Generation Z's emotional engagement boosts stocks of modern retailer Pop Mart, supplanting traditional retail methods

Spicing Up the Stock Market: China's Gen Z Consumers

Investors are jumping on the bandwagon of China's Generation Z consumers, who are spending their cash on everything from trendy toys to budget-friendly drinks, generating outstanding returns on so-called new consumer stocks.

Pop Mart International Group, known for its quirky pop culture merchandise, and Laopu Gold, a jewelry brand aiming to be China's Hermes, have witnessed an unprecedented surge in stock prices. Laopu Gold, in particular, has seen a staggering 23-fold increase over the last 12 months [1].

Zhao Wenli, a strategist at CCB International in Hong Kong, comments, "Investors' risk appetite is altering, with the market's focus shifting towards those 'new consumer' names that offer the potential for valuation expansions and narrate 'transition' stories." He adds, "We haven't found a clear growth ceiling for new consumption. It signals the new direction for consumption upgrades in the future" [1].

The swelling Gen Z demographic, estimated to be over 200 million strong, highlights the significant impact of China's youth on its economy and consumer behavior [1]. In the 80s, America's baby boomers propelled the success of a host of big-name stocks, including Walmart. Today, China's neo-consumers are redefining the investment playbook, prompting fund managers to delve deeper into understanding their mindsets for stock picks [1].

The Appeal of Gen Z

- Digital Savvy: Gen Z, who grew up with uninterrupted access to digital technology, fluently navigates online shopping, socializing, and entertainment platforms [1][4][5].

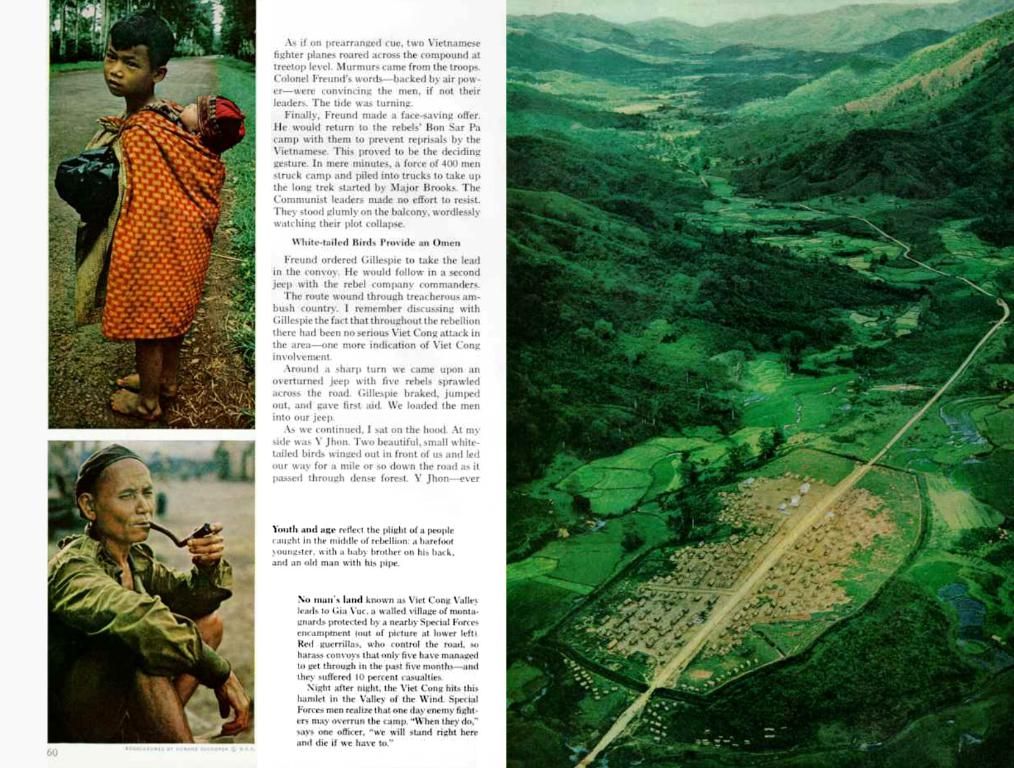

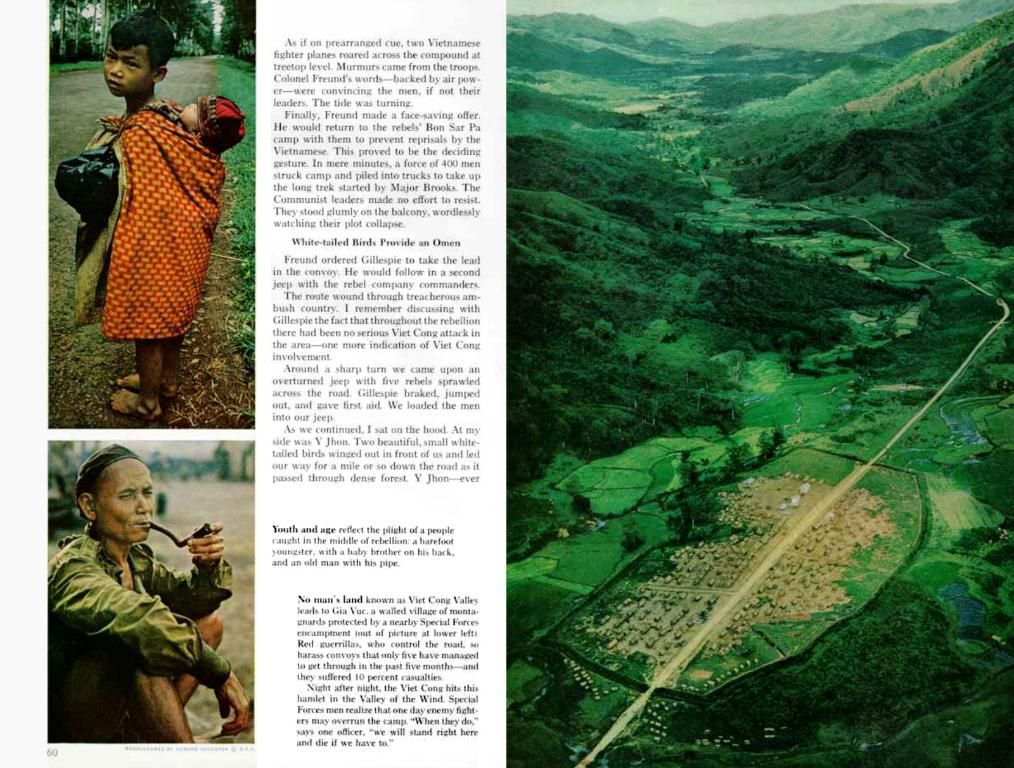

- Emotional Spending: Over half of Gen Z prioritize "self-pleasure," focusing on emotions and personal satisfaction, spending on items like trendy toys, virtual fashion, knowledge payment, and sustainable products [1][4].

- Cultural Roots: Chinese fashion and aesthetics rooted in cultural heritage are increasingly essential, especially in lifestyle and apparel choices. Gen Z exhibits a strong preference for domestic brands integrating national identity with modern trends [1].

- Luxury and Experiential: Gen Z fuels luxury consumption and values experiential purchases, such as travel, health, and beauty. They often blend wellness with digital experiences [1][4][3].

Impact on Markets and Investments

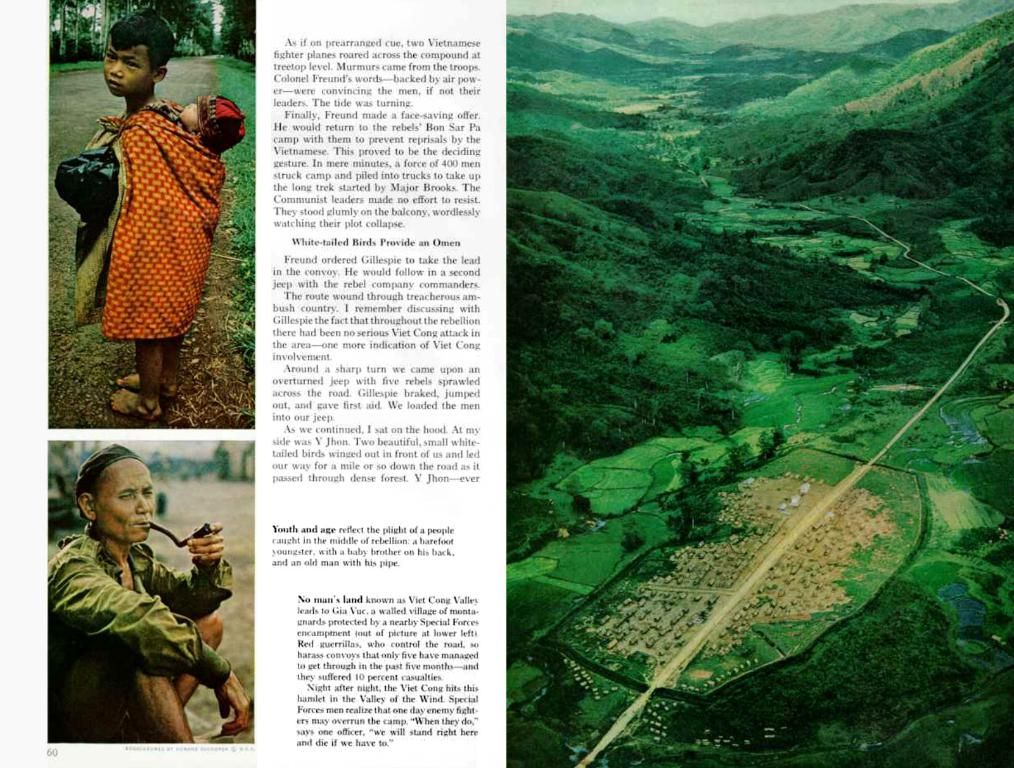

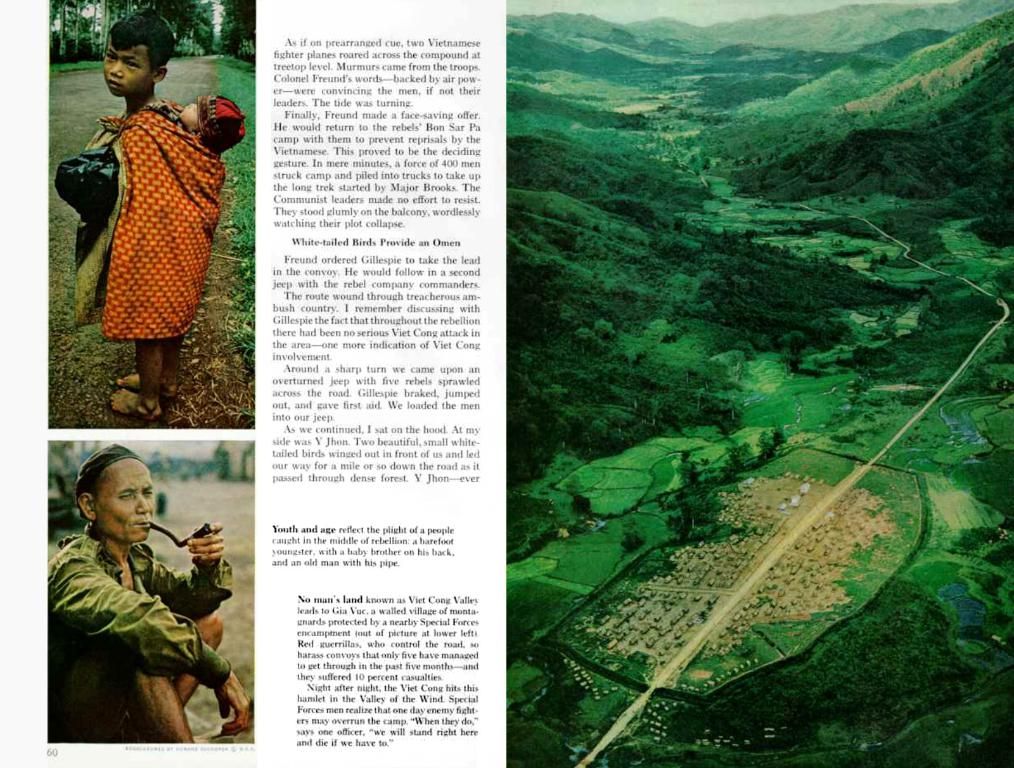

- New Consumer Stocks: The rise of Gen Z-driven sectors like life experiences, cultural apparel, healthy dining, and digitally innovative products has led to the emergence and quick growth of "new consumer stocks." These stocks represent companies catering to younger consumers, including local brands, cultural-creative IPs, and digital-first retail and entertainment platforms [1][4].

- Adjusted Investment Strategies: Fund managers target companies that resonate with Gen Z's values, such as sustainability, emotional connection, and cultural identity. They're shifting their portfolios towards brands reflecting innovation, digital integration, and strong local consumer engagement [1][5].

- Challenging Traditional Brands: Domestic brands, particularly those leveraging intangible cultural heritage or digital marketing, outperform international competitors in certain categories. For example, Laopu Gold and Erdos Group have seen significant revenue growth by incorporating cultural elements and digital strategies, capturing both consumers and investors [1].

- Interest in Tech and Emotion-Driven Ventures: There's rising interest in stocks related to virtual fashion, e-sports, knowledge payment platforms, and functional consumer goods catering to Gen Z's digital and wellness preferences [1][2][4].

References:

[1] Daxue Consulting. (2020). Generation Z’s spending power in China drives a new consumer market.[2] Reuters. (2020). Chinese Generation Z turns to wellness as wealth grows.[3] Jing Daily. (2019). Luxury consumption in China: adeptness, adapt-ability, and authenticity.[4] McKinsey & Company. (2017). Bridging the urban-rural divide in China's digital age.[5] Deloitte Insights. (2020). Generation Z: key trends shaping urban consumer markets in China.

- The swelling Gen Z demographic's preference for trendy toys, virtual fashion, and sustainable products indicates a shift in the investment landscape, with investors increasingly interested in companies that cater to these 'new consumer' needs, such as Pop Mart International Group and Laopu Gold.

- In light of Gen Z's focus on emotional spending and digital savviness, many fund managers are expanding their portfolios to include stocks related to areas like virtual fashion, e-sports, knowledge payment platforms, and functional consumer goods, as these categories align with Gen Z's digital and wellness preferences.

- With Gen Z's strong preference for domestic brands integrating national identity and modern trends, as well as their embrace of luxury and experiential purchases, it's clear that the importance of understanding Gen Z's mindsets has become crucial for investors seeking to make informed decisions in the fashion-and-beauty, finance, and business sectors.