Gold and silver demand skyrockets as supply chains buckle under pressure

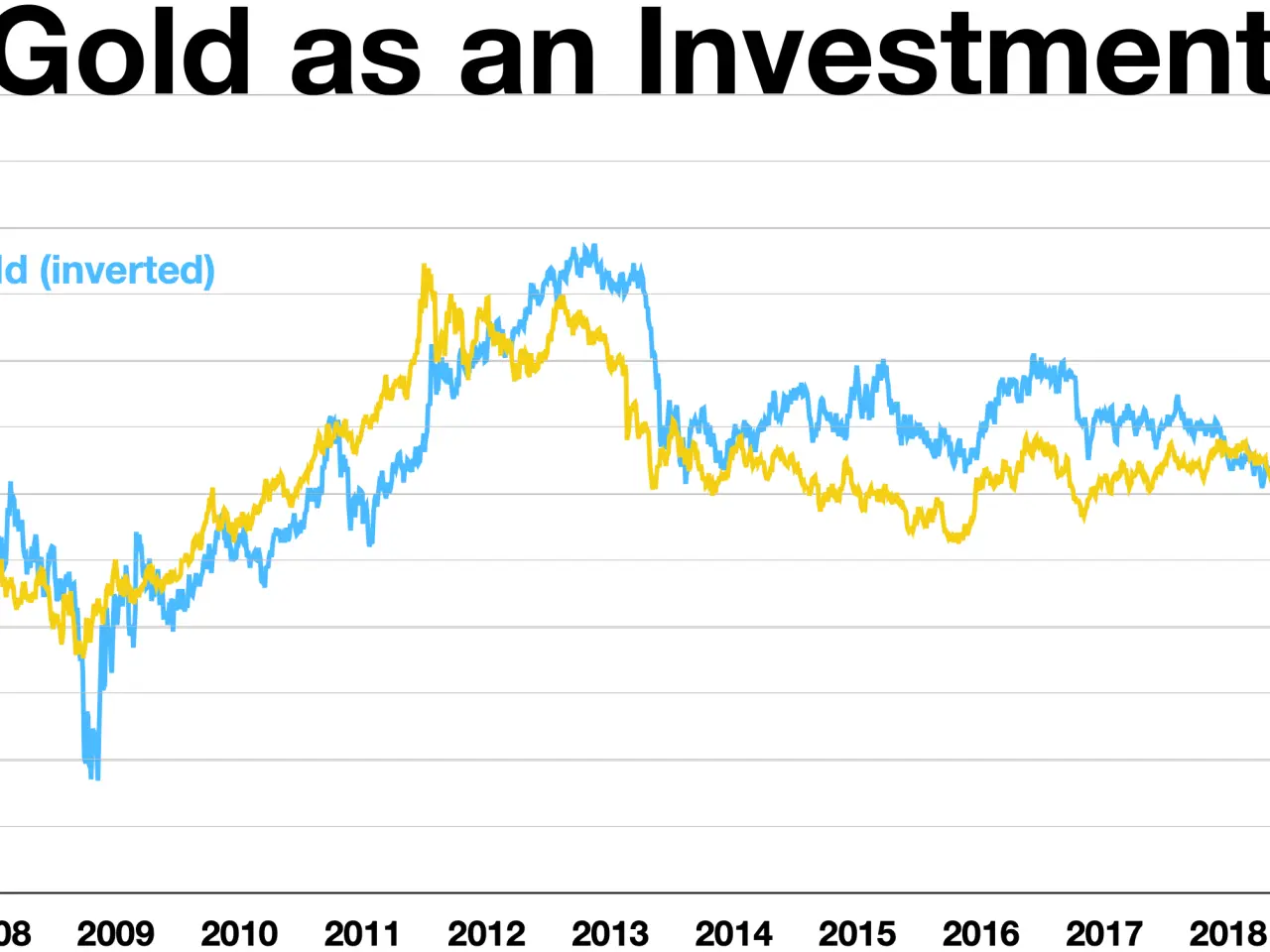

Demand for gold and silver has surged in recent weeks, with Trade Me reporting a sharp rise in searches since mid-January. Prices for both metals hit record levels in late January before stabilising, while global supply chains face growing pressure. The rush has left many mints struggling to meet news demand, with some pausing new orders entirely.

Searches for silver on Trade Me jumped 264% year-on-year in January, far outpacing gold's 18% increase. Over the past 12 months, silver prices have climbed roughly 140%, while gold has risen by about 62%. The spike in interest has also boosted activity in the site's Antiques & Collectables and Jewellery & Watches sections.

Supply issues have worsened since 1 January 2026, when China introduced state approval requirements for silver exports. This move has tightened global news supply, already stretched by rising demand from solar energy, electric vehicles, semiconductors, and defence industries. Gold supply chains, though not facing the same export restrictions, remain volatile due to central bank diversification and geopolitical tensions.

Asia-Pacific regions, including Japan, South Korea, and India, are particularly affected by shortages, driven by high demand for AI hardware and chips. Efforts to secure partnerships with the US for stable supplies are underway, but broader disruptions—such as COMEX backwardation—continue to impact both BRICS nations and Western markets. Many mints have now limited new silver orders or imposed strict allocations to manage the strain.

Trade Me advises sellers to include key details like carat and weight in grams when listing precious metals. Using terms such as 'authentic' and 'hallmarked' can also help build buyer trust. However, experts warn that jewellery remains a poor investment option due to premiums, purity concerns, and GST on resale. Investment bullion, by contrast, is standardised, easily verified, and backed by reputable mints with certifications.

The surge in gold and silver interest has pushed prices to new highs while exposing supply chain vulnerabilities. With China's export controls tightening silver availability and demand from tech industries growing, shortages are likely to persist. Buyers and sellers are now navigating a market where transparency and verification have become more critical than ever.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern