in a 30% decline in gold prices. For example, aggressive Federal Reserve policies that cause interest rates to rise at an unprecedented pace would strengthen the dollar, which would negatively impact gold prices. If gold supply suddenly spikes due to the discovery of new reserves or due to large-scale institutional sales of gold, it could exert downward pressure on gold prices. A strong recovery in global economies and geopolitical stability might also reduce gold's demand. Lastly, increasing interest in alternative investments, such as cryptocurrencies or other commodities, could diminish gold's perceived value.

While a 30% decline is not out of the question, it is unlikely to happen without significant concurrent changes. The decline in prices would likely occur gradually rather than abruptly.

Make smart investments with Trefis Market-Beating Portfolios

Discover all Trefis Price Estimates

Gold price projections in light of enrichment data:

Experts suggest that gold prices may experience fluctuation, potentially including a 30% decrease, due to various factors that can influence gold prices. Here are the primary factors that have an impact on gold prices:

- Central Bank Diversification:

- Central banks are increasingly shifting their reserves away from the US dollar, which has resulted in significant gold purchases. This trend is expected to continue, potentially supporting gold prices. However, any reduction in gold holdings from central banks could negatively impact prices.

- Geopolitical Tensions:

- The presence of ongoing geopolitical tensions, like conflicts in Ukraine and the Middle East, and potential new flashpoints such as rising tensions between China and Taiwan, will likely sustain gold's appeal as a secure haven asset. This could fuel demand and prices during periods of heightened uncertainty.

- Monetary Policy and Interest Rates:

- Monetary policies, particularly those of the Federal Reserve, play a significant role in gold pricing. If the Federal Reserve were to implement interest rate cuts, they would reduce the opportunity cost of holding non-yielding assets like gold, potentially boosting prices. Conversely, rising interest rates could diminish gold's appeal and lead to lower prices.

- Economic Indicators:

- A possible slowdown in the US economy, combined with a weaker dollar, may boost gold prices. As the dollar weakens, gold becomes more affordable for holders of other currencies, thereby amplifying demand. High global debt levels and potential currency devaluation, particularly of the US dollar, could also lead to a shift towards gold, impacting its price.

- Supply Constraints:

- The gold mining industry is grappling with significant supply constraints due to increasing production costs and a lack of new, productive mines. This constraint could put upward pressure on prices as demand remains high but supply remains limited.

- Inflation and Currency Fluctuations:

- While inflation can affect gold prices, its relationship with gold is complex. Gold often moves inversely to the US dollar. If the dollar weakens, gold becomes more affordable for holders of other currencies, potentially increasing demand. However, a significant increase in inflation could also drive up gold prices as investors seek protection from inflation.

- Market Volatility and Global Demand:

- Market volatility and global demand for gold are also critical factors. Crises, such as the 2008 financial crisis and the pandemic, have demonstrated how quickly investors can turn to gold during times of economic uncertainty. Changing consumer demand in key markets like India and China due to economic shifts could also impact gold prices.

These factors collectively contribute to the potential fluctuations in gold prices, including a possible 30% decrease, as they can influence both supply and demand dynamics in the gold market.

The mining giant Barrick Gold, known for its significant gold reserves, has benefited from the surge in gold prices. In fact, Barrick Gold's shares have also seen a notable rise, reflecting the increased value of its gold holdings.

Despite the potential for a 30% decrease in gold prices under certain circumstances, Barrick Gold's operational efficiency and strategic decisions could help mitigate such impacts, ensuring its long-term financial stability.