Global financial hubs are essential for achieving Vietnam's two-digit economic growth rate.

Laid-Back Take:

Hà Nội — There's a lot of buzz going on about setting up international financial centers (IFCs) around here, and it seems like many National Assembly (NA) reps think it's a damn good idea. These centers are seen as an essential part of Vietnam's roadmap for development in this new era.

Deputy Nguyễn Quang Huân from Binh Dương province explains that an IFC is kinda like a hub for all things finance, attracting investors and helping local businesses tap into international capital. But to make this work, there has to be a solid financial market in place, and that's not something we currently got.

Huân believes IFCs could give Vietnam's economy a big lift. However, he's quick to add that financial markets have some strict rules, and it's no use trying to lure investors with pretty beaches or tourist attractions. Instead, we need to play by the international rules without compromising Vietnam's sovereignty, which can prove to be a challenge.

Old man Huân also pointed out that the list of financial services and products provided by the center might be a bit on the rigid side. To accommodate new potential services, he suggests updating the list periodically so that it doesn't block the growth of innovative financial services.

Trản Hoạng Nàn, another representative from Ho Chi Minh City, agrees that Vietnam is ready for IFCs and that they should be set up ASAP. He noted that we already have some financial centers in HCM City, but they need more trust, a stable political and macroeconomic environment, and clear legal frameworks to ensure safety and transparency, before they can become true international financial centers.

Why Do IFCs Matter?

According to Permanent Deputy Prime Minister Nguyễn Hoà Bình, an IFC is a financial hub with specific policies, legal frameworks, and a diverse ecosystem of services that attract investors to a specific location. Global Financial Centres Index (GFCI) evaluates this ecosystem based on five factors: business environment, financial ecosystem, infrastructure, human capital, and city reputation.

Establishing an IFC in Vietnam could draw in international capital and propel our economy towards double-digit growth during this new era of prosperity and modernity. Besides that, it could drive innovation in tech, digital transformation, asset management, and fintech, aligning with Vietnam's digital goals.

An IFC could also improve living standards in the area, create jobs, and foster connections with major financial experts, investors, and intellectuals. Plus, it spruces up local amenities and brings our financial regulations in line with international standards, boosting investor confidence.

But Wait, There's More!

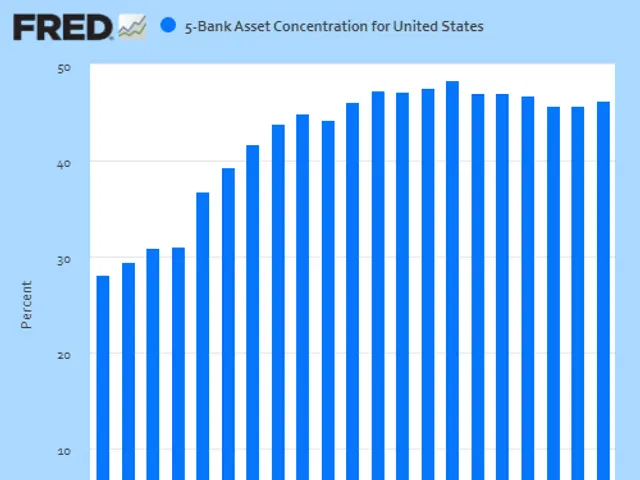

If Vietnam's IFC is to rank among the top 25 globally within a decade, it'll need an efficient, modern financial ecosystem. That includes markets for innovative financial products and services, in line with international standards and trends. The goal is to effectively mobilize financial resources for socio-economic development.

So, there you have it! Establishing IFCs can be a game-changer for Vietnam's economy, but it requires careful planning and addressing regulatory, risk management, and infrastructure challenges. Time to roll up our sleeves and make it happen!

Permanent Deputy Prime Minister Nguyễn Hoà Bình presented the rationale and significance of the development of international financial centres in Việt Nam at the plenary session of the National Assembly on June 11 in Hà Nội. - VNA/VNS Photo

- The proposed International Financial Centers (IFCs) in Vietnam would serve as a hub for various businesses and industries, attracting investors and fostering connections with financial experts.

- As outlined by Permanent Deputy Prime Minister Nguyễn Hoà Bình, the establishment of an IFC requires a diverse ecosystem of services, abiding by both international standards and local regulations.

- To ensure the growth and success of IFCs, accurate and regular updates are needed to the list of financial services and products, accommodating innovations in technology, digital transformation, asset management, and fintech.

- The implementation of IFCs aims to propel Vietnam's economy towards double-digit growth by drawing in international capital, improving living standards, and creating job opportunities.

- Successful IFCs also rely on a stable political and macroeconomic environment, clear legal frameworks for ensuring safety and transparency, and a solid financial market.

- It is crucial for Vietnam to adopt specific policies and legal frameworks that address regulatory, risk management, and infrastructure challenges to make its IFC competitive on a global scale.

- An efficient, modern financial ecosystem is necessary for Vietnam's IFC to rank among the top 25 globally within a decade, focusing on markets for innovative financial products and services.

- IFCS could contribute to Vietnam's digital goals by driving innovation in various sectors, aligning the nation's financial regulations with international standards, and boosting investor confidence.