Finanztip for Gold Sale: Comparing Buyback Prices is Worthwhile - Gold investing secrets: How to buy, store, and sell without losing money

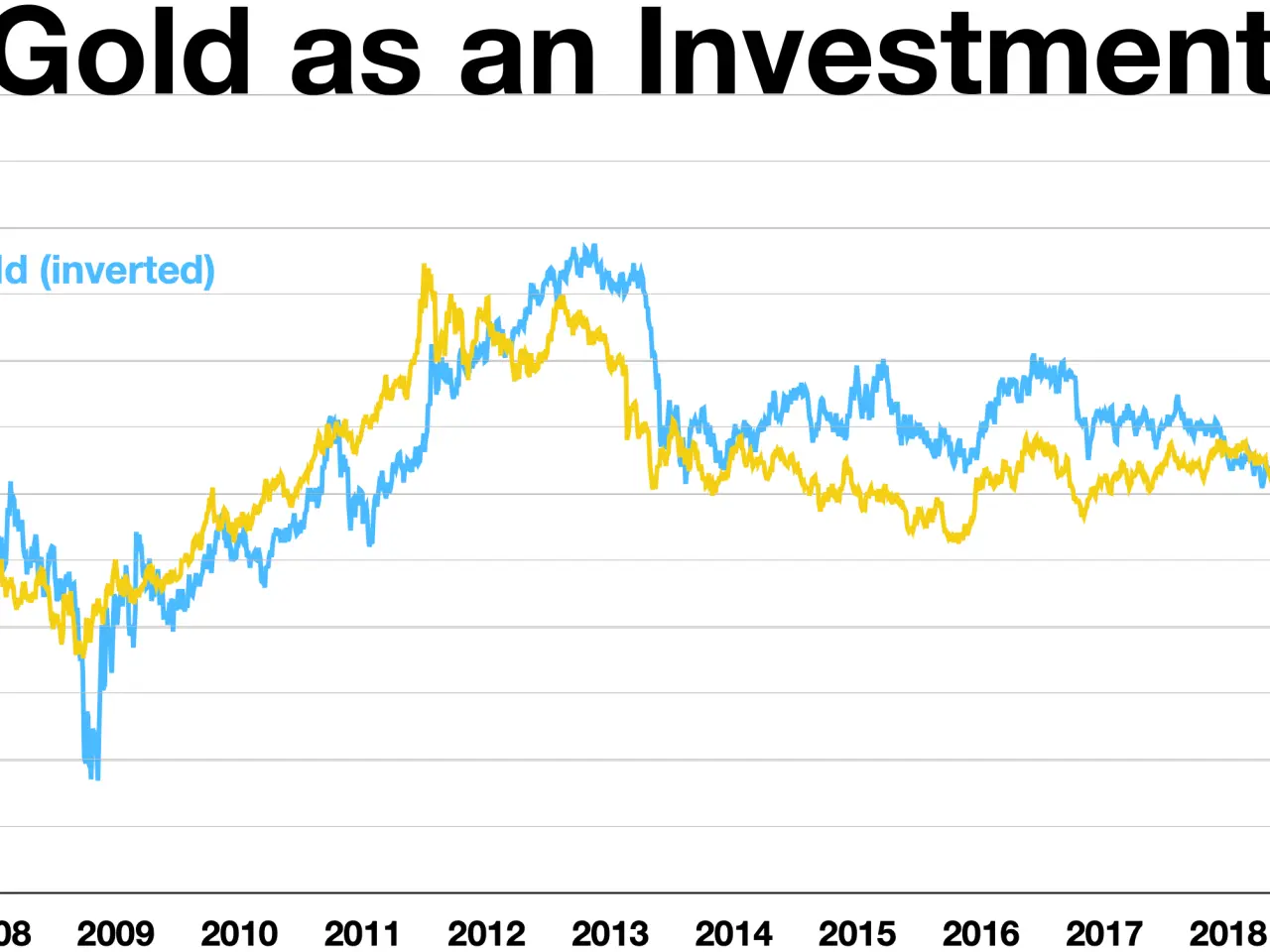

Investing in gold remains a popular way to protect wealth, but buyers and sellers need to understand key rules. Whether storing it at home or in a us bank, costs and security vary. Tax benefits also apply if gold is held for over a year, while selling requires careful planning to avoid losses.

