Creditreform publishes new "Debtor Atlas" - Germany’s debt crisis worsens as overindebtedness surges in 2025

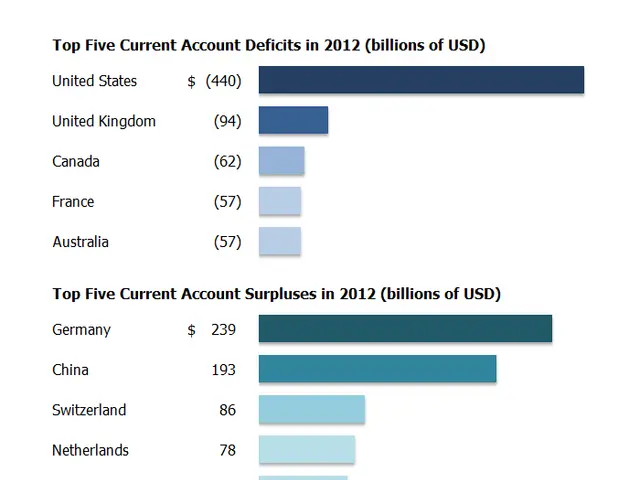

Germany is facing a concerning rise in overindebtedness, with the number of affected individuals expected to increase in 2025. According to Creditreform, the country's leading credit bureau, around 3.2 million people are currently struggling with debt, a figure set to rise from the 5.56 million recorded in 2024.

In 2024, overindebtedness affected approximately 8.09 percent of German adults. This is a reversal from previous years, which had seen a decline in this figure. An individual is deemed overindebted when they are unable to meet their financial obligations long-term. Creditreform's 'Debtor Atlas', due for release on Friday at 10:00 AM, provides these insights using anonymized data from official registers and other sources.

The upcoming 'Debtor Atlas' report underscores the growing challenge of overindebtedness in Germany. With the number of affected individuals projected to rise in 2025, it is crucial for authorities and support services to address this issue promptly and effectively.

Read also:

- India's Agriculture Minister Reviews Sector Progress Amid Heavy Rains, Crop Areas Up

- Sleep Maxxing Trends and Tips: New Zealanders Seek Better Rest

- Over 1.7M in Baden-Württemberg at Poverty Risk, Emmendingen's Housing Crisis Urgent

- Life Expectancy Soars, But Youth Suicide and Substance Abuse Pose Concern