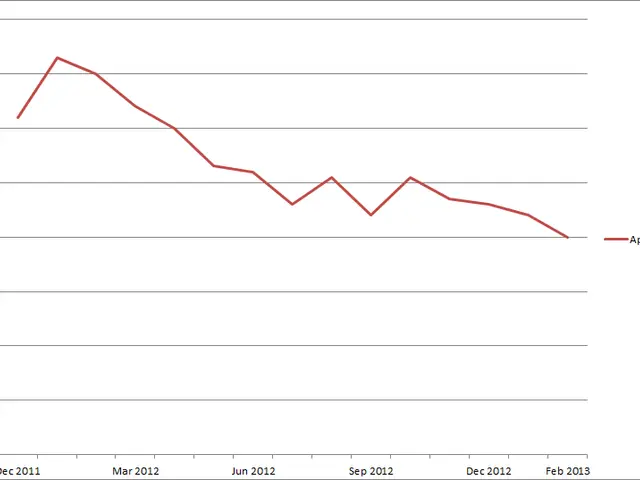

Gold's value depends on three factors: weight, purity, and the current market price. A simple formula—weight multiplied by gold content and then by the price per gram—gives an estimate. However, sellers rarely receive the full amount. Dealers often pay around 90% of the material value due to their own profit margins.

Before selling, checking buyback prices is essential. The item's form, age, and condition all affect its worth. Local dealers, especially those registered with the Berufsverband des deutschen Münzenfachhandels e.V., are the safest choice, as they guarantee authenticity and fair trading practices.

Storing gold securely is another consideration. Home safes are an option, but insurance policies must be updated to cover potential theft. Bank safe deposit boxes offer extra security, though banks may limit their liability. Costs for storage depend on the size of the deposit box and its location.

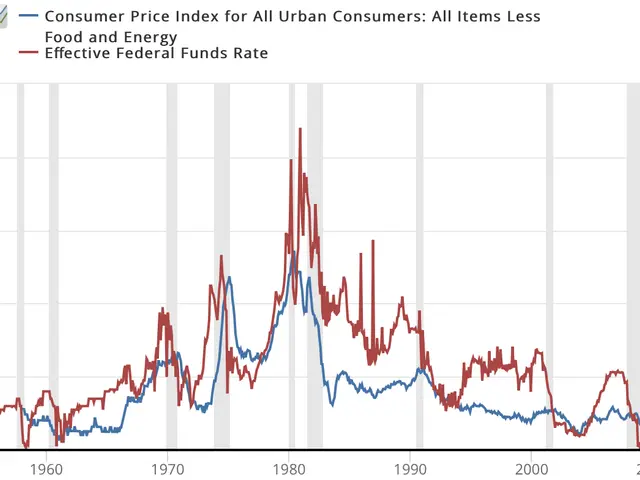

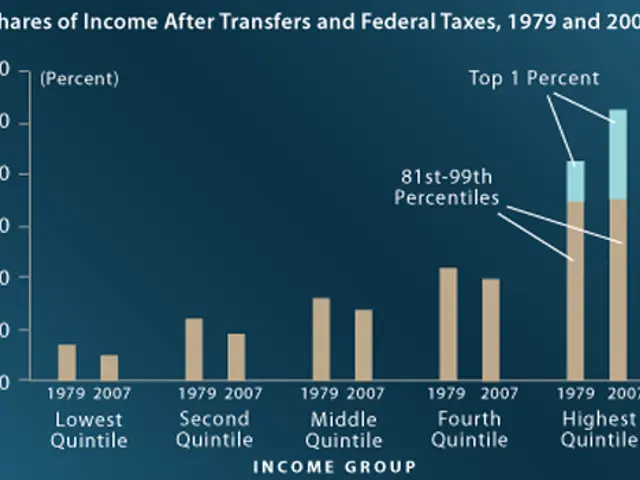

Tax rules also play a role. Profits from gold sales are tax-free after one year of ownership. For shorter holding periods, an annual allowance of €1,000 applies. Financial experts recommend keeping gold investments below 10% of total assets, treating it mainly as a hedge against market risks.

Gold can be a stable investment, but both buying and selling require research. Secure storage, tax exemptions, and trusted dealers all influence the process. By understanding these factors, investors can make better decisions and avoid unnecessary losses.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern